|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Corning Incorporated GLW and Universal Display Corporation OLED are key technology firms focusing on advanced display technologies. Corning is a leading innovator in the glass substrate industry. In addition to being a pioneer in Gorilla Glass technology, the company manufactures specialty materials, including various formulations for glass, glass ceramics and fluoride crystals for specific industrial and commercial applications. It also manufactures optical fibers, glass substrates for LCD and PC displays, automotive glass solutions and various laboratory equipment.

Universal Display is one of the leading manufacturers of Organic Light Emitting Diodes (OLED), which are thin, lightweight and power-efficient solid-state devices that emit light. These are ideal for use in full-color displays and as lighting products.

With domain-specific expertise in core areas, both Corning and Universal Display are well-positioned in the tech-adjacent manufacturing landscape and have the wherewithal to cater to the evolving demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

Corning continues to focus on developing state-of-the-art cover materials, which have been deployed on more than 8 billion devices. Samsung has opted to deploy Corning Gorilla Armor 2 cover material for its latest Galaxy S25 Ultra devices. It is the most scratch-resistant and optically advanced Gorilla Glass yet. The solution brings an enhanced visual experience with unparalleled durability to Samsung’s newest flagship smartphone

The Corning Gorilla Glass Ceramic brings an advanced protective layer for the safety of mobile devices. This innovative transparent material significantly improves drop performance on rough surfaces compared to competitive aluminosilicate glasses, surviving 10 repeated drops from one meter on surfaces replicating asphalt in lab testing. The Corning Gorilla Glass Ceramic has added a new dimension to the toughness quotient of mobile devices, with the existing aluminosilicate glass coverings failing miserably in similar lab tests.

The company has been developing environmentally friendly formulations that impart superior picture quality. Corning’s generation 10 substrates use the proprietary EAGLE XG formulation. A higher generation substrate is a larger-sized substrate, which enables panel makers to reduce manufacturing costs since more panels can be built from each substrate. Corning’s capability positions it to better serve the secular increase in demand for LCD panels. The company’s fusion technology reduces glass thickness, enabling panel manufacturers to do away with thinning costs that are usually necessary for making slimmer, lighter and more power-efficient consumer devices.

However, end market diversification is limited within the Display and Optical segments, which account for more than half of total revenues. Since the Display Technologies and Specialty Materials segments are primarily dependent on consumer spending, particularly on LCD TVs and mobile PCs, this narrows down the market. Building a significant market position in China amid a bitter U.S.-China trade relationship with heightened risk of the imposition of tariffs can adversely impact its operations.

Universal Display is a dominant provider of OLED technology. The technology is likely to eventually replace LED and LCD technologies due to energy efficiency, higher contrast ratio, better viewing angle, lower video response time and smaller form factor. Strong end-market demand also presents a significant growth opportunity for Universal Display over the long term. OLED is suitable for commercial usage in several industries, including smartphones, television, virtual reality devices and automotive markets.

The increasing proliferation of smartphones, wearables and tablets is driving the adoption of small-area OLEDs. Large-area OLED displays are increasingly used in televisions. Further, unlike LEDs, OLEDs can be viewed directly and don’t need diffusers. It is also expected to be cost-effective when manufactured in high volumes, which makes it suitable for commercial application in the solid-state lighting market.

Universal Display’s dominance in OLED technology is primarily driven by its strong portfolio of more than 6,500 patents worldwide. The company’s UniversalPHOLED phosphorescent OLED technology produces OLEDs that are four times more efficient than fluorescent OLEDs and significantly more efficient than current LCDs. This provides Universal Display with a competitive advantage over other OLED makers.

However, fluctuating material purchasing trends from quarter to quarter increase uncertainties regarding Universal Display’s top-line growth. Customers’ constrained spending behavior stemming from macroeconomic concerns is expected to affect revenues from material sales. In addition, Universal Display faces significant competition not only from other OLED makers but also from other emerging technologies like quantum dots or thermally activated delayed fluorescence.

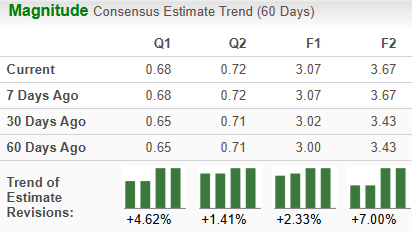

The Zacks Consensus Estimate for Corning’s 2026 sales implies a year-over-year rise of 10.4%, while that for EPS indicates growth of 21.8%. EPS estimates have been trending up 2.3% on average over the past 60 days.

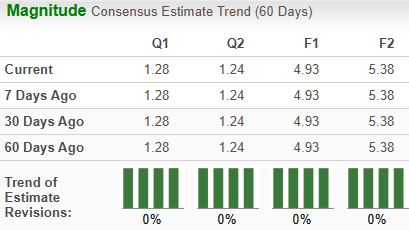

The Zacks Consensus Estimate for Universal Display’s 2025 sales suggests year-over-year growth of 0.5%, while that for EPS implies a rise of 0.2%. The EPS estimates have remained steady over the past 60 days.

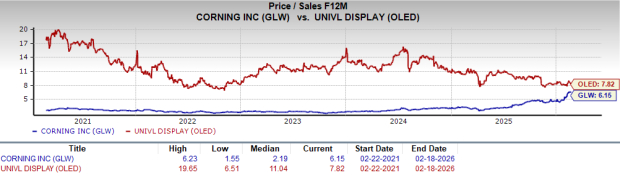

Over the past year, Corning has surged 154.5% compared with the industry’s growth of 183.7%. Universal Display has declined 18.7% over the same period.

Corning looks more attractive than Universal Display from a valuation standpoint. Going by the price/sales ratio, Corning’s shares currently trade at 6.15 forward sales, lower than 7.82 for Universal Display.

Both Corning and Universal Display carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies expect their sales and earnings to improve. In terms of price performance, Corning has outperformed Universal Display and is trading relatively at a discount compared with the latter. With exposure to long-term trends (data centers, telecom infrastructure and advanced glass), steady revenue streams and dividend support, GLW currently appears to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite