|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Caterpillar Inc. CAT and Deere & Company DE remain two of the most prominent players in the heavy machinery space. Caterpillar, widely recognized for its yellow equipment, caters to diverse end markets such as construction, mining, infrastructure, oil & gas and transportation. Deere, known for its green tractors, leads in agricultural, forestry and turf equipment while making notable progress in precision agriculture, alongside maintaining a presence in construction machinery.

With market capitalizations of roughly $357 billion for Caterpillar and $163 billion for Deere, both stocks serve as key indicators of industrial, agricultural and infrastructure trends. The central question for investors is which stock currently offers the more compelling opportunity.

In fourth-quarter 2025, Caterpillar reported record revenues of $19.1 billion, marking an 18% year-over-year increase, primarily driven by higher volumes across all segments. Earnings per share came in at $5.16, up 0.4% year over year. While modest, the improvement signaled a return to earnings growth after five consecutive quarters of declines.

For 2026, Caterpillar expects revenues to grow year over year near the upper end of its long-term 5–7% CAGR target. Adjusted operating margin is projected toward the lower end of its range, reflecting ongoing tariff headwinds, with an estimated $2.6 billion tariff impact for the year.

The company guides adjusted operating margins of 15–19% at around $60 billion in revenues. At $72 billion in revenues, margins are expected in the 18–22% range, while revenues of $100 billion could support margins of 21–25%.

Caterpillar is targeting revenue growth at a CAGR of 5–7% through 2030, with Machinery, Power & Energy free cash flow projected in the $6-$15 billion range. The company plans to return all free cash flow to shareholders over time and aims to grow its dividend at a high-single-digit rate.

The company’s long-term outlook is supported by rising U.S. infrastructure spending, growing demand for mining equipment tied to the energy transition and increased adoption of autonomous solutions to improve productivity and safety. In Power & Energy, sustainability initiatives and data-center investments are driving demand. Caterpillar is also expanding its high-margin aftermarket business, with service revenues targeted to increase from $24 billion in 2025 to $30 billion by 2030.

Deere returned to positive revenue growth in the fourth quarter of fiscal 2025, with revenues rising 11% on higher volumes after eight consecutive quarters of declines. However, earnings fell as increased production costs and tariff-related pressures offset volume gains. The company is set to report first-quarter fiscal 2026 results tomorrow. While revenue growth is projected at 11.7%, earnings are expected to plunge 39.8%, which suggests that a recovery in earnings growth is not on the cards yet.

Deere expects net income for fiscal 2026 between $4.00 billion and $4.75 billion. The mid-point suggests a 29.6% decline from the net income of $5.027 billion reported in fiscal 2025. The company anticipates pre-tax direct tariff expenses of $1.2 billion for 2026, along with additional inflationary pressures stemming from the indirect impacts of tariffs.

Net sales for Production & Precision Agriculture are expected to decrease 5-10% year over year. Sales of Small Agriculture & Turf are expected to rise 10%. Sales of Construction & Forestry are projected to increase 10%. The Financial Services segment’s net income is expected to be $830 million.

The U.S. Department of Agriculture (USDA) forecasts a 0.7% year-over-year dip in net farm income to $153.4 billion in 2026. Total crop receipts are expected to inch up 1.2%, driven by higher corn and hay receipts. In inflation-adjusted terms, total crop receipts are predicted to fall 0.7%. Meanwhile, total production expenses are expected to increase 1%. Direct government farm payments are expected to offer some relief, rising from $13.8 billion in 2025 to $44.3 billion in 2026.

Despite near-term weakness, agricultural equipment demand will be supported by increased global demand for food, stemming from population growth. Also, the need to replace ageing equipment will support DE’s top line. The demand for its construction equipment will be supported by increased infrastructure spending.

Over the long term, Deere is well-positioned for growth, underpinned by consistent investments in innovation and geographic expansion. Its focus on launching products with advanced technologies and features provides it with a competitive edge. The company remains focused on revolutionizing agriculture with technology in an effort to make farming automated, easy to use and more precise across the production process.

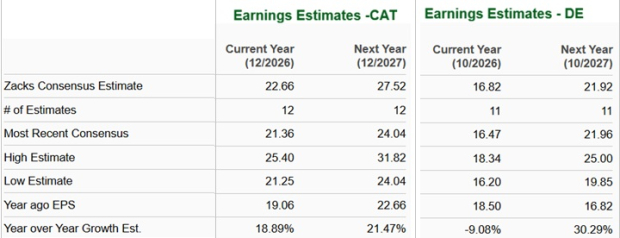

The Zacks Consensus Estimate for Caterpillar’s 2026 sales is $73.6 billion, suggesting year-over-year growth of around 9%. The estimate for earnings is $22.66 per share, indicating year-over-year growth of 18.9%.

The consensus estimate for Caterpillar’s 2027 sales is $80.1 billion, indicating year-over-year growth of 8.8%. The earnings estimate for 2027 is $27.52 per share, implying year-over-year growth of 21.5%.

The Zacks Consensus Estimate for Deere’s fiscal 2026 sales is $40 billion, indicating year-over-year growth of 2.8%. The estimate for earnings is $16.82 per share, indicating a year-over-year fall of 9.1%. The fiscal 2027 estimate for sales implies growth of 8.9% and the estimate for earnings is $21.92 per share, which indicates growth of 30.3%.

Both the earnings estimates for CAT have moved up over the past 90 days.Meanwhile, both earnings estimates for fiscal 2026 and 2027 for DE have been trending south over the past 90 days.

In a year, CAT stock has gained 116.9%, whereas DE has gained 18.2%.

CAT is currently trading at a forward 12-month earnings multiple of 32.81X, while DE stock is currently trading at a forward 12-month earnings multiple of 32.73X.

CAT’s return on equity of 45.76% is way higher than DE’s 20.54%. This reflects Caterpillar’s efficient use of shareholder funds in generating profits.

Both companies face near-term tariff-related pressures, but Caterpillar demonstrates stronger momentum, backed by rising volumes, solid revenue growth and upward estimate revisions. Deere’s long-term outlook tied to agricultural technology and global food demand remains compelling, but near-term pressure from lower farm income and declining earnings makes the stock less attractive at the moment.

Caterpillar’s superior return on equity, improving fundamentals and exposure to major secular trends, such as data center expansion, energy transition and infrastructure investment, make it the more favorable choice for investors seeking industrial exposure. Currently, Caterpillar holds a Zacks Rank #3 (Hold), while Deere is rated Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 30 min |

Stock Market Today: Dow Drops Amid U.S.-Iran Tensions; Financials Get Slammed (Live Coverage)

DE +11.58%

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite