|

|

|

|

|||||

|

|

Homebuilder Taylor Morrison Home (NYSE:TMHC) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 11.5% year on year to $1.90 billion. Its non-GAAP profit of $2.18 per share was 14.7% above analysts’ consensus estimates.

Is now the time to buy Taylor Morrison Home? Find out by accessing our full research report, it’s free.

"In the first quarter, we delivered 3,048 homes at an average price of $600,000, producing $1.8 billion of home closings revenue, up 12% year over year, with an adjusted home closings gross margin of 24.8%, up 80 basis points year over year. Combined with 70 basis points of SG&A leverage, our adjusted earnings per diluted share increased 25% while our book value per share grew 16% to approximately $58. Once again, each of our operational metrics met or exceeded our prior guidance. These strong top and bottom-line results reflect the benefits of our diversified consumer and product strategy. Especially in volatile market environments, this diversification is a valuable differentiator that we believe contributes to greater volume and margin resiliency," said Sheryl Palmer, Taylor Morrison CEO and Chairman.

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE:TMHC) builds single family homes and communities across the United States.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

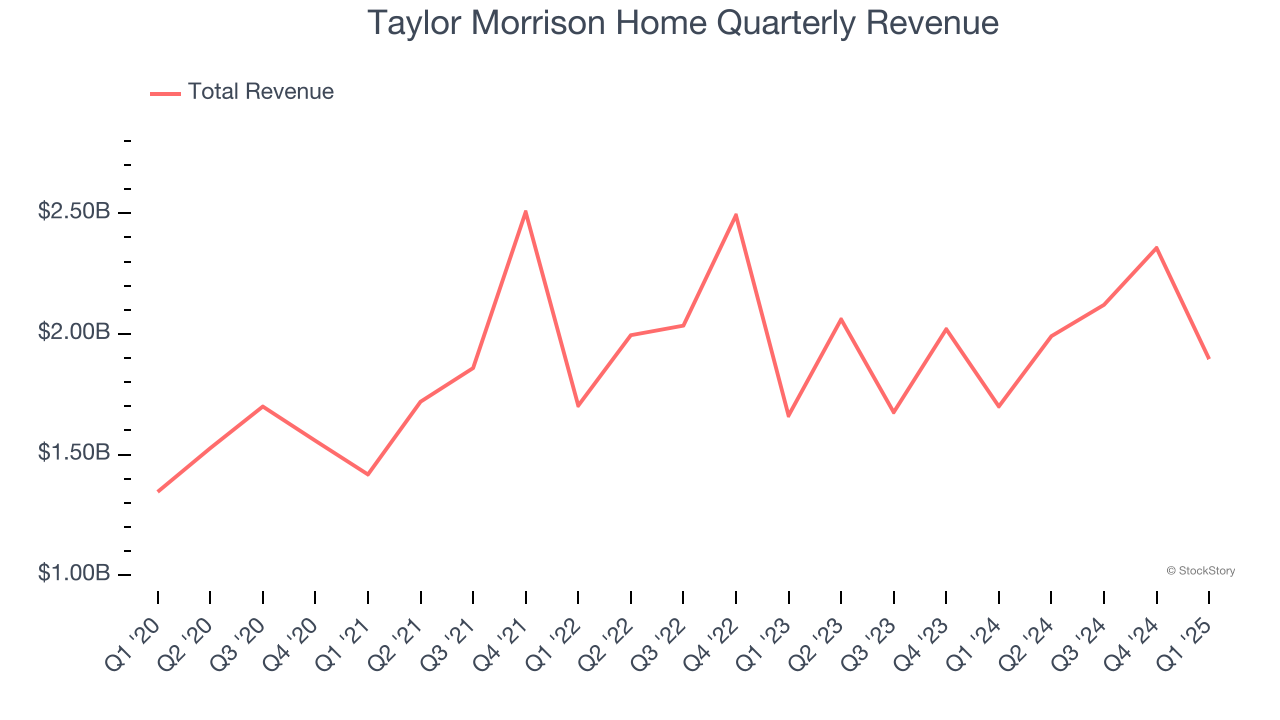

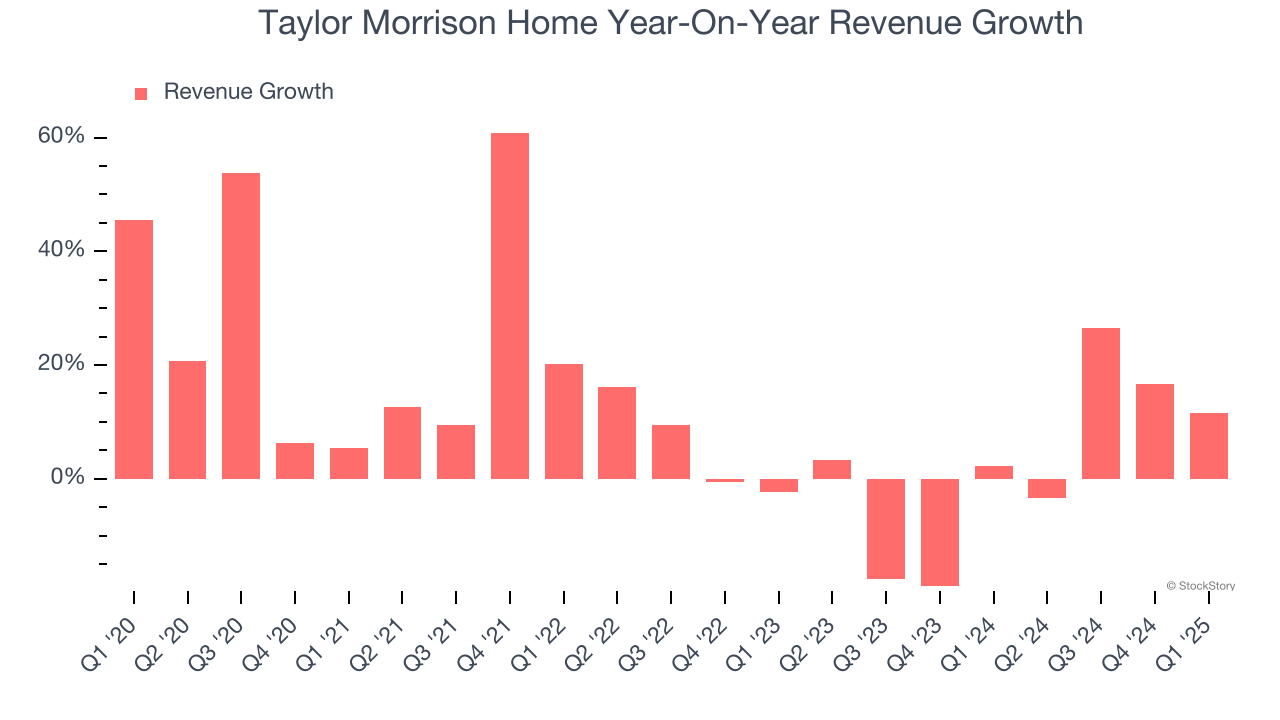

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Taylor Morrison Home’s sales grew at a solid 10% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Taylor Morrison Home’s recent performance shows its demand has slowed as its annualized revenue growth of 1.1% over the last two years was below its five-year trend.

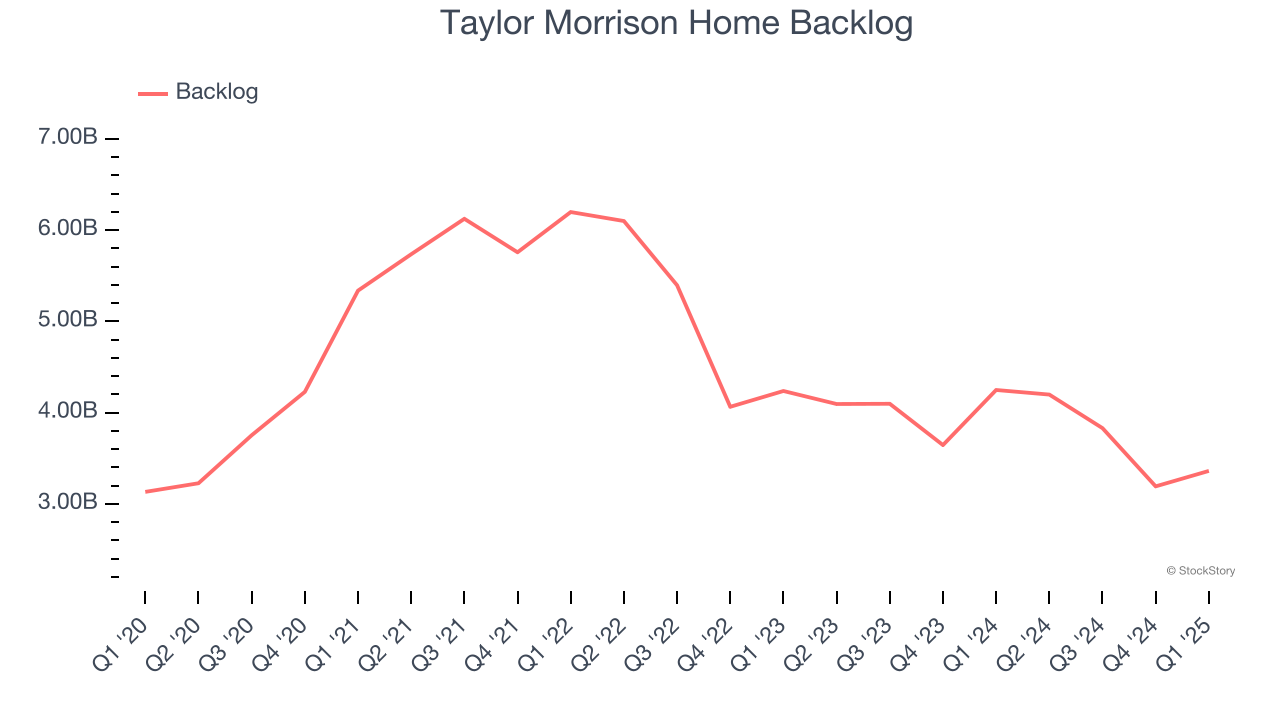

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Taylor Morrison Home’s backlog reached $3.36 billion in the latest quarter and averaged 13% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Taylor Morrison Home reported year-on-year revenue growth of 11.5%, and its $1.90 billion of revenue exceeded Wall Street’s estimates by 5.7%.

Looking ahead, sell-side analysts expect revenue to decline by 1.7% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

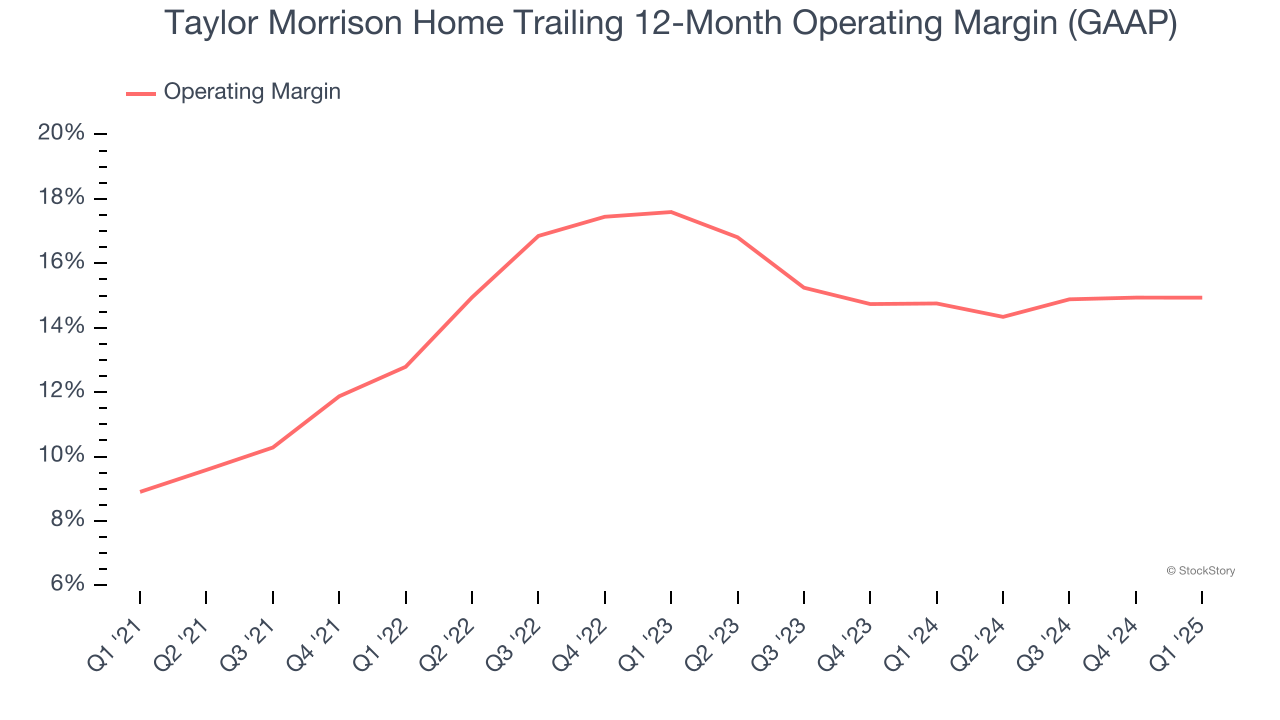

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Taylor Morrison Home has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Taylor Morrison Home’s operating margin rose by 6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Taylor Morrison Home generated an operating profit margin of 14.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

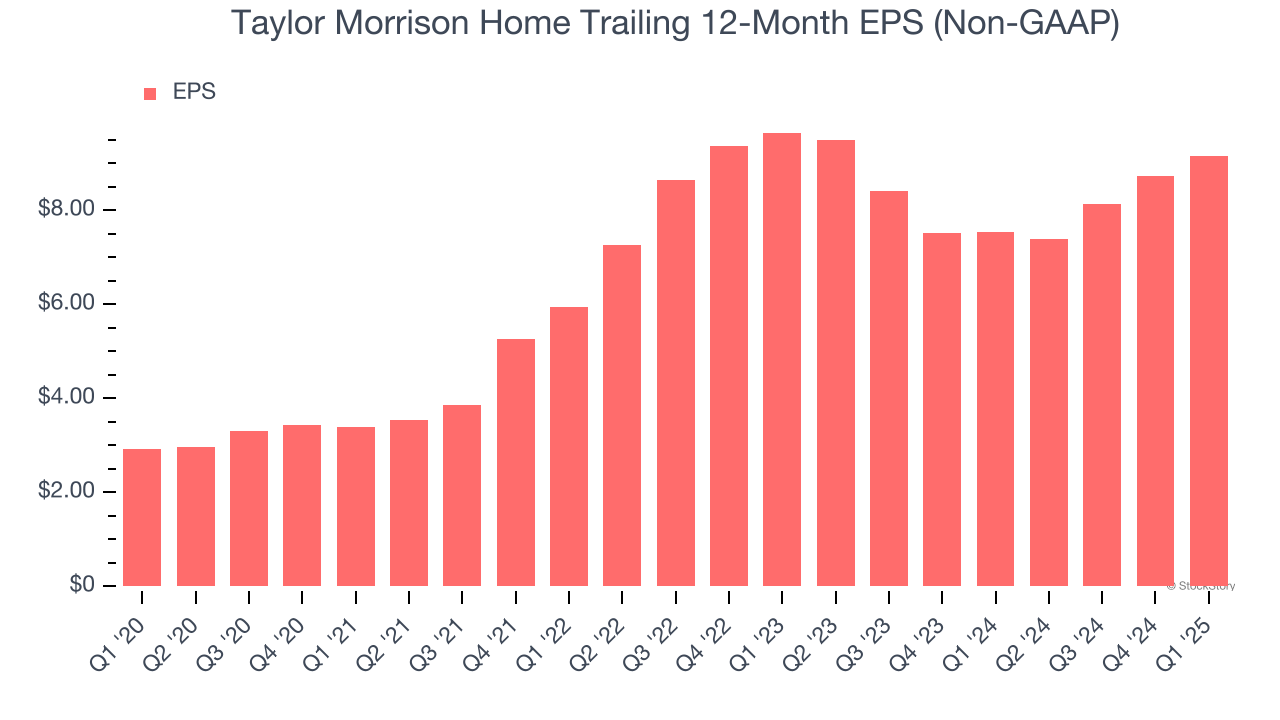

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Taylor Morrison Home’s EPS grew at an astounding 25.6% compounded annual growth rate over the last five years, higher than its 10% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

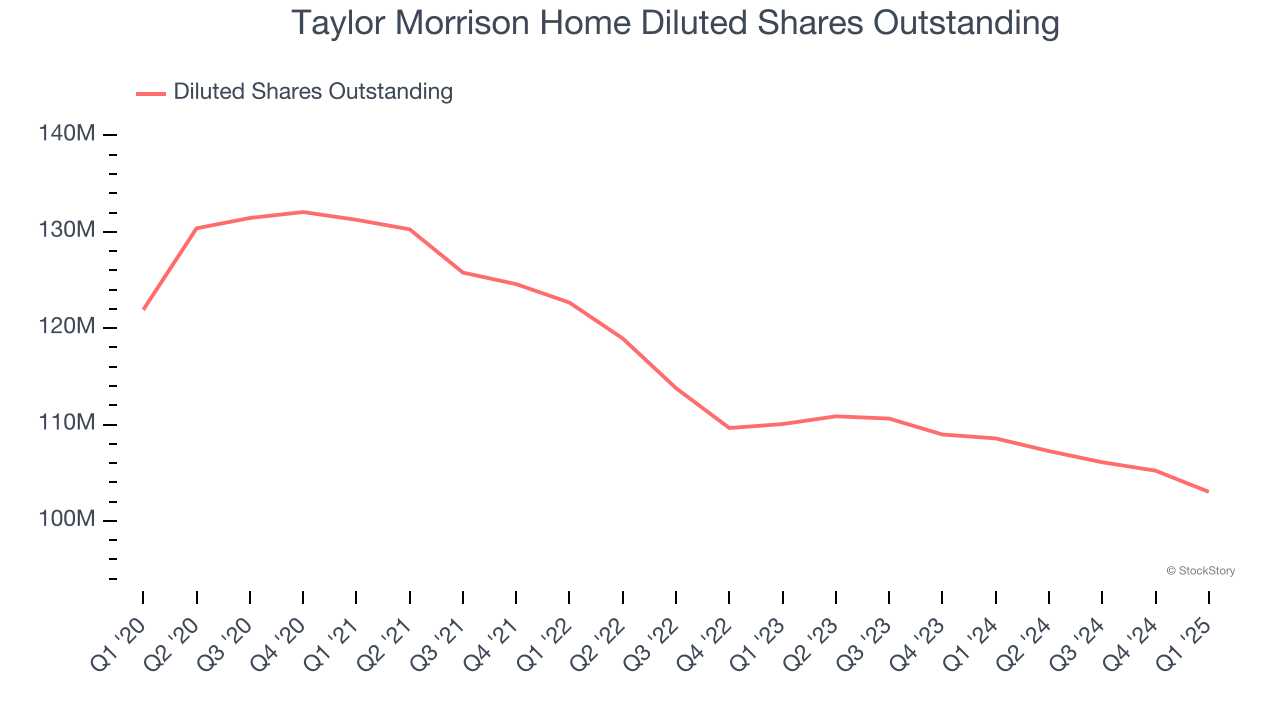

We can take a deeper look into Taylor Morrison Home’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Taylor Morrison Home’s operating margin was flat this quarter but expanded by 6 percentage points over the last five years. On top of that, its share count shrank by 15.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Taylor Morrison Home, its two-year annual EPS declines of 2.6% mark a reversal from its (seemingly) healthy five-year trend. We hope Taylor Morrison Home can return to earnings growth in the future.

In Q1, Taylor Morrison Home reported EPS at $2.18, up from $1.75 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Taylor Morrison Home’s full-year EPS of $9.16 to shrink by 4.4%.

We liked that revenue and EBITDA both beat analysts’ expectations this quarter. On the other hand, its backlog missed significantly. Overall, this quarter was mixed because the backlog metric is a leading indicator of future revenues, meaning a shortfall somewhat negates the good revenue and EBITDA performance in the quarter. The stock remained flat at $59 immediately following the results.

Indeed, Taylor Morrison Home had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| 1 hour | |

| 11 hours | |

| 17 hours | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-07 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite