|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Americans restrained spending activity in December, ending the holiday shopping season on a soft note. Data from the Commerce Department showed retail sales were unchanged month over month, a sharp deceleration from November’s revised reading of a 0.6% increase. The flat reading caught market pundits off guard, who had expected continued growth despite concerns around moderating job growth, trade policy uncertainty and broader macroeconomic pressures. The slowdown also comes amid weakening consumer confidence.

November’s stronger-than-expected performance had reinforced confidence that consumer demand would remain solid heading into the final month of the critical holiday season period. Instead, the December sales data suggest that households may be growing more cautious as higher prices and policy uncertainty weigh on purchasing decisions. Sales declined across eight of the 13 retail categories tracked by the Census Bureau.

Building material and garden equipment dealers posted a month-over-month gain of 1.2%. While food and beverage stores edged up 0.2%, sporting goods, hobbies, musical instruments and bookstores rose 0.4%. Non-store retailers, primarily by online channels, inched up 0.1%, while receipts at gasoline stations increased 0.3%.

On the contrary, sales at motor vehicle & parts dealers slipped 0.2%. Sales at clothing & clothing accessories stores fell 0.7%, while sales at health & personal care stores declined 0.2%. Food services & drinking places experienced a 0.1% decrease in sales, while miscellaneous stores witnessed a drop of 0.9%.

Furniture & home furnishing stores experienced a 0.9% decline. Sales at general merchandise stores and electronics & appliance outlets fell 0.1% and 0.4%, respectively.

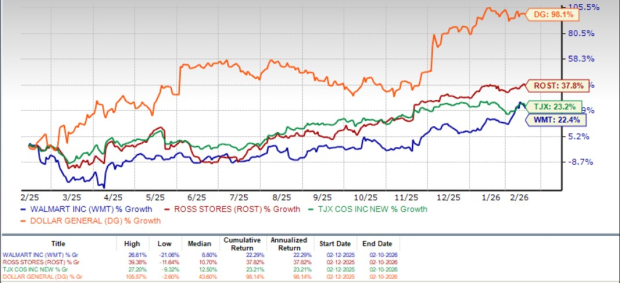

Subdued retail sales do not justify a complete withdrawal from the retail sector. Industry players such as Dollar General Corporation DG, Walmart Inc. WMT, Ross Stores, Inc. ROST and The TJX Companies, Inc. TJX are better positioned to navigate a cautious consumer environment. As households trade down, prioritizing essentials and seeking greater value, these retailers — with scale advantages, pricing flexibility, loyal customer bases and resilient balance sheets — emerge as winners.

Dollar General continues to solidify its market-leading position through a combination of extreme value and unmatched convenience in rural America. The company’s bullish case is anchored by sustained market share gains across both consumable and non-consumable categories, driven by a broadening appeal to higher-income households and improved operational execution. Strategic real estate initiatives, particularly the large-scale "Project Elevate" and "Project Renovate" remodels, are delivering measurable sales lifts and enhanced customer satisfaction, while physical expansion continues to target a vast remaining runway of domestic and international opportunities. The rapid scaling of digital capabilities, including robust delivery partnerships and the high-margin DG Media Network, is successfully extending the company's reach and increasing transaction sizes.

The Zacks Consensus Estimate for Dollar General’s current financial-year sales and EPS implies growth of 4.8% and 9.6%, respectively, from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 4.1% rise in sales and 9.2% growth in earnings. DG, which carries a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 22.9%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Walmart continues to demonstrate strong market leadership by leveraging its massive scale and increasingly diversified business model. The company’s focus on high-growth, high-margin strategic initiatives, particularly in global advertising, membership services and marketplace expansion, is successfully shifting its profit mix. A robust omnichannel ecosystem has fueled consistent double-digit e-commerce growth, supported by significant advancements in fulfillment speed and store-integrated delivery. Broad-based market share gains across key categories and demographic groups underscore the enduring appeal of its value proposition in a dynamic economic environment. By combining disciplined operational execution with digital innovation, WMT is well-positioned to deliver sustained growth.

The Zacks Consensus Estimate for Walmart’s current financial-year sales and EPS implies growth of 4.6% and 5.2%, respectively, from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 4.6% rise in sales and 11.6% growth in earnings. WMT, which carries a Zacks Rank #2, has a trailing four-quarter earnings surprise of 0.8%, on average.

Ross Stores continues to demonstrate the strength of its off-price model, driven by compelling branded assortments, effective merchandising execution and strong customer engagement across regions. Management highlighted broad-based category momentum, improved vendor partnerships, and successful marketing initiatives that are enhancing traffic and basket trends. Store expansion and disciplined inventory management further reinforce its ability to capitalize on favorable buying opportunities. With a resilient value proposition and a proven operating playbook, Ross appears well-positioned to sustain market share gains.

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and EPS implies growth of 6.4% and 2.4%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 5.4% rise in sales and 10% growth in earnings. This Zacks #2-Ranked company has a trailing four-quarter earnings surprise of 6.7%, on average.

TJX's strong off-price business model is supported by a portfolio of well-known retail banners and a compelling value proposition that resonates across income levels and geographies. Through its extensive sourcing network, the company creates a "treasure hunt" shopping experience that drives consistent foot traffic. Management’s disciplined approach to inventory flow, ongoing store expansion and international growth, including planned entry into Spain, strengthens TJX’s ability to capture market share. Sustained investments in store execution, supply-chain efficiency and selective technology initiatives further reinforce competitive positioning. With multiple long-term growth levers and a proven ability to execute through varying economic cycles, TJX looks well-positioned for sustained gains.

The Zacks Consensus Estimate for TJX Companies’ current financial-year sales and EPS implies growth of 6.5% and 9.6%, respectively, from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 5.5% rise in sales and 9.7% growth in earnings. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 5.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite