|

|

|

|

|||||

|

|

Hologic HOLX is set to release second-quarter fiscal 2025 results on May 1, after the closing bell.

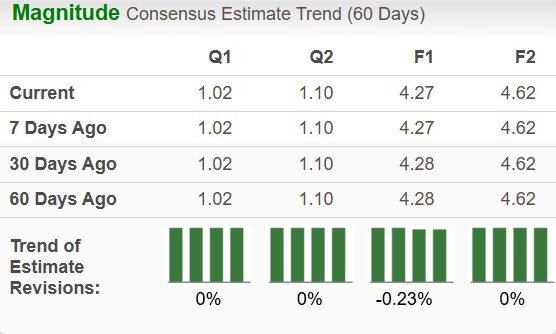

The Zacks Consensus Estimate for second-quarter earnings suggests a 0.97% decrease year over year to $1.02 per share. The estimate has remained stable in the past 60 days. The Zacks Consensus Estimate for second-quarter revenues currently stands at $1.00 billion, a 1.56% decline year over year. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

In the last four quarters, Hologic surpassed the consensus mark three times and missed once, the average surprise being 2.53%.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), along with a positive Earnings ESP, has a higher chance of beating estimates, which is not the case here.

Earnings ESP: Hologic has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks Rank #1 stocks here.

We expect a couple of challenges to have impacted the company’s overall performance in the second quarter of fiscal 2025. This includes heightened macroeconomic volatilities, such as the impact of new U.S. administration policy changes, supply-chain constraints, alongside cost inflation in critical materials and components. Additionally, the continued strengthening of the U.S. dollar is likely to impact results. In the Skeletal Health segment, revenues may have experienced a dip due to lower sales of the Horizon DXA system due to delays in resuming shipments following the temporary stop-ship. Our model forecast indicates a 32.8% year-over-year decline in the division’s sales in the to-be-reported quarter.

Also, in the Breast Health segment, Hologic is expected to have witnessed lower sales of capital equipment. On the first-quarter earnings call, the company revealed its updated outlook for 2025, projecting a softer year for gantry placements after its initial view was clouded by post-chip shortage growth momentum in mammography sales. Going by our model, Breast Health revenues are likely to decline 3.6% year over year in the second quarter.

On a positive note, the service revenue side of the business is likely to have experienced strong growth. Following the addition of Endomagnetics’ market-leading product lineup and research and development (R&D) capabilities, Hologic’s interventional breast business is expected to have favorably boosted its revenues in the fiscal second quarter.

Similar to the past quarters, the Diagnostics division’s performance is likely to have been led by its core Molecular business. The growth is expected to have been powered by the robust sales of the BV/CV/TV assay and the Biotheranostics’ lab testing business from the expanding adoption and coverage for the breast cancer index (BCI) test. Furthermore, strong U.S. sales of the ThinPrep Pap Test are likely to have driven the Cytology & Perinatal revenues in the to-be-reported quarter. Our model forecast for the Diagnostics segment points to modest 0.5% growth.

Lastly, Hologic is likely to deliver solid GYN Surgical revenues in the fiscal second quarter, driven by its International business, which alone grew nearly 20% in the first quarter. Sales of both MyoSure and NovaSure devices may have been strong in Europe due to the company’s go-direct strategy and an improved reimbursement landscape. Additionally, the segment is likely to have benefited from the robust uptake of the Fluent fluid management system.

In January 2025, Hologic acquired Gynesonics, adding its flagship SOMATEX minimally invasive radio frequency ablation tool to the Surgical portfolio. Its healthy international profile is expected to have positively boosted the segment in the second quarter. According to our model, the Surgical division revenues are expected to improve 3% year over year.

In the past 30 days, Hologic shares have declined 4.2%, narrower than the industry’s 9% fall and the S&P 500 composite’s 7% decline. The company has performed relatively better than two of its peers, GE Healthcare GEHC and Becton, Dickinson and Company BDX, which plummeted 18.7% and 10.4%, respectively, in the same time frame.

At a forward 12-month Price/Earnings (P/E) of 13.05X, Hologic shares are trading at a discount than the industry average of 27.41X. The stock is graded a Value Score of B at present.

Meanwhile, GE Healthcare trades at a five-year P/E of 13.81X, whereas BDX at 13.53X, presenting Hologic as a more attractive investment option in terms of valuation standpoint.

With more than 20 assays on the Panther and Panther Fusion platforms, Hologic’s molecular diagnostics business still has more room to grow, while its Genius digital cytology platform holds strong potential to stabilize the Cytology business and drive growth. In Breast Health, the company holds close to 80% of the U.S. market with its 3D Genius mammography machine and plans to launch its next-generation gantry, Envision, in 2026. Hologic has deliberately focused on enhancing its processes, capabilities and leadership in the service business in recent years, which is helping strong margin gains. Furthermore, the Surgical division continues to expand both organically and inorganically, supported by an extensive sales channel.

Hologic’s recent acquisitions of early-stage companies like Endomagnetics and Gynesonics reflect the strength of its balance sheet. With industry-leading operating margins in the low 30s, the company continues to generate consistently strong cash flows, aiming for $1 billion annually. Hologic aims to sustain its double-digit earnings growth through a combination of steady mid-single-digit top-line growth, operating margin expansion, and a balanced mix of acquisitions and share buybacks. Top cash-generating brands such as Panther, Aptima, Genius and Myosure are most likely to anchor this performance, allowing Hologic to reinvest in innovations and expand its offerings.

The company is building capabilities to grow internationally on a consistent basis by going direct in more geographies and businesses. In particular, Hologic has delivered above 20% growth for several years in the International Surgical business by attaining reimbursement and promoting guidelines for its portfolio of product offerings there. While International cytology and Sexually Transmitted Infection (STI) testing have more dominant U.S. revenues, they are expected to become significant revenue drivers in the global markets with time.

The company currently navigates broader macroeconomic and divisional pressures that may negatively weigh on its fiscal 2025 second-quarter results. Those eyeing HOLX stock could wait for a better buying opportunity. However, Hologic’s Diagnostics division is expected to be the top performer this time as well. In the long run, the company looks poised to benefit from the consistent performance of its growth drivers across core businesses and add new ones, both organically and through acquisitions. With its solid financial stability, focus on international growth and appealing valuation, HOLX stands out as a worthwhile option to hold for now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 min | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite