|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Opendoor Technologies Inc. OPEN is scheduled to release fourth-quarter 2025 results on Feb. 19.

The Zacks Consensus Estimate for OPEN’s fourth-quarter earnings per share (EPS) is pegged at a loss of 8 cents, suggesting an improvement of 27.3% from a loss of 11 cents reported in the prior-year quarter. The consensus mark for earnings has remained unchanged in the past 60 days.

The consensus mark for fourth-quarter revenues is pegged at $596.4 million, indicating a decline of 45% from the year-ago quarter’s reported figure.

Opendoor has an impressive track record of earnings surprises. Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with an average surprise of 6.3%.

Our proven model does not conclusively predict an earnings beat for Opendoor this time around. A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to beat on earnings. But that's not the case here.

OPEN’s Earnings ESP: Opendoor has an Earnings ESP of -8.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Opendoor’s Zacks Rank: The company carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Revenue Drivers

Opendoor’s fourth-quarter performance is expected to have reflected early traction from its strategic reset toward a higher-velocity, software-driven operating model. Management’s shift to “Opendoor 2.0” — centered on scaling acquisitions, tightening execution and embedding AI across workflows — is likely to have influenced transaction volumes and overall operational momentum in the to-be-reported quarter.

The company’s renewed focus on accelerating high-quality home acquisitions is expected to have been a primary driver. With stronger first offers, reduced average spreads and improved selection discipline, Opendoor aimed to increase contract activity while mitigating adverse selection risk. The rollout of standardized, AI-powered inspection and underwriting processes likely enhanced conversion rates and shortened the time from initial assessment to contract execution, supporting improved top-of-funnel throughput.

Reactivation of direct-to-consumer (D2C) channels is expected to have aided the company’s fourth-quarter performance. Management indicated that early D2C tests demonstrated meaningfully stronger conversion compared to traditional flows. By simplifying the selling experience and reducing human touchpoints in underwriting, the company likely improved customer engagement while lowering friction in the transaction process.

Product innovation may have supported the company’s performance in the fourth quarter. The launch of Opendoor Checkout — enabling buyers to place offers digitally without direct interaction — along with features such as Buyer Peace of Mind and expanded warranty offerings, is expected to have strengthened the value proposition for both buyers and sellers. Additionally, early progress toward integrating ancillary services, including mortgage and insurance capabilities, may have started to position the company for improved revenue per transaction over time.

Margins

Fourth-quarter margins are expected to have reflected a balance between acquisition rescaling and continued operational discipline. As the company worked to clear legacy inventory and replace it with homes acquired under its revised pricing framework, contribution margins likely remained in transition. Management emphasized a model focused on tighter spreads but faster resale velocity, suggesting that improved days in possession and a better inventory mix could begin to support margin stabilization.

Financing costs and holding expenses remain key variables in the current housing environment. However, faster underwriting cycles, AI-driven renovation scoping and streamlined closing processes are expected to have supported improved resale velocity, helping mitigate some cost pressures. The company’s emphasis on reducing the percentage of homes on the market beyond extended timelines underscores its focus on improving capital efficiency.

On the operating expense front, Opendoor’s aggressive cost rationalization initiatives — including eliminating external consultants, consolidating software vendors and tightening marketing spend — are likely to have supported operating leverage. Management has signaled a structurally lower adjusted operating expense base, with reinvestment prioritized toward engineering and automation. These measures may have partially offset margin pressure tied to inventory turnover and macro housing headwinds.

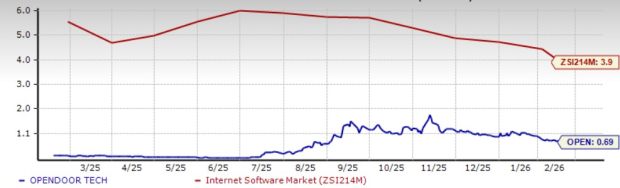

Shares of Opendoor have gained 17.6% in the past six months against the industry’s 22.4% decline. In the same time frame, other industry players like Chegg, Inc. CHGG, Exodus Movement, Inc. EXOD and EverCommerce Inc. EVCM have lost 54.2%, 57.6% and 5.6%, respectively.

From a valuation perspective, Opendoor stock is currently trading at a discount. It is currently trading at a forward price-to-sales (P/S) multiple of 0.69, significantly below the industry’s average of 3.9. Conversely, industry players, such as Chegg, Exodus and EverCommerce, have P/S multiples of 0.25, 2.61 and 2.94, respectively.

Opendoor is executing from a position of strategic reset, supported by a renewed focus on acquisition velocity, tighter spreads and AI-driven operational discipline. Management has repositioned the company as a software-first real estate platform, emphasizing higher-quality home purchases, faster resale turns and improved unit economics rather than defensive inventory management. Early traction in direct-to-consumer channels, streamlined underwriting workflows and standardized AI-powered inspections underscore the company’s intent to scale efficiently while maintaining selection rigor.

With a structurally lower cost base, significant nonrecourse borrowing capacity and a defined path toward adjusted net income breakeven by the end of 2026, Opendoor appears focused on translating operational improvements into sustainable operating leverage and long-term platform expansion.

That said, investment risks remain elevated. The company is in the early stages of rebuilding acquisition volumes, and near-term margins may face pressure as legacy inventory is replaced and newer pricing frameworks mature. Achieving targeted contribution margins and improving resale velocity will be critical to validating the revised operating model. Moreover, the broader housing environment — characterized by elevated mortgage rates, affordability constraints and subdued transaction activity — may limit the pace of recovery.

Investors may consider maintaining exposure to Opendoor ahead of its fourth-quarter 2025 results, given the company’s accelerating strategic reset and renewed focus on acquisition velocity, tighter spreads and AI-enabled operational efficiency. Management’s transition to a software-first, higher-turn model — supported by standardized AI-driven inspections, streamlined underwriting and stronger direct-to-consumer traction — positions the company to gradually rebuild transaction volumes while improving unit economics. Enhanced liquidity, substantial nonrecourse borrowing capacity and a defined path toward adjusted net income breakeven by the end of 2026 likely provide additional financial flexibility.

However, risks remain pronounced. Revenue comparisons are still under pressure, contribution margins are recalibrating as legacy inventory clears and the broader housing environment — characterized by elevated mortgage rates and affordability constraints — may temper the pace of recovery. With earnings visibility limited in the near term, investors may prefer to hold existing positions and await confirmation of sustained margin stabilization and acquisition momentum before increasing exposure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite