|

|

|

|

|||||

|

|

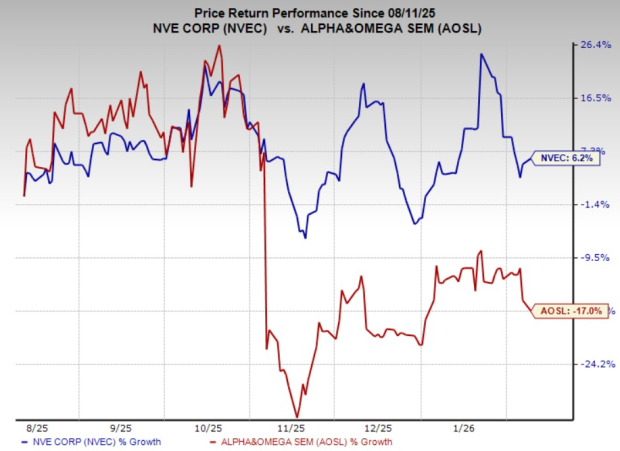

In the semiconductor space, NVE Corporation NVEC and Alpha and Omega Semiconductor AOSL represent two very different ends of the small-cap chip spectrum. Over the past year, NVEC shares have gained 6.2%, clearly outperforming AOSL’s decline of roughly 17%.

But does NVEC’s relative outperformance automatically make it the better investment? A closer look at fundamentals, business models, balance-sheet strength and valuation suggests the answer is more nuanced.

Stock price movements often reflect short-term sentiment rather than long-term earnings quality. To reach a sound investment conclusion, it is essential to examine underlying fundamentals and operating exposure.

NVEC operates a highly specialized niche business focused on spintronic sensors and isolation products, prioritizing profitability and financial strength over scale. AOSL, by contrast, is a volume-driven power semiconductor supplier whose results are closely tied to cyclical end markets, such as PCs, smartphones, gaming and data centers. These structural differences result in meaningfully different risk and return profiles.

Alpha and Omega continues to face soft demand across several of its core markets. Recent results reflect prolonged inventory digestion in PCs and gaming, uneven smartphone demand, and a slower-than-expected recovery in power supply and industrial applications.

While management continues to highlight long-term growth opportunities in AI data centers, e-mobility and higher-value power solutions, these initiatives have not yet been sufficient to offset near-term volume weakness. Elevated operating expenses and sustained R&D investment have further pressured margins, keeping earnings in negative territory.

Until demand conditions improve across consumer and computing markets, AOSL’s earnings outlook remains highly dependent on a cyclical recovery, increasing near-term volatility for investors.

By contrast, NVE Corp operates a fundamentally different and more defensive business model. The company focuses on high-performance spintronic sensors, couplers and specialty products serving industrial automation, medical devices, defense, and factory automation markets.

This focus allows NVEC to generate consistently high gross margin, maintain a debt-free balance sheet and produce reliable cash flows. Limited exposure to consumer electronics cycles and commodity cost inflation further enhances earnings stability. Long product life cycles and deep customer relationships help support revenue visibility even during periods of broader semiconductor weakness.

That said, NVE Corp’s narrow market focus also limits its growth potential. Revenue trends can be uneven, and earnings may fluctuate, depending on the timing of large customer orders or government-related contracts, constraining upside during strong industry upcycles.

Balance-sheet risks further differentiate the two companies. Alpha and Omega carries a modest amount of debt, with total borrowings of roughly $5 million against a much larger equity base, resulting in a low but non-zero debt-to-capitalization ratio. While leverage is not currently excessive, continued operating losses increase sensitivity to prolonged downturns or delayed recoveries.

NVE Corp, by contrast, operates with no meaningful interest-bearing debt. Its liabilities are largely related to operating leases and working capital, resulting in an effectively zero debt-to-capitalization ratio. This conservative capital structure enhances financial flexibility and reduces downside risks during periods of industry softness.

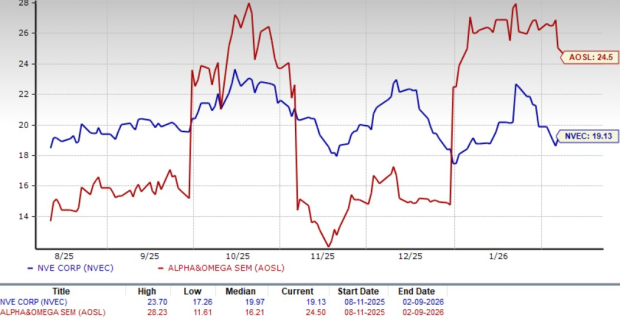

From a valuation standpoint, NVEC appears more attractively positioned. The stock trades at a trailing 12-month EV/EBITDA multiple of 19.1X, which is meaningfully lower than AOSL’s 24.5X multiple.

A lower EV/EBITDA multiple generally signals a cheaper valuation and can indicate undervaluation, when supported by stable earnings and a strong balance sheet. In NVE Corp’s case, high margins, consistent profitability and minimal financial risk lend credibility to the lower multiple and suggest more favorable risk-adjusted value.

By contrast, Alpha and Omega’s higher valuation implies investors are already pricing in a recovery that has yet to fully materialize. With earnings still under pressure and end-market visibility limited, the premium multiple increases downside risks if the anticipated rebound is delayed.

While AOSL offers greater upside leverage in a strong semiconductor recovery, its near-term outlook remains clouded by cyclical weakness, margin pressure and valuation risks. NVEC, though slower growing, offers superior financial strength, more stable profitability and a cleaner balance sheet at a lower valuation multiple.

As a result, NVE Corp appears better-positioned for investors seeking stability and downside protection, while Alpha and Omega may remain more suitable for those willing to tolerate higher volatility in anticipation of a future cycle-driven rebound. For now, fundamentals favor caution, with NVEC holding the clearer risk-adjusted edge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-10 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-02 | |

| Feb-02 | |

| Jan-30 | |

| Jan-29 | |

| Jan-28 | |

| Jan-27 | |

| Jan-26 | |

| Jan-26 | |

| Jan-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite