|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Shares of Rigetti Computing RGTI have plunged 23% year to date, reflecting growing investor caution after the company reset expectations around its near-term roadmap. While Rigetti continues to post meaningful technical progress, recent developments have underscored the gap between ambition and execution. Third-quarter results highlighted declining revenue, compressed gross margins and persistent operating losses, while the pushout of general availability for its 108-qubit Cepheus system into early 2026 weighed on sentiment. The company’s failure to advance to Phase B of DARPA’s Quantum Benchmarking Initiative further added to near-term uncertainty. However, management stressed that the decision was tied to long-horizon fault-tolerant milestones rather than current system performance.

Still, the longer-term narrative remains intact. Rigetti has deepened its presence in on-premises quantum systems, highlighted by an $8.4 million order from India’s C-DAC for a 108-qubit system and additional Novera system sales that offer future upgrade-driven revenue optionality. The company continues to anchor its strategy around a chiplet-based architecture, targeting a 150-plus qubit system by 2026 and scaling to 1,000-plus qubits by 2027. Rigetti enters this next phase with roughly $600 million in cash and no debt, providing the financial flexibility to absorb execution delays and fund intensive R&D. However, revenue visibility remains uneven and contract-driven.

Competition further complicates the outlook. IonQ IONQ is steadily building momentum with its trapped-ion platform and an expanding commercial pipeline, strengthening its standing as one of the more financially secure players in the sector. D-Wave Quantum QBTS is prioritizing near-term enterprise adoption by targeting optimization-focused workloads through its annealing systems. At the same time, Quantum Computing Inc. QUBT is carving out a niche around software, photonics and government-driven programs, creating a distinct risk-reward profile. In this environment, Rigetti’s differentiated hardware strategy and ecosystem partnerships underpin a longer-term growth case, but uneven execution and a still-modest revenue base continue to weigh on confidence.

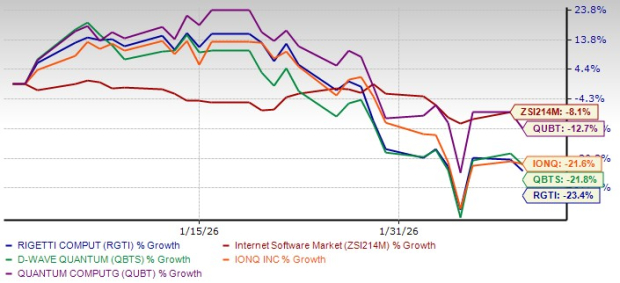

In the year-to-date period, RGTI’s shares have plunged 23%, reflecting a sharp reversal in sentiment across the quantum computing space. The stock’s decline is broadly in line with peers, as IONQ and QBTS are both down more than 20% over the same period. QUBT has fared relatively better, posting a smaller double-digit drop of about 13%. The Zacks Internet-Software industry has lost 8.1% over the same period.

RGTI's Price Performance

Government-Backed Demand Anchors Near-Term Visibility: Despite ongoing share price volatility, RGTI continues to attract government and research-oriented orders that help underpin its medium-term revenue outlook. The company secured a three-year, $5.8 million contract with the U.S. Air Force Research Laboratory focused on advancing superconducting quantum networking, alongside roughly $5.7 million in orders for two upgradable 9-qubit Novera systems.

More recently, Rigetti received an $8.4 million purchase order from India’s C-DAC for a 108-qubit on-premises system, further extending its reach with government-backed customers. While these contracts are not expected to generate large, recurring revenue streams in the near term, they reinforce Rigetti’s position as a trusted partner in foundational quantum development and provide incremental revenue visibility as federal and international quantum funding, including support under the reinstated National Quantum Initiative, continues to normalize.

Broadening Global and Academic Footprint: Rigetti is steadily expanding its ecosystem through partnerships that prioritize long-term positioning over near-term monetization. A recently signed memorandum of understanding with India’s C-DAC ties the company to a rapidly scaling, government-backed quantum program. It creates potential avenues for joint development of hybrid quantum–classical systems.

At the academic level, Montana State University’s installation of a 9-qubit Novera system represents Rigetti’s first on-premises deployment within a university setting, laying the groundwork for deeper research collaboration and future system upgrades. Together with Rigetti’s involvement in NVIDIA’s NVQLink platform, these initiatives enhance its international reach and academic credibility, helping stabilize the business as broader commercialization timelines continue to evolve.

Roadmap Execution Remains the Core 2026 Catalyst: From a technology standpoint, Rigetti continues to make measurable progress on its chiplet-based architecture, supported by encouraging performance data from its existing 36-qubit system. Management reaffirmed plans to introduce a 100-plus qubit system with 99.5% median two-qubit fidelity at the end of the first quarter of 2026 and targets a 150-plus qubit system with 99.7% fidelity by 2026-end, followed by a 1,000-plus qubit platform in 2027, enabled by larger 36-qubit chiplets. Execution against these milestones will likely be central to whether investors remain patient with the stock into 2026.

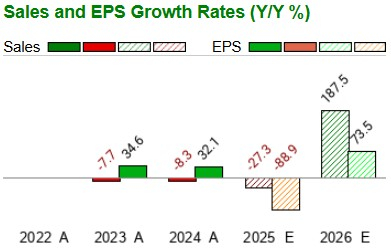

In 2026, Rigetti is expected to experience a 234.7% improvement in revenues. On the profitability front, earnings per share are expected to remain negative, but gaining 74.3% year over year.

Revenue Volatility and Margin Compression Continue to Weigh: For Rigetti, the central challenge continues to be translating technological progress into steadier, more scalable revenues. This tension was evident in third-quarter results, with revenue declining 18% year over year to $1.9 million, reflecting both the pause in U.S. National Quantum Initiative funding and the inherently uneven timing of government-driven contracts.

Profitability also came under strain as gross margin fell to 21%, weighed down by a higher proportion of strategically important but lower-margin agreements. Meanwhile, operating expenses rose to $21 million as the company sustained elevated investment in R&D, compensation and stock-based incentives. Together, these trends highlight Rigetti’s ongoing reliance on government and research programs, while broader commercial adoption and operating leverage remain slow to emerge.

Rigetti stock is not so cheap, as suggested by the Value Score of F.

The stock is currently trading at a price-to-book (P/B) ratio of 15.06X, which is higher than the industry average of 5.4X.

RGTI's P/B Ratio

Rigetti continues to stand out as a compelling but high-risk play within the quantum computing space. The company is making measurable progress on its long-term hardware roadmap, while expanding relationships across government, academic and ecosystem partners, including initiatives tied to hybrid quantum–AI computing. However, the latest results also reinforced near-term pressure points, with soft third-quarter revenue, compressed margins and rising operating costs highlighting the execution challenges that still dominate the investment narrative.

Given these crosscurrents, RGTI currently appears more appropriate for observation than aggressive buying. With a Zacks Rank #3 (Hold), the stock’s outlook hinges on how effectively Rigetti can convert its technical milestones into broader enterprise adoption, stronger unit economics and more predictable revenue streams. The 2026–2027 timeframe will be especially important, as sustained proof of commercialization will be critical to rebuilding investor confidence. For existing shareholders, maintaining a patient and disciplined stance may be prudent as the company works to narrow the gap between technological leadership and durable commercial scale. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite