|

|

|

|

|||||

|

|

Zscaler, Inc. ZS shares have remained mostly in a downward trajectory over the past six months. ZS stock has plunged 38.5% over the past six months, underperforming the Zacks Computer and Technology sector’s rise of 10.4%.

Compared to key competitors like Cisco Systems, Inc. CSCO, Fortinet, Inc. FTNT and Palo Alto Networks, Inc. PANW, Zscaler’s slump appears even more pronounced. In the trailing six months, shares of Cisco Systems and Fortinet have soared 21.5% and 10.7%, respectively. PANW shares have declined 6.6%.

The sharp contrast raises a tough question: Is it time to move on from Zscaler, or is there still long-term value in retaining the stock?

Zscaler’s stock drop can be attributed to macroeconomic headwinds, including inflation, elevated interest rates and cautious enterprise IT spending. Increasing competition in the Zero Trust cybersecurity space and the company’s historically high valuation also contributed to its vulnerability during market corrections.

Zscaler holds a premium valuation, reflected in its Zacks Value Score of F. This is further reinforced by its Forward 12-month P/S ratio of 7.49, significantly exceeding the Zacks Computer and Technology sector’s average of 6.54.

Compared with its key competitors, Zscaler trades at a lower P/S multiple than Palo Alto Networks and Fortinet, while at a higher multiple than Cisco Systems. At present, Palo Alto Networks, Fortinet and Cisco Systems have forward 12-month P/S ratios of 10.22, 8.58 and 5.46, respectively.

We consider that the ongoing macroeconomic headwinds and lofty valuations are short-term pressures that do not diminish Zscaler’s long-term growth potential. We believe that while near-term issues are weighing on the stock, there’s still a strong fundamental case for staying invested.

Despite macroeconomic pressures, Zscaler’s financial results remain impressive. In the first quarter of fiscal 2026, revenues soared 26% year over year to $788 million, with emerging products growing at a faster rate than core offerings. The company achieved a record operating margin of 22% and delivered non-GAAP earnings growth of approximately 24% to 96 cents per share.

Zscaler’s growing customer base underscores its strong market positioning. At the end of the first quarter, it had 698 customers generating $1 million or more in annual recurring revenues (ARR), with Fortune 500 and Global 2000 companies comprising a substantial portion. At the end of the first quarter, more than 45% of the Fortune 500 companies and approximately 40% of the Global 2000 companies are using Zscaler’s solutions.

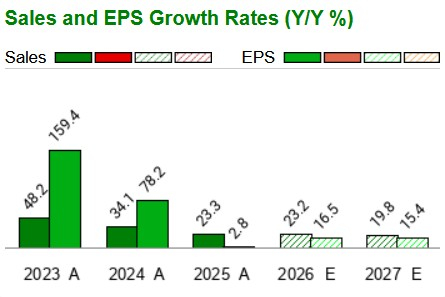

Zscaler is poised to benefit from enterprise migration to cloud environments, the increasing adoption of AI-driven cybersecurity and a recovery in IT spending. Its focus on large-scale enterprise deals and innovation pipeline is expected to drive accelerated growth in 2026 and beyond. The Zacks Consensus Estimate for fiscal 2026 and 2027 indicates strong double-digit revenue and earnings per share growth.

Zscaler remains at the forefront of the cybersecurity space through its innovative efforts. The company’s three main growth areas — AI Security, Zero Trust Everywhere and Data Security Everywhere — have together crossed the $1 billion milestone in annual recurring revenues (ARR) in the first quarter of fiscal 2026, growing faster than the company’s overall business.

AI Security alone reached $400 million ARR at the end of the first quarter and is expected to exceed $500 million in fiscal 2026 as enterprises adopt AI Guard and agentic operations. Zero Trust Everywhere has already attracted more than 450 enterprises, achieving its goal of 390 enterprises quarters ahead of the initial target date. Data Security ARR rose to $450 million, with strong upsell opportunities as most customers use only a few modules today. These three pillars are likely to create strong, diversified drivers for Zscaler’s future growth.

Zscaler is taking an early lead in AI security, a fast-growing area of enterprise demand. The company reported a 35-fold jump in AI/ML transactions on its cloud in fiscal 2025, showing how quickly enterprises are adopting AI. To address new risks like prompt injection and model poisoning, Zscaler launched AI Guard, which is now being tested by large customers. Its Agentic Operations portfolio is also gaining traction and is expected to contribute significantly to AI Security ARR in fiscal 2026. With the integration of recently acquired Red Canary’s AI technology, Zscaler is building a differentiated AI-powered security operations center solution, positioning itself as a trusted vendor for securing AI applications.

Zscaler’s Z-Flex program is helping the company win bigger and more strategic multi-year deals. Introduced just three quarters ago (the third quarter of fiscal 2025), Z-Flex already delivered more than $175 million in total contract value bookings in the first quarter of fiscal 2026, a 70% sequential increase. The program gives customers the flexibility to adopt multiple modules over time under predictable pricing, making it easier to expand usage. For example, a large aerospace company added nine new modules in a multi-year, eight-figure deal. The deal increases Zscaler’s ARR with the company by more than 40%. This model encourages long-term commitments, strengthens customer relationships, and supports sustainable growth in fiscal 2026 and beyond.

Although Zscaler faces challenges related to macroeconomic uncertainties and premium valuation, the company’s heavy investment in AI, innovative cybersecurity capabilities and growing adoption of its solutions make the stock worth retaining at present.

Zscaler currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Palo Alto Networks Lifts Revenue Outlook as Second-Quarter Profit Jumps

PANW

The Wall Street Journal

|

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite