|

|

|

|

|||||

|

|

While Nu Holdings Ltd. NU directly disrupts traditional financial services as a digital bank, Palantir Technologies Inc. PLTR provides the underlying data analytics and AI infrastructure that can empower such disruption.They are technology-driven disruptors in the broader fintech and data ecosystem, targeting inefficiencies in traditional financial services.

Palantir focuses on data analytics and AI solutions for government and commercial clients, while Nu Holdings offers digital banking services in Latin America. Investors interested in the fintech space may find value in comparing these two companies to assess their potential.

While many companies are engaged in an arms race to develop slightly improved AI models, Palantir differentiates itself by focusing on seamless AI integration into enterprise operations. The company refers to this approach as quantified exceptionalism, delivering transformative, measurable outcomes such as time savings, cost reductions, and productivity enhancements.

At the core of Palantir’s strategy is its Artificial Intelligence Platform, which enables businesses to structure and organize their data, whether financial, supply chain, operational or HR-related, so that AI can process and execute tasks more effectively. By leveraging an ontology-driven approach, Palantir creates digital representations of entire enterprises, allowing AI to interact seamlessly with business operations. Unlike companies that contribute to the oversupply of AI models, Palantir is actively shaping the demand side of the AI economy, positioning itself as a key player in enterprise AI adoption.

PLTR’s recent financial performance underscores its strength. In 2024, revenues surged 29% year over year, with its U.S. commercial business experiencing 54% growth. The company has also secured several high-profile customer deals, including partnerships with Walgreens and Heineken, which have driven a bullish sentiment in the stock market. Additionally, Palantir has formed strategic alliances with TWG Global, EYSA, Voyager, and Databricks, further solidifying its market position.

For 2025 and 2026, we are projecting PLTR’s earnings to rise 34% and 25%, respectively, year over year. Sales are projected to rise 32% in 2025 and 28% in 2026.

Palantir's forward 12-month P/E ratio of 169.3, significantly higher than the industry average of 32.4, indicates a steep overvaluation. This premium suggests investors are pricing in aggressive future growth, particularly in AI and government contracts. However, such a high multiple also reflects elevated expectations, leaving little room for error. While confidence in Palantir’s long-term potential remains strong, the valuation implies that much of the anticipated success is already baked into the stock price, making it vulnerable to short-term volatility.

As a trailblazer in the fintech industry, Nu Holdings leverages a digital-first and scalable business model to drive down operational costs while boosting efficiency. This innovative approach has positioned NU as a disruptor in traditional banking, enhancing financial inclusion and accessibility across its markets. NuBank, NU’s flagship platform, has earned recognition as one of Latin America’s most trusted and prominent brands.

In Brazil, a market dominated by traditional banking giants, NU has carved out a distinct identity with its innovative cost structure and customer-centric model. Its customer base continues to grow at an impressive pace, propelled by its digital-first strategy. The company is also making substantial strides in expanding its operations across Latin America, particularly in Mexico and Colombia, where adoption is accelerating. With opportunities to penetrate untapped regions, NU’s footprint is poised to expand further. During the fourth quarter of 2024, the company added 4.5 million customers, bringing its global customer count to 114.2 million. The increasing trend toward digitization is expected to sustain and enhance this growth trajectory.

NU’s revenue model is highly diversified, encompassing streams such as lending, interchange fees and marketplace services. This diversification not only mitigates risks but also provides stability during economic uncertainties. The company has consistently demonstrated robust revenue growth, driven by higher monetization of its platform and increased user engagement. Key areas like credit cards and personal loans have significantly contributed to its financial success. In the fourth quarter, NU reported a 24% year-over-year revenue increase.

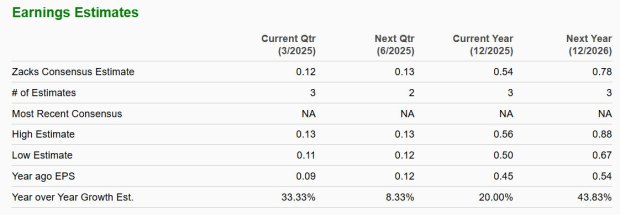

The Zacks Consensus Estimate for NU’s 2025 earnings is pegged at 54 cents, indicating 20% growth from the year-ago level. Earnings in 2026 are expected to increase 44% from the prior-year actuals. The company’s sales are expected to grow 34% and 25% year over year, respectively, in 2025 and 2026.

NU stock appears significantly overvalued compared to industry peers, currently trading at 18.7 times forward earnings, more than double the sector's average of 9.1 times. This substantial premium reflects the market’s optimism about NU’s growth potential, driven by its innovative fintech model, expanding customer base and strong revenue trajectory. However, such a lofty valuation also introduces risks, as any shortfall in earnings or slower-than-expected growth could lead to a sharp correction.

While both companies are tech-driven disruptors, Nu Holdings stands out as the stronger investment due to its direct disruption of traditional banking, explosive growth in Latin America, and a scalable, high-margin fintech model. NU’s more than 114 million customers, diversified revenue streams, and strong earnings growth showcase its execution, whereas Palantir’s overvaluation (169x P/E) and reliance on enterprise AI adoption pose higher risks. NU’s lower customer acquisition costs, expanding profitability, and untapped regional markets give it a clearer path to sustained outperformance. For investors seeking pure-play fintech upside, NU is a better consideration.

While NU has a Zacks Rank #3 (Hold), PLTR has a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

PLTR

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Nasdaq, Dow Climb; Airline Name Flies Higher (Live Coverage)

PLTR

Investor's Business Daily

|

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite