|

|

|

|

|||||

|

|

Bristol-Myers Squibb Company BMY reported first-quarter 2025 adjusted earnings per share (EPS) of $1.80, which comfortably beat the Zacks Consensus Estimate of $1.51. In the year-ago quarter, BMY posted an adjusted loss per share of $4.40. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Total revenues of $11.2 billion surpassed the Zacks Consensus Estimate of $10.7 billion. However, revenues were down 6% from the year-ago period’s level due to a decline in Legacy portfolio sales.

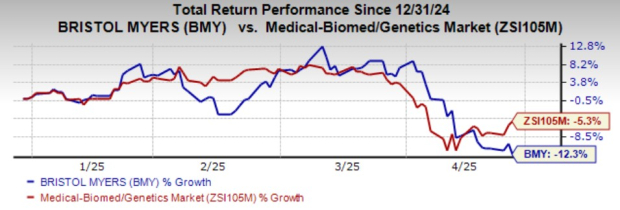

BMY’s shares have lost 12.3% year to date compared with the industry's decline of 5.3%.

Revenues decreased 7% to $7.9 in the United States. International revenues decreased 2% year over year to $3.3 billion.

BMY’s Growth Portfolio comprises drugs like Opdivo, Orencia, Yervoy, Reblozyl, Camzyos, Breyanzi, Opdualag, Zeposia, Abecma, Sotyku, Krazati and Cobenfy.

Revenues from the Growth portfolio totaled $5.6 billion, up 16% from the year-ago level. Sales grew 18% when adjusted for foreign exchange impacts.

Growth Portfolio revenues were primarily driven by higher demand for Opdivo, Reblozyl, Breyanzi, Camzyos, Yervoy and Opdualag.

Total sales of the immuno-oncology drug Opdivo, approved for multiple cancer indications, increased 9% year over year to $2.26 billion. The figure beat the Zacks Consensus Estimate of $2.17 billion and our model estimate of $2.14 billion.

However, sales of the rheumatoid arthritis drug Orencia decreased 4% to $770 million.

Melanoma drug Yervoy contributed $624 million to the top line. The figure rose 7% year over year. Yervoy sales beat both the Zacks Consensus Estimate and our model estimate of $597 million.

Reblozyl sales surged 35% year over year to $478 million. Reblozyl sales were in line with the Zacks Consensus Estimate but missed our model estimate of $493.9 million.

Opdualag sales jumped 23% to $252 million. Opdualag sales missed the Zacks Consensus Estimate of $262 million and our model estimate of $257 million.

Breyanzi sales skyrocketed 146% to $263 million and beat the Zacks Consensus Estimate of $240 million and our model estimate of $260 million. Camzyos sales, too, surged 89% to $159 million.

Sales of Zeposia declined 3% to $107 million. Abecma sales increased 26% to $103 million.

Sotyktu sales totaled $55 million. Krazati raked in sales of $48 million. The newly approved schizophrenia drug, Cobenfy, generated sales of $27 million.

Revenues for the Legacy Portfolio plunged 20% to $5.64 billion due to the continued generic impact on Revlimid, Pomalyst, Sprycel and Abraxane, as well as the effects of the U.S. Medicare Part D redesign.

Eliquis sales of $3.56 billion were down 4%. Nonetheless, sales beat both the Zacks Consensus Estimate of $3.3 billion and our model estimate of $3.4 billion.

Please note that Bristol-Myers has a collaboration agreement with Pfizer PFE for Eliquis. The companies collaborated in 2007. Profits and losses are shared equally on a global basis, except in certain countries where Pfizer commercializes Eliquis and pays BMY a sales-based fee.

Multiple myeloma (MM) drug Revlimid revenues plummeted 44% to $936 million due to lower demand on account of generic erosion. Sales surpassed both the Zacks Consensus Estimate of $885 million and our model estimate of $764.3 million.

MM drug Pomalyst generated sales of $658 million, down 24% year over year.

Leukemia drug Sprycel sales nosedived 53% year over year to $175 million due to generic competition.

Abraxane revenues declined 52% to $105 million.

Gross margin decreased to 73.1% from 75.5% in the year-ago quarter due to product mix. Adjusted research and development expenses decreased 5% to $2.2 billion. Adjusted marketing, selling and administrative expenses decreased 20% to $1.6 billion due to BMY’s cost-cutting initiative.

The FDA updated the prescribing information for Camzyos, simplifying treatment options for patients and physicians by reducing the required echo monitoring for eligible patients in the maintenance phase and expanding patient eligibility by reducing contraindications.

Earlier, the late-stage ODYSSEY-HCM study evaluating Camzyos for the treatment of adult patients with symptomatic New York Heart Association class II-III non-obstructive hypertrophic cardiomyopathy did not meet its dual primary endpoints.

The late-stage study evaluating Cobenfy as an adjunctive treatment to atypical antipsychotics in adults with schizophrenia did not meet the threshold for statistical significance for the primary endpoint.

The FDA approved Opdivo plus Yervoy as a first-line treatment for adult patients with unresectable or metastatic hepatocellular carcinoma.

Bristol Myers Squibb Company price-consensus-eps-surprise-chart | Bristol Myers Squibb Company Quote

Bristol-Myers raised its annual revenue guidance to $45.8-$46.8 billion from $45.5 billion on the back of strong performance of the Growth Portfolio, better-than-expected Legacy Portfolio sales in the first quarter of 2025 and a favorable impact of approximately $500 million related to foreign exchange rates.

The Zacks Consensus Estimate for 2025 revenues is pinned at $45.82 billion.

The company now expects adjusted earnings to be in the range of $6.70-$7 (previous guidance: $6.55-$6.85). The Zacks Consensus Estimate for 2025 EPS is pegged at $6.76.

Management added that the stated guidance revisions include the estimated impact of current tariffs on U.S. products shipped to China but do not account for potential pharmaceutical sector tariffs.

BMY’s better-than-expected quarterly results were driven by higher demand for Opdivo, Breyanzi, Reblozyl and Camzyos.

As expected, sales in the Legacy portfolio declined, but the deterioration was lower than expected.

Consequently, the guidance was raised to reflect this performance.

The strategic productivity initiative undertaken by the company is boosting the bottom line.

While the performance definitely boosts investor sentiment, BMY has a few challenges to navigate.

Bristol-Myers currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the biotech sector are ANIP Pharmaceuticals ANIP and ADMA Biologics ADMA. While ANIP currently sports a Zacks Rank #1 (Strong Buy), ADMA carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2025 earnings per share (EPS) have risen from $5.54 to $6.36. EPS estimates for 2026 have increased from $6.75 to $7.14 during the same period.

ANI Pharmaceuticals’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 17.32%.

In the past 30 days, estimates for ADMA Biologics’ 2025 EPS have increased from 69 cents to 71 cents. The estimate for 2026 earnings per share has remained constant at 93 cents. Year to date, shares of ADMA Biologics have gained 29%.

ADMA’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 32.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite