|

|

|

|

|||||

|

|

Cadence Design Systems, Inc. CDNS has taken a transformative step in semiconductor innovation with the launch of the ChipStack AI Super Agent, the industry’s first agentic AI workflow purpose-built for front-end silicon design and verification. Designed to address the escalating complexity of modern chip architectures, the ChipStack AI Super Agent automates critical tasks across coding, testbench development, test plan creation, regression orchestration, debugging and automated issue resolution, delivering up to 10x productivity improvements in key engineering workflows.

ChipStack is a natural extension of Cadence’s Intelligent System Design vision, where AI orchestration, principled simulation and accelerated computing converge to deliver next-generation semiconductor solutions. The platform integrates agentic AI with Cadence’s established AI technologies, including the Verisium Verification Platform, Cadence Cerebrus Intelligent Chip Explorer and the JedAI data and AI platform, which have collectively supported more than 1,000 successful tapeouts to date. By building on proven AI optimization frameworks, ChipStack enhances both reliability and scalability across design environments.

The solution is architected for flexibility, supporting both cloud-based and on-premises deployments. It integrates with frontier AI models, including open NVIDIA Nemotron models customizable with NVIDIA NeMo, as well as cloud-hosted large language models such as OpenAI GPT. This multi-model capability advances Cadence’s long-term vision of a true silicon agent capable of spanning the diverse disciplines and workflows required to bring intelligent devices to market.

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

Management highlighted that the launch marks a major milestone in Cadence’s broader design-for-AI and AI-for-design strategy. By embedding intelligent agents directly into customers’ front-end design flows, Cadence is enabling autonomous orchestration of its foundational EDA tools. These AI-driven virtual engineers operate collaboratively to streamline processes that traditionally demand extensive manual effort and deep domain expertise. The result is faster design cycles, improved verification coverage and more efficient use of highly skilled engineering talent.

Industry leaders are already seeing tangible benefits. Early deployments with top semiconductor and system companies, including Altera, NVIDIA, Qualcomm and Tenstorrent, are demonstrating meaningful productivity gains.

As the semiconductor industry grapples with mounting design complexity and a shortage of senior engineering talent, ChipStack represents a strategic response to both challenges. By automating routine yet sophisticated tasks and enabling engineers to focus on higher-value innovation, Cadence is redefining how chips are conceived, verified and brought to market.

Cadence is well-positioned to gain from rising demand for its solutions, especially the AI-driven portfolio, amid robust design activity and strong spending by customers on AI initiatives. With rapid AI proliferation, the Cadence.ai portfolio has been gaining strength, and the new product launches (like Cerebrus AI Studio) are expected to aid in sustaining the momentum. The latest hardware systems continue to gain traction from AI, HPC and automotive companies. Cadence's inorganic strategy is the calculated execution of its Intelligent System Design vision.

However, stiff competition in the EDA space, headwinds pertaining to international exposure and a high level of goodwill and intangible assets are major headwinds for Cadence. Acquisitions have affected its balance sheet, as a high level of goodwill and intangible assets adds to the risk of investing in the company. The company’s goodwill and intangible assets totaled $3.3 billion or 34.6% of total assets as of Sept. 30, 2025. Cadence acquired Arm Holdings and Secure-IC in 2025.

For the fourth quarter of 2025, revenues are estimated to be in the $1.405-$1.435 billion band. The company reported sales of $1.356 billion in the year-ago quarter. Non-GAAP EPS is anticipated to be between $1.88 and $1.94. It reported EPS of $1.88 in the year-ago quarter. Non-GAAP operating margin is estimated to be between 44.5% and 45.5% in the fourth quarter.

Cadence’s fourth-quarter 2025 results are scheduled to be reported on Feb. 17, 2026.

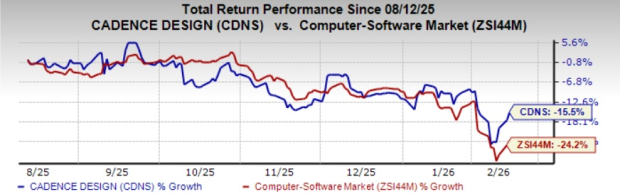

CDNS currently has a Zacks Rank #4 (Sell). Shares of the company have plunged 15.5% in the past six months compared with the Zacks Computer-Software industry’s decline of 24.2%.

Some better-ranked stocks from the broader technology space are Commvault Systems, Inc. CVLT, SS&C Technologies Holdings, Inc. SSNC and Salesforce, Inc. CRM. CVLT sports a Zacks Rank #1 (Strong Buy), while SSNC and CRM carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CVLT’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 7.77%. In the last reported quarter, Commvault Systems delivered an earnings surprise of 19.39%. Its shares have declined 50.9% in the past year.

SSNC’s earnings beat the Zacks Consensus Estimate all the trailing four quarters, with the average surprise being 4.21%. In the last reported quarter, SS&C Technologies delivered an earnings surprise of 4.32%. Its shares have lost 13.4% in the past year.

Salesforce’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 6.9%. In the last reported quarter, CRM delivered an earnings surprise of 14.04%. Its shares have decreased 40.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 31 min | |

| 5 hours | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite