|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Eli Lilly and Company LLY announced robust fourth-quarter results on Feb. 4. Lilly beat estimates for both earnings and sales and issued an upbeat guidance for 2026. Adjusted earnings per share of $7.54 rose 42% year over year, while revenues of $19.3 billion rose 43% year over year, driven by robust uptake of Lilly’s popular GLP-1 drugs, Mounjaro for type II diabetes and Zepbound for obesity. While Mounjaro’s sales rose 110% in the fourth quarter, those of Zepbound rose 123%.

In 2026, Lilly expects to record revenues in the range of $80 billion to $83 billion, representing an increase of 25% at the midpoint. Earnings per share are expected to be in the range of $33.50 to $35.00, indicating growth of more than 40% at the midpoint. The robust earnings report has built a bullish sentiment around the stock.

However, a single quarter’s results are not so important for long-term investors, and the focus should rather be on the company’s strong fundamentals to make an investment decision. Let’s understand the company’s strengths and weaknesses to better analyze how to play Lilly stock in the post-earnings scenario.

Lilly boasts a robust portfolio of treatments for diabetes and other cardiometabolic conditions, with its cardiometabolic division emerging as the company’s strongest segment. This success is largely attributed to its widely used GLP-1 therapies, Mounjaro and Zepbound. Despite being on the market for slightly more than three years, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly. These therapies account for more than 50% of the company’s total revenues.

Mounjaro is the market leader in new prescriptions within type II diabetes incretin analogs in both the United States and ex-U.S. markets, while Zepbound also holds a leading market share in the branded obesity market with nearly 70% share of new prescriptions.

In 2025, the drugs generated combined sales of $36.5 billion, comprising around 56% of the company’s total revenues. Robust growth trends in the U.S. incretin analogs market and positive uptake trends of Mounjaro and Zepbound in new international markets led to strong sales growth in 2025, with the positive trend expected to continue in 2026.

Regulatory approvals for new indications and improved production capacity can boost sales further.

Mounjaro and Zepbound face strong competition from Novo Nordisk’s NVO semaglutide medicines, Ozempic for diabetes and Wegovy for obesity.

In addition to Mounjaro and Zepbound, Lilly has secured approvals for several other new therapies over the past few years. These include Omvoh for treating ulcerative colitis and Crohn’s disease, BTK inhibitor Jaypirca for mantle cell lymphoma and chronic lymphocytic leukemia, Ebglyss for moderate-to-severe atopic dermatitis and Kisunla (donanemab) for early symptomatic Alzheimer’s disease. These newly approved drugs are also contributing to Lilly’s revenue growth.

Lilly expects its new drugs, Mounjaro, Zepbound, Ebglyss, Jaypirca, Inluriyo, Kisunla and Omvoh to drive sales growth in 2026.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development with a range of oral and injectable medications with different mechanisms of action. A key drug in its obesity pipeline is the once-daily oral GLP-1 small molecule called orforglipron.

Lilly has announced positive data across six studies on orforglipron in obesity and type II diabetes. Lilly filed regulatory applications in the United States, the EU and several other countries in late 2025/early 2026 seeking approval for orforglipron in obesity. Lilly expects to launch orforglipron for obesity in the United States during the second quarter of 2026 and in most international markets during 2027.

Oral pills will be a more convenient alternative to the once-weekly injectable obesity treatments like Zepbound and Novo Nordisk’s Wegovy. Oral pills may significantly lower treatment burden and potentially broaden patient adoption versus injections. Oral pills can also be manufactured at scale to meet global demand, which, in turn, can drive billions in additional sales.

For the type II diabetes indication, Lilly has filed a regulatory application in the EU and plans to file regulatory applications in the United States and other countries later in 2026.

Lilly is also evaluating orforglipron in late-stage studies in other disease areas like obstructive sleep apnea, osteoarthritis pain of the knee, stress urinary incontinence and hypertension.

The company is also evaluating another key candidate, triple-acting incretin, retatrutide (which combines GLP-1, GIP and glucagon), in type II diabetes and obesity, along with other indications like obstructive sleep apnea, knee osteoarthritis and chronic low back pain, in late-stage studies.

Data from a phase III study on retatrutide in obesity and knee osteoarthritis pain showed that the drug delivered significant weight loss with substantial relief from osteoarthritis pain. Lilly expects data readouts from three phase III studies on retatrutide for treating obesity in 2026. Lilly plans to seek approval for retatrutide for obesity and knee osteoarthritis pain in 2026.

In the past couple of years, Lilly upped its efforts to diversify beyond GLP-1 drugs by expanding into cardiovascular, oncology and neuroscience areas. In 2025, it announced several M&A deals. It acquired Verve Therapeutics to add gene therapies for heart disease to its pipeline. Lilly has also acquired Scorpion Therapeutics’ oncology drug and SiteOne Therapeutics’ non-opioid pain candidate. The acquisition of Adverum Biotechnologies in December 2026 added its lead candidate, Ixo-vec, an intravitreal single-administration gene therapy being developed in phase III to treat vision loss associated with wet age-related macular degeneration. In January 2026, Lilly announced a definitive agreement to buy Ventyx Biosciences to deepen its exposure in oral small-molecule therapies targeting inflammatory-mediated diseases. In February, it announced a deal to acquire private biotech Orna Therapeutics, which is making in vivo CAR-T therapies to treat a wide range of B cell-driven autoimmune diseases.

Competition in the obesity market is heating up. Novo Nordisk gained approval for an oral version of Wegovy in December 2025 and launched the pill in January 2026. The Wegovy pill gives NVO the first-to-market advantage and will initially bring in additional revenues, which may hurt Lilly’s market share. However, we believe Lilly may be able to close the gap fast, once its own oral obesity pill, orforglipron is approved by the FDA in 2026.

Smaller biotechs like Structure Therapeutics GPCR and Viking Therapeutics VKTX are also developing oral GLP-1 drugs for treating obesity.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity. Viking plans to advance oral VK2735 into phase III development for obesity in the third quarter of 2026.

Structure Therapeutics’ ACCESS study on its orally GLP-1 RA, aleniglipron, for obesity, met its primary and all key secondary endpoints. Structure Therapeutics expects to initiate the late-stage program of aleniglipron in obesity around mid-2026.

Others like Roche, Merck and AbbVie are also looking to enter the obesity space by in-licensing obesity candidates from smaller biotechs, which could threaten Novo Nordisk and Eli Lilly’s dominance in the market. In November, Pfizer acquired obesity drugmaker Metsera to gain a foothold in the space.

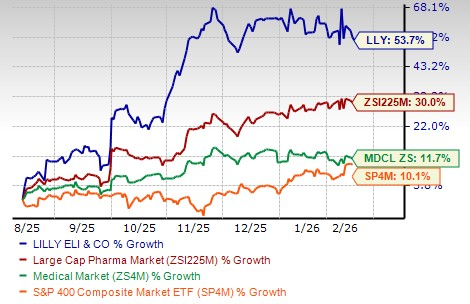

Lilly’s stock has risen 53.7% in the past six months compared with the industry’s increase of 30.0%. The stock has also outperformed the Medical sector and the S&P 500 index, as seen in the chart below.

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, LLY’s shares currently trade at 29.62 forward earnings, much higher than 18.52 for the industry. However, LLY’s stock is trading below its 5-year mean of 34.57.

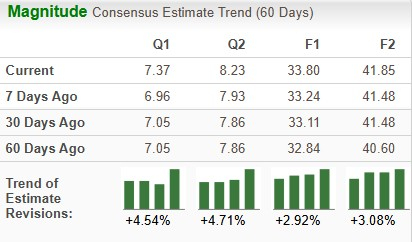

The Zacks Consensus Estimate for 2026 has risen from $33.11 to $33.80 per share over the past 30 days, while that for 2027 has risen from $41.48 to $41.85 per share over the same timeframe.

Lilly has its share of problems. Prices of most of Lilly’s products are declining in the United States. Price is expected to continue to be a drag on top-line growth in the low to mid-teens percentage in 2026. Rising competition in the GLP-1 diabetes/obesity market is a key headwind. Also, sales of late-life cycle products like Trulicity, Taltz and Verzenio are expected to be flat or decline in 2026.

However, exceptional growth from Mounjaro and Zepbound has made Lilly the largest drugmaker. It is the first and only drugmaker to hit a $1 trillion market cap. It delivered robust financial performance in 2025 with revenues surging 45% to $65.2 billion and EPS growing 86% to $24.21. Expectations for continued growth in 2026 remain high.

Despite its expensive valuation, Lilly is a great stock to have in one’s portfolio, given its significant price appreciation, its product and pipeline portfolio in high-growth therapeutic areas like obesity, robust growth prospects and bullish analyst sentiment. Consistently rising estimates also reflect analysts’ optimistic outlook for the stock. Investors should stay invested in this Zacks Rank #3 (Hold) stock while long-term investors may consider buying it as well despite the consistent price gain and expensive valuation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 10 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite