|

|

|

|

|||||

|

|

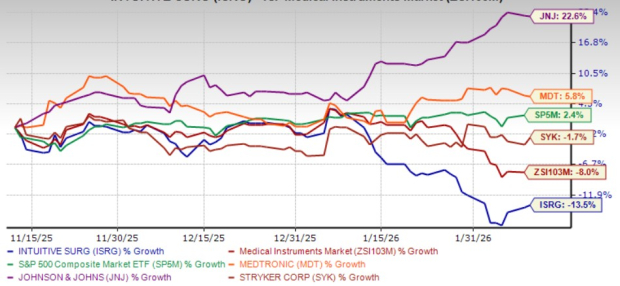

Shares of Intuitive Surgical ISRG have declined 13.5% over the past three months, despite continued strong procedure growth and robust adoption of the da Vinci 5 system in fourth-quarter 2025. Over the same period, the company’s shares lagged the industry’s 8% decline and significantly underperformed the S&P 500 Index, which rose 2.8%.

ISRG stock has underperformed its closest peers, namely Medtronic MDT, Stryker SYK and Johnson & Johnson JNJ. Over the same period, shares of Medtronic and JNJ have gained 5.8% and 22.6%, respectively, while Stryker declined 1.7%.

Despite the recent sell-off, the key question is whether Intuitive Surgical’s fundamentals support maintaining a hold rating. Let’s take a closer look at the underlying factors.

Management guided 13-15% global da Vinci procedure growth in 2026, driven by U.S. general surgery and accelerating adoption in international markets beyond urology. In 2025, procedures outside the United States rose 23%, accounting for roughly 35% of global volume, reflecting improved market access, training, and reimbursement dynamics. This shift in geographic mix provides near-term resilience as procedure growth increasingly diversifies beyond the mature U.S. urology market.

The full commercial rollout of da Vinci 5 is a key catalyst for 2026. Customers are responding to efficiency gains, enhanced visualization, and Force Feedback capabilities, which, according to management, are driving higher utilization than prior-generation systems. In the fourth quarter, da Vinci utilization rose 4%, with after-hours procedures up 35%, highlighting incremental capacity creation rather than mere case substitution.

The SP platform delivered 87% procedure growth in 2025, supported by new U.S. clearances, such as nipple-sparing mastectomy and early-stage international uptake. Ion procedures grew 51% globally, with utilization expanding as Intuitive prioritizes deeper penetration of the installed base. These platforms add incremental procedure categories and strengthen ISRG’s presence across the surgical portfolio.

Management emphasized that ISRG is in the early stages of its growth journey, with approximately 9 million procedures now in direct line of sight for 2026, up from 7 million in 2024. Cardiac surgery represents a meaningful long-term opportunity, as da Vinci 5 recently received FDA clearance for select cardiac procedures. While initial volumes are modest, the long-term total addressable market is substantial, particularly as additional geographies and Force Feedback instruments gain approval.

The rollout of refurbished Xi systems (XiR) positions Intuitive to participate in the structural shift of lower-acuity procedures toward ASCs. Management views this as a multiyear opportunity, particularly within integrated delivery networks where surgeon training already exists. Over time, ASC penetration should support incremental system placements and recurring instrument utilization.

Medtronic continues to invest in robotic-assisted surgery, but its platforms remain earlier in their adoption curve relative to ISRG’s mature installed base. Johnson & Johnson's MedTech division, through its surgical technology initiatives, is progressing toward broader robotic offerings, though the commercialization will take some time. Stryker maintains strength in orthopedics and robotics, yet its exposure to soft-tissue multi-specialty procedures is more limited compared with ISRG’s strong position in the segment.

Medtronic faces challenges in scaling utilization and building a comparable ecosystem, while Johnson & Johnson is still moving from development to meaningful clinical adoption. Stryker benefits from strong orthopedic demand but lacks ISRG’s global density in soft-tissue procedures.

Over the medium term, all three remain credible competitors, yet ISRG’s scale, clinical evidence, and recurring revenue mix continue to set it apart.

Estimates for Intuitive Surgical’s 2026 earnings have moved up 7% to $10.03 per share over the past year, while the same for 2027 earnings has improved 5.6% to $11.40. The positive estimate revision depicts bullish sentiments for the stock.

ISRG guided 2026 gross margins of 67-68%, reflecting headwinds from tariffs (about a 120-basis-point impact), a higher da Vinci 5 mix, and incremental depreciation from facility expansion. While cost-reduction initiatives partially offset these pressures, margins are expected to remain range-bound in the near term.

Capital spending pressures in Japan and parts of Europe, along with intensified price competition in China, could weigh on system placements. Management also noted lower tender win rates in China due to local competition and pricing intensity, adding volatility to international capital sales.

The 2026 outlook reflects potential impacts from changes in U.S. healthcare policy, including Medicaid funding and ACA subsidy adjustments, which could shape hospital behavior and procedure volumes.

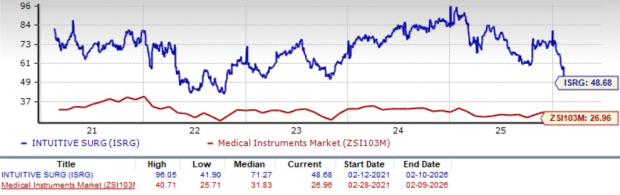

From a valuation standpoint, Intuitive Surgical is trading at a forward P/E ratio of 48.68X, lower than its five-year median of 71.27X but well above the industry average of 26.96X. In comparison, MDT trades at 16.83X, SYK at 23.93X and J&J at 20.49X.

Intuitive Surgical’s fourth-quarter 2025 performance and 2026 outlook reinforce a high-quality growth narrative tied to procedure expansion, platform innovation and ecosystem monetization. Near-term growth is supported by da Vinci 5 adoption, international procedure momentum, and accelerating SP and Ion utilization, while long-term upside stems from new procedure categories, ASC penetration and digital revenue streams.

Although margin headwinds and regional capital constraints persist, ISRG’s scale, clinical leadership, and recurring revenue base position it to compound value throughout 2026. For long-term investors, the company’s execution trajectory and expanding addressable market continue to support a constructive investment stance. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours |

Johnson & Johnson to Invest More Than $1 Billion in Pennsylvania Cell Therapy Factory

JNJ

The Wall Street Journal

|

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours | |

| 15 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite