|

|

|

|

|||||

|

|

Lockheed Martin Corp. LMT delivered a robust performance in the first quarter of 2025, underscoring its resilience in the defense sector. The company reported earnings per share of $7.28, which beat the Zacks Consensus Estimate by 14.8%. Revenues grew 4.5% year over year to $17.96 billion. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

This growth was primarily driven by sustained demand for its defense products, including missile systems and F-35 fighter jets. Segment-wise, all its business units registered positive growth, except Space. LMT reiterated its full-year financial guidance and ended the first quarter with solid cash and cash equivalents worth $1.80 billion. This positioned the company as an attractive investment opportunity.

However, a prudent investor knows that a significant decision like buying a stock should not depend on a company’s single quarterly performance alone. Instead, to make a more informed decision, one should be mindful of the stock’s performance over the past year in terms of share price return, long-term prospects as well as risks (if any) to investing in the same. Below, we have provided a detailed discussion on this.

Shares of Lockheed have slipped 0.2% over the past year, underperforming the Zacks aerospace-defense industry’s growth of 2.3%. The stock has also underperformed the broader Zacks Aerospace sector’s growth of 6.5% as well as the S&P 500’s gain of 7% in the same time frame.

On the contrary, a stellar performance has been delivered by other industry players like Embraer ERJ and RTX Corp. RTX, which outpaced the industry, sector as well as the S&P 500. Notably, shares of ERJ and RTX have witnessed a surge of 77% and 18.3%, respectively, over the past year.

Lockheed Martin's modest 0.2% share price decline over the past year reflects a confluence of operational challenges and shifting investor sentiment despite its robust position in the defense sector.

A recent factor affecting the stock’s price movement at the bourses must have been Lockheed's failure to secure the $20 billion Next Generation Air Dominance contract in March 2025. Boeing, a major competitor of LMT, won the award instead, which might have caused investors to lose confidence in LMT for the moment.

Another significant factor contributing to the company’s poor performance in the U.S. stock market is the unexpected $2 billion loss that LMT incurred in 2024, primarily due to cost overruns in classified missile and aeronautics programs.

The global defense industry’s growth outlook remains robust due to heightened geopolitical tensions, which have led to increased defense spending worldwide. This bodes well for prominent defense contractors like Lockheed and RTX.

As the largest U.S. defense contractor, Lockheed benefits from consistent contract flows for its combat-proven products from the Pentagon and U.S. allies. This is evident from its solid backlog count, which implies strong revenue generation prospects. Notably, of its $173 billion worth of backlog as of March 30, 2025, the company expects to recognize approximately 38% over the next 12 months and 64% over the next 24 months.

Such revenue generation prospects also bolster the company’s bottom-line growth opportunities. In line with this, the consensus estimate for LMT’s long-term (three-to-five year) earnings growth rate is pegged at a solid 10.6%.

Moreover, it is imperative to mention that apart from its core defense capabilities, Lockheed is a well-known manufacturer of advanced space technology systems ranging from satellites to spacecraft. With the global space economy estimated to exceed the value of $1 trillion beyond 2030, (as per a major number of analysts worldwide), LMT’s growth prospects in this industry remain immense.

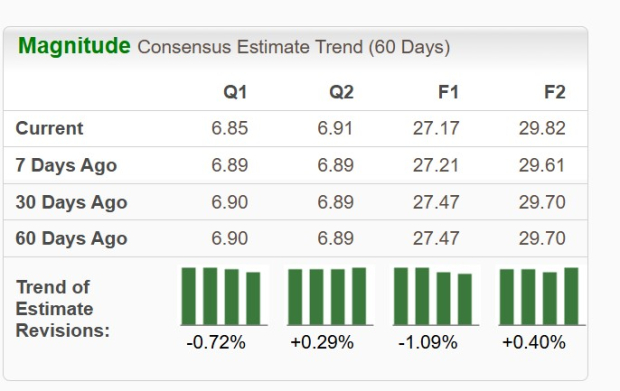

A quick sneak peek at its near-term earnings and sales estimates mirrors a similar growth story.

The Zacks Consensus Estimate for second-quarter and full-year 2025 sales suggests an improvement of 3.2% and 4.5%, respectively, year over year.

However, the bottom-line estimate for second-quarter and full-year 2025 suggests a year-over-year decline and a downward movement of 0.7% and 1.1%, respectively, over the past 60 days. This indicates analysts’ declining confidence in the stock.

Despite being a prominent defense contractor, Lockheed faces some notable challenges and one should consider them before adding this stock to their portfolio.

Lockheed’s Canadian Maritime Helicopter Program (“CMHP”), which involves the design, development and production of CH-148 aircraft, has been facing performance issues lately, including delivery delays. The Royal Canadian Air Force’s flight hours have been significantly less than anticipated. This has affected program revenues and the recovery of Lockheed’s costs under this program. As of March 30, 2025, the company’s cumulative losses in relation to CMHP were approximately $100 million.

Moreover, LMT might still be facing some operational challenges for the F-35's Technology Refresh-3 (TR-3) upgrade, particularly in regard to full combat capability. While deliveries of TR-3-equipped aircraft resumed last year after a long pause, software and hardware issues may impact the program, leading to delays in full operational testing and the finalization of the TR-3 upgrade package (as per major media reports).

In terms of valuation, LMT’s forward 12-month price-to-earnings (P/E) is 16.63X, a premium to its peer group’s average of 16.49X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared to that of its peers.

Its industry peers are also trading at a premium compared to the peer group’s average P/E ratio. While RTX is trading at a forward earnings multiple of 18.95X, Embraer is trading at 17.03X.

Investors interested in Lockheed should wait for a better entry point, considering its premium valuation and downward revision witnessed in its near-term earnings estimate.

However, those who already own this Zacks Rank #3 (Hold) stock may stay invested as its recent quarterly performance, strong backlog count and impressive sales growth expectations offer significant growth prospects.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 12 hours | |

| 12 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite