|

|

|

|

|||||

|

|

Fluid and coating equipment company Graco (NYSE:GGG) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 7.3% year on year to $528.3 million. Its non-GAAP profit of $0.70 per share was 3.9% above analysts’ consensus estimates.

Is now the time to buy Graco? Find out by accessing our full research report, it’s free.

"Sales were up 7 percent in the first quarter with growth in all segments and regions," said Mark Sheahan, Graco's President and CEO.

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

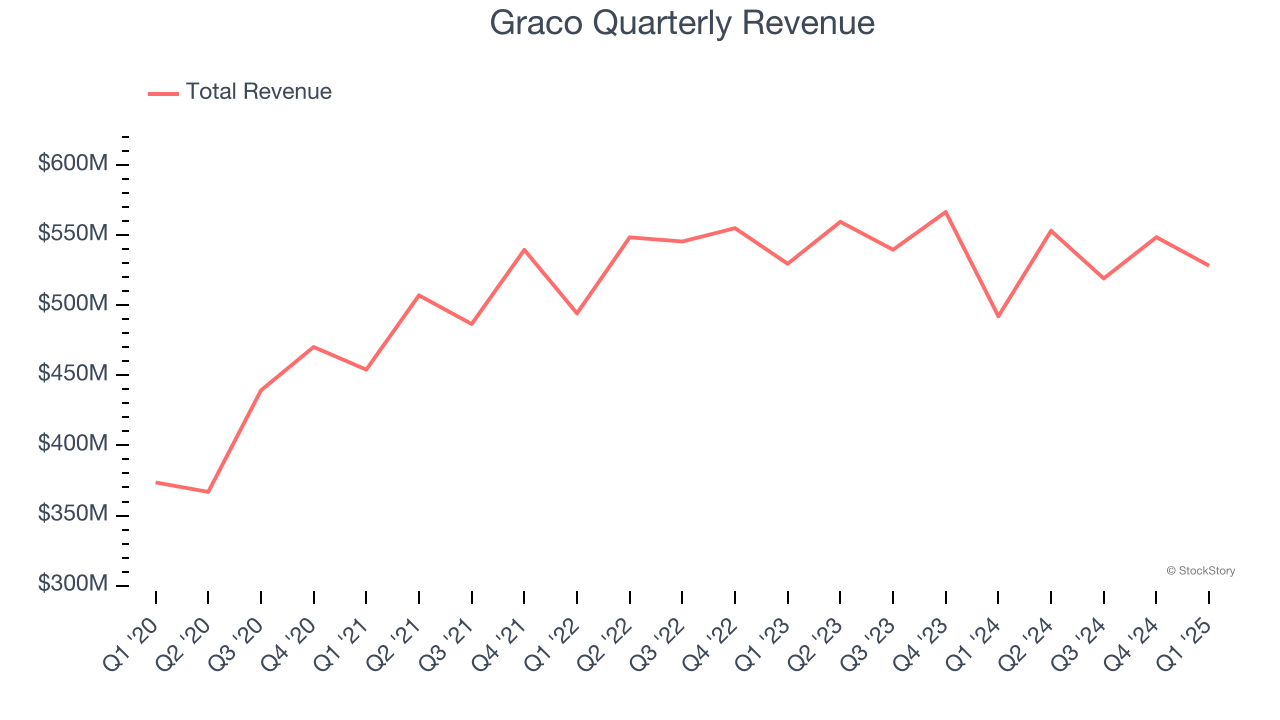

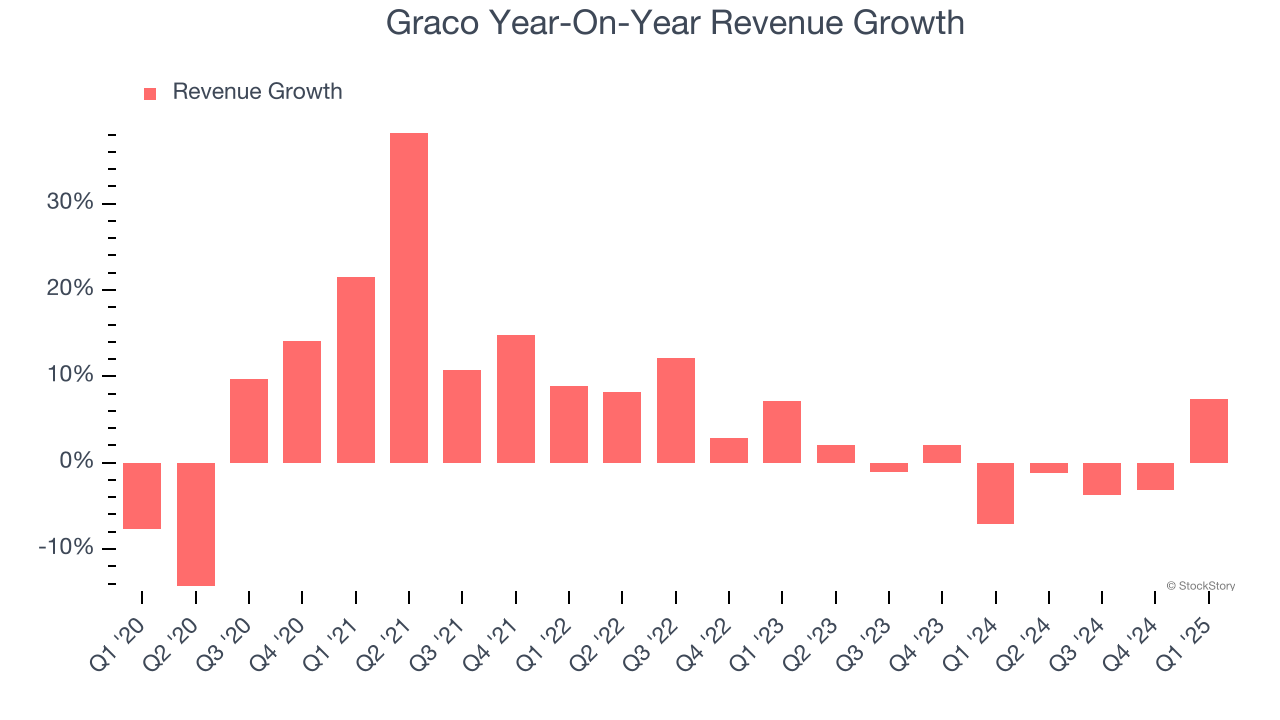

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Graco’s 5.9% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Graco’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Graco also breaks out the revenue for its most important segment, Contractor. Over the last two years, Graco’s Contractor revenue was flat. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Graco grew its revenue by 7.3% year on year, and its $528.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

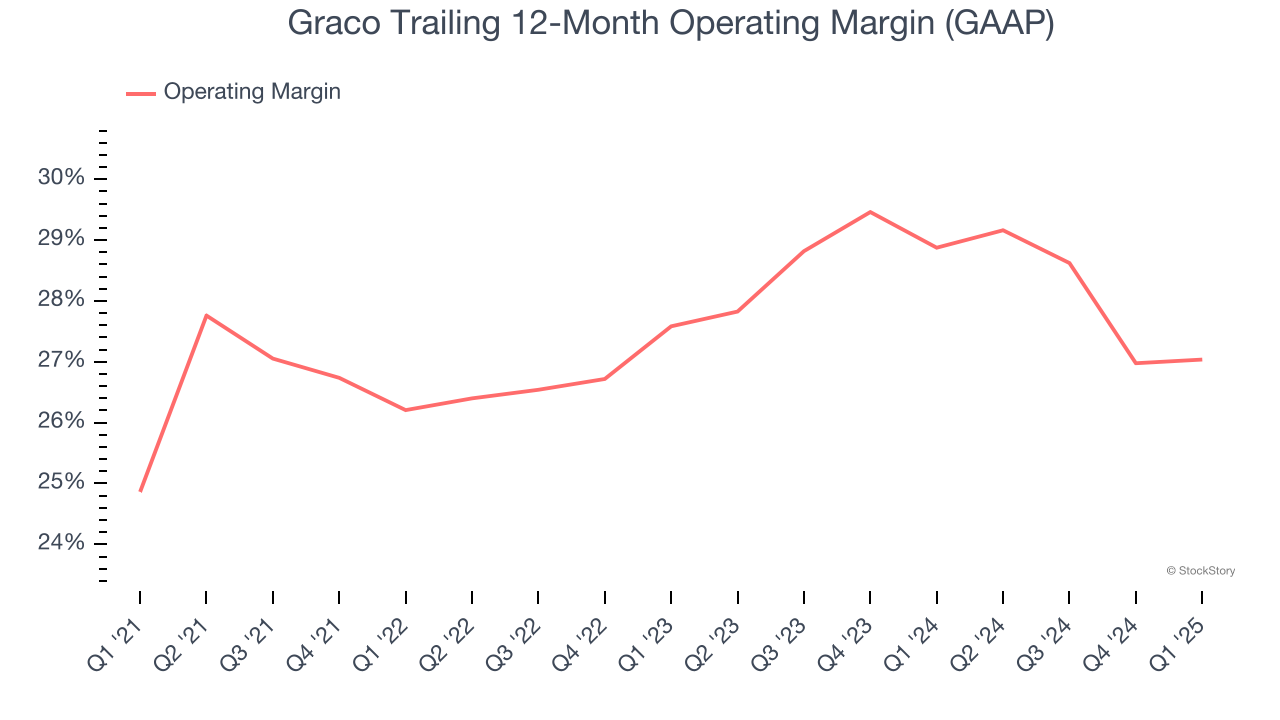

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Graco has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Graco’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Graco generated an operating profit margin of 27.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

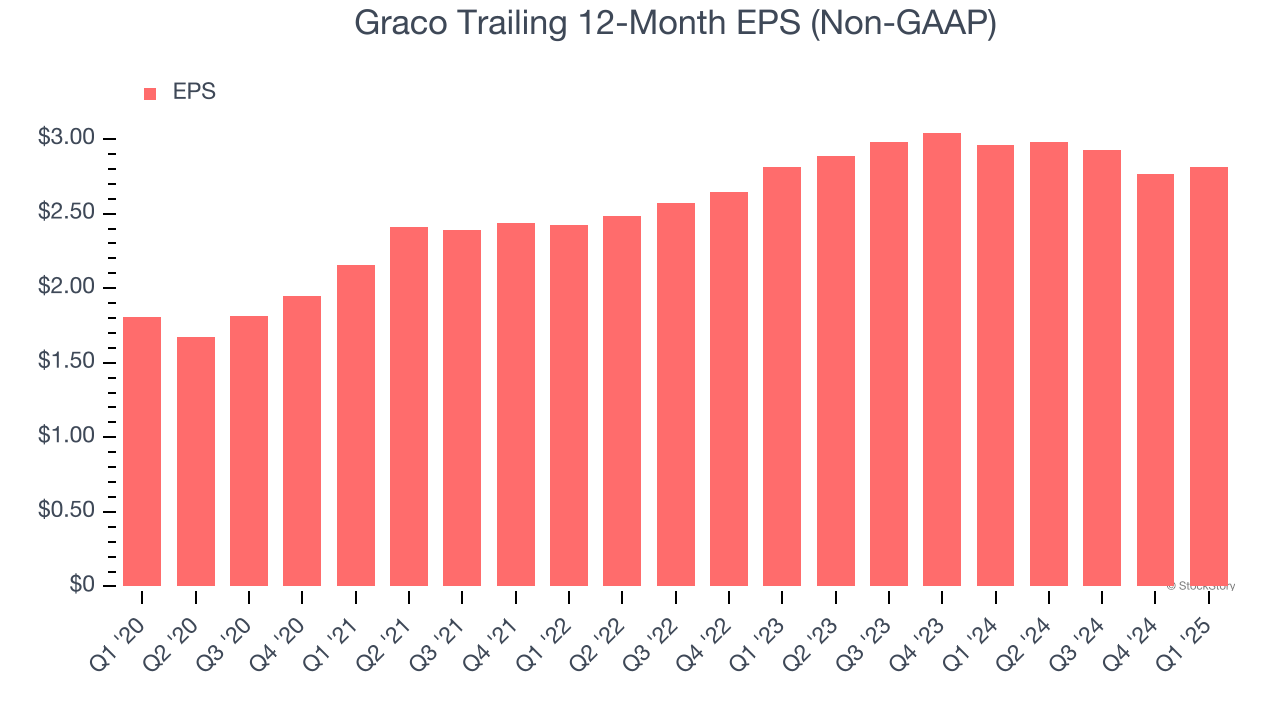

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Graco’s EPS grew at a decent 9.3% compounded annual growth rate over the last five years, higher than its 5.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Graco’s earnings can give us a better understanding of its performance. As we mentioned earlier, Graco’s operating margin was flat this quarter but expanded by 2.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Graco, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q1, Graco reported EPS at $0.70, up from $0.65 in the same quarter last year. This print beat analysts’ estimates by 3.9%. Over the next 12 months, Wall Street expects Graco’s full-year EPS of $2.81 to grow 7.5%.

We were impressed by how significantly Penumbra blew past analysts’ constant currency revenue expectations this quarter. We were also glad its EPS and EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 5.4% to $293.55 immediately following the results.

Is Graco an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

| 10 hours | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite