|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As global air travel rebounds and defense modernization accelerates, aerospace technology stocks are drawing fresh investor interest. Two stocks that stand out to gain from this trend are Astronics Corporation ATRO and Heico Corporation HEI. The sector’s focus on mission-critical systems, next-gen avionics, and advanced connectivity solutions is fueling long-term growth, especially as airlines and militaries upgrade their fleets.

Astronics specializes in innovative electrical power systems, lighting, and inflight connectivity solutions (for both commercial and defense clients) — key components in the modernization of aircraft cabins and cockpit systems. Heico, on the other hand, takes a diversified approach by acquiring and growing niche aerospace and electronics businesses, focusing on high-margin, FAA-approved replacement parts and specialty components.

With 2025 shaping up to be pivotal for aviation tech, investors might be weighing which of these mid-cap aerospace specialists is best positioned to deliver sustainable returns. Let’s delve deeper to gain a better understanding.

Recent Achievements: Astronics ended 2024 with a 15% year-over-year sales growth, backed by a solid 21% surge in its sales to the commercial transport market and an impressive 43% improvement in sales to the military aircraft market.

The company made good progress last year in its contract for the U.S. Army Future Long Range Assault Aircraft (“FLRAA”) program. With prototypes for this program expected to fly in 2026, the development stage of FLRAA is projected to generate $60-$65 over the next couple of years for ATRO.

More recently, in April 2025, Astronics announced that it has been selected to provide the Frequency Converter Unit (“FCU”) for the NASA and Boeing Transonic Truss-Braced Wing (“TTBW”) X-66 aircraft demonstrator. In addition to designing the FCU, Astronics will collaborate closely with project stakeholders to support ground and flight tests, slated to start in 2028. Such contract wins and the company’s progress in mission-critical programs like FLRAA should help it generate steady revenue growth over the coming years as well.

Financial Stability: The company ended December 2024 with a cash and cash equivalent of $18 million. While its long-term debt totaled $169 million as of 2024-end, its current debt was nil. So, it is safe to conclude that the stock boasts a solid solvency position in the near term, which should enable it to duly meet its capital expenditure target of $35-$40 million in 2025.

Notably, a major part of this investment is expected to be dedicated to new product innovation. Technological innovation is a cornerstone of growth strategy for stocks like ATRO, as both the commercial and defense aerospace markets increasingly thrive on next-gen solutions.

Recent Achievement: Heico ended the first quarter of fiscal 2025 (January 2025) with 15% year-over-year sales growth, backed by increased demand for its aftermarket replacement parts, repair and overhaul parts, and service product lines.

The company's disciplined acquisition strategy, a major part of its growth story, has been driving its overall performance. Keeping up with this trend, HEI announced in April 2025 that its Mid Continent Controls subsidiary acquired all of the ownership interests of Rosen Aviation, which designs and manufactures in-flight entertainment (IFE) products, principally in-cabin displays and control panels, for the business and VVIP aviation markets.

In February, the company’s Flight Support Group unit acquired 90% of Millennium International, a provider of business jet avionics repair solutions. Such valuable acquisitions are projected to expand Heico’s product portfolio and customer base, which should keep its cash flow in good shape.

Financial Stability: The company’s cash and cash equivalents as of Jan. 31, 2025, totaled $165.5 million, which improved sequentially. The company’s long-term debt as of Jan. 31, 2025, was $2,350 million. Although its long-term debt level was more than the company’s cash reserve, its current debt of $4.1 million as of Jan. 31, 2025, was quite lower than that. So, we may safely conclude that Heico holds a strong solvency position, at least in the short run, which should enable it to continue with its acquisition spree in the coming years.

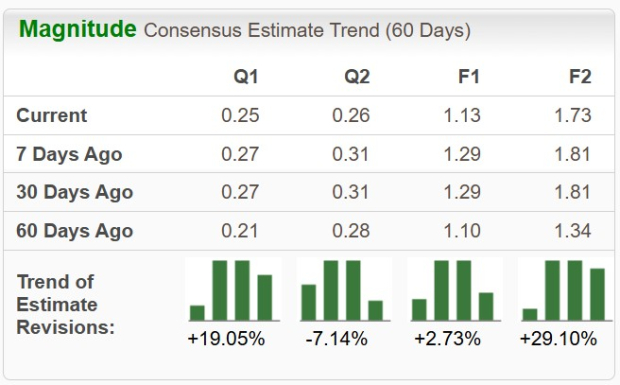

The Zacks Consensus Estimate for ATRO’s 2025 sales and earnings per share (EPS) implies an improvement of 3.6% and 3.7%, respectively, from the year-ago quarter’s reported figures. ATRO’s EPS estimates have shown an upward movement over the past 60 days.

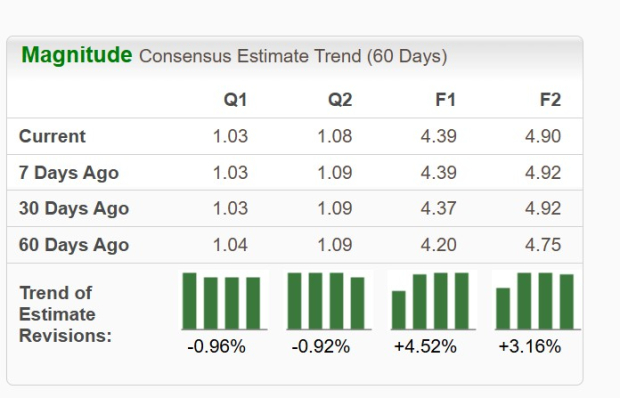

The Zacks Consensus Estimate for HEI’s fiscal 2025 sales implies a year-over-year improvement of 11.1%, while that for earnings suggests a 19.6% surge. The stock’s 2025 and 2026 EPS estimates have shown upward movement over the past 60 days.

ATRO (up 19.5%) has outperformed HEI (up 3.1%) over the past three months. Also, in the past year, ATRO has outperformed HEI. While ATRO’s shares surged 24.3%, HEI rose 18.6%.

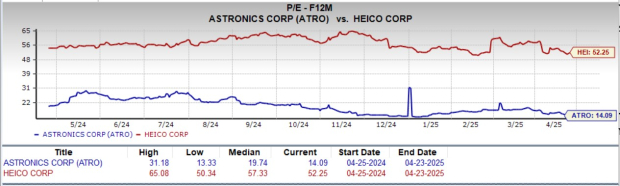

Astronics is trading at a discount, with its forward 12-month price/earnings multiple of 14.09X being below HEI’s forward price/earnings multiple of 52.25X. Also, when compared to its one-year median, ATRO is trading at a discount.

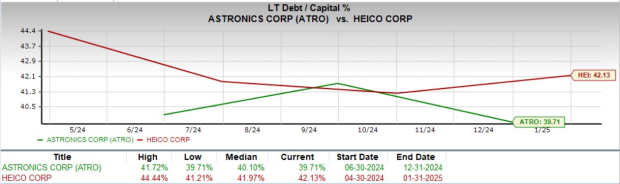

Given that these stocks are facing the brunt of the supply-chain challenge, which is still affecting the commercial aerospace industry, a comparative analysis of their long-term debt-to-capital reflects that HEI is more debt-ridden than ATRO.

A comparative analysis of both these stocks’ Return on Equity (ROE) suggests that that ATRO is less efficient at generating profits from its equity base than HEI.

Both Astronics and Heico offer compelling opportunities as aerospace technology demand accelerates. ATRO boasts a cleaner balance sheet, stronger near-term solvency, and trades at a significant valuation discount. On the flip side, HEI’s proven acquisition strategy, solid aftermarket business, and robust earnings growth projections underline its operational efficiency and scalability.

While HEI’s higher ROE and stronger cash position offer long-term appeal, its premium valuation and higher leverage may pose some risk. ATRO’s recent outperformance at the bourses and improving earnings outlook suggest a promising story, particularly for value-focused investors.

With ATRO sporting a Zacks Rank #1 (Strong Buy) and HEI carrying a Zacks Rank #2 (Buy) at present, the better pick depends on one’s risk appetite — ATRO for upside potential at a bargain, or HEI for consistency and established growth. Either way, both are poised to benefit from 2025’s aerospace tailwinds.

You can see the complete list of today’s Zacks Rank #1 stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite