|

|

|

|

|||||

|

|

Salesforce, Inc. CRM and Oracle Corporation ORCL are two major players in the cloud enterprise software market. Both companies offer powerful, enterprise-grade platforms spanning customer relationship management, enterprise resource planning, database management and artificial intelligence (AI)-powered cloud solutions.

Both companies have transformed how businesses manage operations, customer relationships and data infrastructure. With the digital transformation wave accelerating, the question remains: Which stock makes a better investment pick today? Let’s break down their fundamentals, growth prospects and market challenges to determine which offers a more compelling investment case.

Salesforce has long held the top position in the customer relationship management market, according to Gartner. The company’s vision now goes beyond customer management, and it is building a broader ecosystem focused on AI, data and collaboration. Acquisitions like Waii, Bluebirds, Informatica and Slack show Salesforce’s push to evolve into a more complete enterprise platform.

AI is now central to Salesforce’s growth story. Since the 2023 rollout of Einstein GPT, Salesforce has been embedding generative AI across its offerings to help companies automate processes, improve decision-making and strengthen customer relationships.

Its latest innovation, Agentforce, is gaining momentum. Combined with Data Cloud, these AI-driven offerings brought in $1.4 billion in recurring revenues in the third quarter of fiscal 2026, representing a 114% year-over-year increase. Agentforce alone generated $540 million in recurring revenues, calling for a 330% year-over-year surge.

Financially, Salesforce continues to deliver steady performance. In the third quarter of fiscal 2026, revenues and non-GAAP earnings per share (EPS) rose 10% and 34.9% year over year, respectively. The bottom line surpassed the Zacks Consensus Estimate by 14.04%, while the top line matched the consensus mark.

Salesforce Inc. price-consensus-eps-surprise-chart | Salesforce Inc. Quote

Total remaining performance obligation (RPO) was $59.5 billion at the end of the third quarter of fiscal 2026, up 12% year over year. Management expects the current RPO will increase approximately 15% in the fourth quarter of fiscal 2026, suggesting continued growth momentum for the company. The non-GAAP operating margin expanded 240 basis points to 35.5% in the third quarter.

These results suggest Salesforce is transitioning from a growth-heavy model to a more efficient, profitable enterprise solution provider while keeping innovation at its core.

Oracle is doing well financially. In the company’s last reported financial results for the second quarter of fiscal 2026, revenues climbed 14% year over year to $16.1 billion, while non-GAAP EPS surged 54% to $2.26. The robust performance was driven by explosive growth in cloud infrastructure as Oracle continues to establish itself as the destination of choice for AI workloads.

Revenues from Oracle’s cloud infrastructure business grew 68% year over year to $4.1 billion in the second quarter, while demand for graphics processing units used in AI training increased 177% in the trailing 12 months. The company added $68 billion in new commitments during the second quarter from Meta, NVIDIA and others.

Oracle Corporation price-consensus-eps-surprise-chart | Oracle Corporation Quote

Oracle is also expanding through its multi-cloud strategy, which is driving its cloud database services’ growth. During the second quarter, the cloud database services revenues increased 30% year over year. It added 11 new multi-cloud regions during the last reported quarter, bringing the total count to 45 regions. The multi-cloud consumption soared 817% during the second quarter, depicting strong adoption of its cloud database services.

Oracle faces execution challenges. The company raised fiscal 2026 capital expenditure guidance to approximately $50 billion, up $15 billion, reflecting massive infrastructure investments required. The second-quarter fiscal 2026 free cash flow was negative $10 billion, substantially worse than the analyst consensus.

Customer concentration poses material risk, with OpenAI's reported $300 billion infrastructure deal representing the majority of RPO growth. Rising leverage amid negative cash flow generation raises questions about financial flexibility. The third-quarter fiscal 2026 guidance calls for revenue growth of 19% to 21%, with $4 billion in additional revenues expected in fiscal 2027.

Salesforce has a decent earnings surprise history compared with Oracle. CRM surpassed the Zacks Consensus Estimate for earnings in each of the trailing four quarters. On the other hand, ORCL surpassed the consensus mark for earnings twice in the trailing four quarters, matched once and missed it on one occasion.

The Wall Street analysts seem to be more optimistic about Salesforce’s profitability. Over the past 30 days, the Zacks Consensus Estimate for CRM’s fiscal 2026 and 2027 earnings has remained unchanged.

The consensus mark for ORCL’s fiscal 2026 and 2027 earnings has been revised downward over the past seven days.

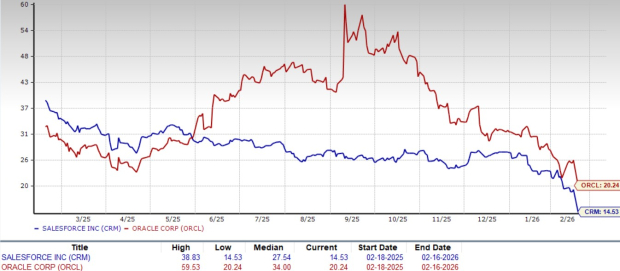

Comparing the two stocks’ valuations, Oracle currently trades at a higher forward 12-month price-to-earnings (P/E) multiple of 20.24 compared to Salesforce’s 14.53. This suggests investors are paying a larger premium for ORCL stock, even though there is a downward revision in earnings estimates.

Both Salesforce and Oracle are formidable forces in the cloud enterprise software market, but Salesforce stands out as the better investment choice today. Salesforce’s accelerated growth in AI, deeply unified platform strategy and superior profitability growth prospects offer a more compelling risk-reward profile. While Oracle is chasing massive infrastructure growth, which could pay off in the long term, it requires heavy spending and carries concentration risk. A lower valuation multiple than Oracle also suggests Salesforce as a better investment option right now.

Currently, Salesforce has a Zacks Rank #2 (Buy), making the stock a must-pick compared with Oracle, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

ORCL

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite