|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Allot Inc. ALLT is scheduled to report its fourth-quarter 2025 results on Feb. 25.

The Zacks Consensus Estimate for Allot’s fourth-quarter 2025 revenues is pegged at $27.93 million, which implies growth of 12.2% from the year-ago reported figure.

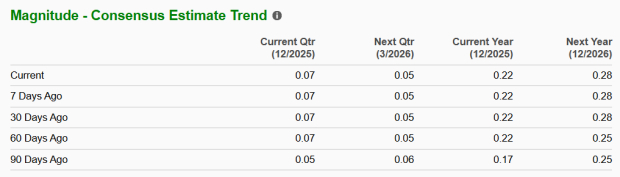

The consensus mark for ALLT’s fourth-quarter non-GAAP earnings has remained unchanged at 7 cents per share over the past 60 days, which calls for a 40% increase from the year-ago quarter’s earnings.

In the last reported results for the third quarter of 2025, Allot reported earnings per share of 10 cents, beating the Zacks Consensus Estimate of 4 cents.

Allot Ltd. price-eps-surprise | Allot Ltd. Quote

Our proven model does not conclusively predict an earnings beat for Allot this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Allot has an Earnings ESP of 0.00% and carries a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Allot provides network-based cybersecurity and network intelligence solutions, mainly for telecom operators and service providers. Allot’s fourth-quarter 2025 performance is likely to have benefited from the robust growth in its Cybersecurity-as-a-Service (SECaaS) business.

In the third quarter of 2025, SECaaS’ ARR increased about 60% year over year. Growth was primarily driven by higher adoption from telecom partners and more end users signing up for Allot's security services. SECaaS made up around 28% of Allot’s total revenues in the third quarter, and looking ahead, management expects this share to move closer to 30%. This is crucial because SECaaS is a subscription-based offering, which offers more predictable revenues. Recurring revenues accounted for 63% of total revenues in the third quarter compared with 58% a year ago, showing a gradual improvement in revenue quality.

During the third quarter earnings call, management outlined a few clear drivers behind SECaaS growth. Large Tier-1 telecom customers that launched services in recent quarters are continuing to add new subscribers, which is driving demand for Allot’s solutions. Existing customers are also buying additional services over time, which supports upselling. Newer offerings, such as OffNetSecure, allow the company to offer protection even when users are off the operator’s network. ALLT’s fourth-quarter performance is likely to have benefited from this demand surge.

The above-mentioned factors are likely to have contributed positively to Allot’s progress in the to-be-reported quarter. If telecom partners continue to scale these services and user adoption remains steady, SECaaS momentum could continue to support Allot’s overall growth in the to-be-reported quarter’s results.

Allot shares have gained 50.8% in the past year, outperforming the Zacks Computer and Technology Sector’s appreciation of 22.3%. The stock has outperformed its peers, including Check Point Software CHKP, Fortinet FTNT and Palo Alto Networks PANW. In the past year, shares of Fortinet, Check Point Software and Palo Alto Networks have lost 25.8%, 26.7% and 21%, respectively.

Despite its strong growth, ALLT stock still looks reasonably priced. Allot is currently trading at a lower price-to-sales (P/S) multiple compared to the sector. Allot’s forward 12-month P/S ratio sits at 4.21X, lower than the sector’s forward 12-month P/S ratio of 6.41X.

ALLT stock trades at a lower P/S multiple compared with its peers, including Check Point Software, Fortinet and Palo Alto Networks. At present, Check Point Software, Fortinet and Palo Alto Networks have P/S multiples of 6.00X, 7.92X and 9.31X, respectively. This discount adds to the appeal for long-term investors.

Allot’s SECaaS business is scaling rapidly across telecom customers and contributing to total revenue growth. If Tier-1 operators keep adding users and demand for newer security offerings remains healthy, SECaaS should remain a key driver of Allot’s performance going forward, which bodes well for the company’s long-term prospects.

The company faces stiff competition from well-established companies in network traffic management and cybersecurity space, such as Check Point Software, Fortinet and Palo Alto Networks. Fortinet recently updated its FortiCNAPP cloud security platform, which factors in network protection when assessing cloud workload risk, which helps security teams focus on real risks instead of dealing with too many alerts.

Check Point Software's Quantum Firewall Software, R82.10, focuses on improving network security for its customers and helps companies use AI safely, apply Zero Trust security rules and protect networks that span offices, data centers and the cloud. Palo Alto Networks has partnered with IBM to launch a joint solution, which combines IBM Consulting’s expertise in quantum-safe security with Palo Alto Networks’ network security platform.

Allot is seeing strong growth in its SECaaS business, which is driving higher revenues, rising recurring income and better earnings visibility. Rising customer interest in newer cybersecurity offerings, such as OffNetSecure, creates opportunities to sell more services to existing customers, which bodes well for the company's prospects.

However, stiff competition from well-established legacy players, such as Check Point Software, Fortinet and Palo Alto Networks, remains a concern.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 39 min |

Stock Market Mixed With Walmart, Iran, Trump Tariff Ruling In Focus: Weekly Review

PANW

Investor's Business Daily

|

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite