|

|

|

|

|||||

|

|

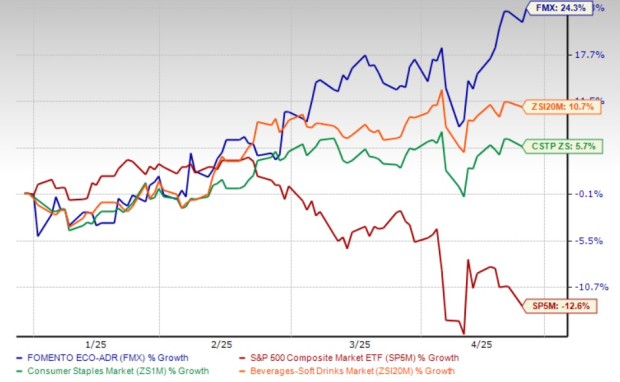

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, shares have rallied 24.3% in the year-to-date period. With this rise, FMX shares have outperformed the broader industry and the Consumer Staples sector’s growth of 10.7% and 5.7%, respectively. The company’s shares have also surpassed the S&P 500’s decline of 12.6% in the same period.

At the current price of $106.23, the FMX stock trades at a 13.7% discount to its 52-week high of $123.09. The current stock price reflects a 31% premium from its 52-week low mark of $81.08. FEMSA trades above its 50 and 200-day moving averages, indicating a bullish sentiment.

FMX stays on the list of investors’ favorite beverage stocks mainly because of effective growth strategies and strong market demand. The company is progressing on the FEMSA Forward Strategy, which is focused on the long-term value creation of its core businesses — retail, Coca-Cola FEMSA KOF and Digital@FEMSA. FMX’s retail business provides substantial opportunities for long-term growth, backed by improvements in the Proximity division.

FEMSA has been gaining pace in the digital space through its tech and innovation unit, Digital@FEMSA, which aims to build a value-added digital and financial ecosystem for consumers and businesses. This unit also focuses on enhancing and leveraging the strategic assets of FEMSA’s core business verticals.

Coca-Cola FEMSA is at the forefront with its omni-channel approach, whereas the Proximity division continues to advance digital initiatives within OXXO stores. The company is actively investing in digital offerings, loyalty programs and fintech platforms within its OXXO chains to strengthen its long-term position.

Fomento Economico Mexicano S.A.B. de C.V. price-eps-surprise | Fomento Economico Mexicano S.A.B. de C.V. Quote

FMX has been witnessing solid growth trends across all business units. FEMSA’s Proximity and Health retail businesses offer significant opportunities for long-term growth and value creation. The company is on track to accelerate earnings growth in its retail division through organic expansion, and by continually enhancing the value it provides to consumers across various formats and markets.

OXXO Mexico remains a key pillar of FEMSA's retail operations, driven by its ongoing efforts to refine and expand its value proposition while growing its footprint and scale to better serve customers. OXXO's store network in Mexico has grown significantly, now exceeding 1,000 locations, with increasing productivity per store. In its Health division, FEMSA is well-positioned to leverage its multi-country platform and scale to optimize purchasing, pricing, supply chain and other critical aspects of the business.

From a valuation perspective, FEMSA is trading at a premium relative to the industry average. The company trades at a forward 12-month price-to-earnings ratio of 19.79X, exceeding the industry average of 12.49X. This suggests that shares are somewhat expensive on a relative basis.

While this might be perceived as a risk, the premium is justified due to FEMSA’s consistent financial performance and growth prospects, driven by the success of its digital initiatives, business expansions, and strong performances in OXXO Mexico and OXXO Gas.

A focus on the FEMSA Forward strategy, digital expansion, and potential in its Proximity and Health retail businesses offer significant opportunities for long-term growth and value creation. These efforts highlight the company’s resilience and adaptability in a dynamic market. While the pricey valuation and the stock’s recent rally may keep investors cautious, the stock certainly offers significant long-term potential. The company currently carries a Zacks Rank #2 (Buy).

Two other top-ranked stocks in the border sector are Primo Brands Corporation PRMB and Carlsberg CABGY.

Primo Brands is a branded beverage company with a focus on healthy hydration, delivering sustainably and domestically sourced diversified offerings. The company currently has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for PRMB’s 2025 earnings and sales indicates growth of 146.9% and 57.4%, respectively, from the previous year’s reported figures. Primo Brands has a trailing four-quarter average earnings surprise of 7.2%.

Carlsberg is a brewing company and has operations in Northern and Western Europe, Eastern Europe, and Asia. CABGY currently has a Zacks Rank #2.

The Zacks Consensus Estimate for the company’s 2025 sales and earnings implies growth of 23.4% and 3.8%, respectively, from the previous year’s reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite