|

|

|

|

|||||

|

|

Gilead Sciences, Inc. GILD reported lower-than-expected first-quarter 2025 results. Adjusted earnings per share (EPS) of $1.81 missed the Zacks Consensus Estimate by a penny. In the year-ago quarter, the company reported a loss per share of $1.32. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Total revenues of $6.7 billion also missed the Zacks Consensus Estimate of $6.8 billion. Revenues were roughly flat year over year as lower Veklury (remdesivir) and oncology sales were offset by higher HIV and Liver Disease sales.

Consequently, the stock was down in after-market trading on April 24. The stock is also down in pre-market trading today.

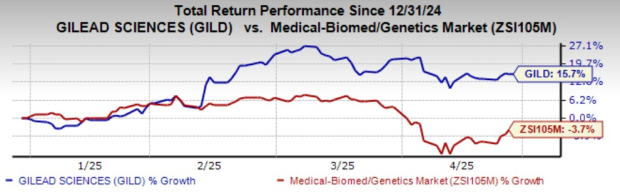

Gilead’s shares have surged 15.7% in the past year against the industry's decline of 3.7%.

Total product sales decreased 1% year over year to $6.6 billion. Excluding Veklury, product sales increased 4% to $6.3 billion.

HIV product sales grew 6% year over year to $4.6 billion, primarily driven by increased demand and higher average realized price. The figure beat both the Zacks Consensus Estimate and our model estimate of $4.5 billion.

Flagship HIV therapy Biktarvy’s sales increased 7% year over year to $3.15 billion, driven by higher demand. This was partly offset by the expected headwinds associated with the Medicare Part D redesign. The reported number missed the Zacks Consensus Estimate of $3.2 billion and our model estimate of $3.16 billion.

Per GILD, Biktarvy accounts for over 51% share of the treatment market in the United States.

Descovy (FTC 200 mg/TAF 25 mg) sales increased 38% year over year to $586 million, driven by higher demand and average realized price. The reported number beat the Zacks Consensus Estimate of $479 million and our model estimate of $424 million. Descovy maintained over 40% of the U.S. market share in pre-exposure prophylaxis (PrEP).

The Liver Disease portfolio sales, which include chronic HCV, chronic hepatitis B virus (HBV) and chronic hepatitis delta virus (HDV), increased 3% to $758 million. The increase was driven by higher demand for HBV and HDV drugs and incremental sales of Livdelzi (seladelpar) in primary biliary cholangitis (PBC).

Veklury sales plunged 45% to $302 million, primarily due to lower rates of COVID-19-related hospitalizations. Sales missed the Zacks Consensus Estimate of $387 million and our model estimate of $432 million.

Cell Therapy product (comprising Yescarta and Tecartus) sales decreased 3% to $464 million. The figure missed the Zacks Consensus Estimate of $491 million and our model estimate of $482 million.

Yescarta sales increased 2% year over year to $386 million, primarily driven by higher average realized price and increased demand outside the United States, partially offset by lower demand in the country.

Tecartus (adult acute lymphoblastic leukemia) sales decreased 22% to $78 million due to lower demand in the United States.

Breast cancer drug Trodelvy’s sales decreased 5% year over year to $293 million due to inventory dynamics and lower average realized price. Trodelvy's sales missed the Zacks Consensus Estimate of $354 million and our model estimate of $349.3 million.

Adjusted product gross margin inched up to 85.5% from 85.4% in the year-ago quarter due to product mix.

Research and development expenses totaled $1.3 billion, down from $1.4 billion in the year-ago quarter due to lower clinical manufacturing activities.

SG&A expenses amounted to $1.2 billion, down from $1.3 billion due to lower corporate expenses.

As of March 31, 2025, Gilead had cash and cash equivalents of $7.9 billion compared with $10.0 billion as of Dec. 31, 2024.

Gilead declared a quarterly dividend of $0.79 per share of common stock for the second quarter of 2025. The dividend is payable on June 27, 2025, to stockholders of record at the close of business on June 13, 2025.

Gilead reiterated its guidance for 2025 on a non-GAAP basis. Product sales are projected to be between $28.2 billion and $28.6 billion. Total product sales, excluding Veklury, are expected to be between $26.8 billion and $27.2 billion. Total Veklury sales are estimated to be $1.4 billion.

Adjusted EPS is anticipated to be in the range of $7.70-$8.10.

The FDA accepted new drug application submissions for twice-yearly lenacapavir for HIV prevention under priority review, with a target action date of June 19, 2025.

The European Medicines Agency validated the Marketing Authorization Application and EU-Medicines for All application for twice-yearly lenacapavir for HIV prevention.

Gilead received conditional marketing authorization from the European Commission for seladelpar for the treatment of PBC.

Gilead Sciences, Inc. price-consensus-eps-surprise-chart | Gilead Sciences, Inc. Quote

Gilead’s first-quarter results were disappointing as a decline in oncology drugs affected revenue growth. Nonetheless, HIV growth driver Biktarvy maintained its dominant position despite the Medicare Part D redesign.

Descovy, too, put up a strong performance.

Given the strong data from the phase III PURPOSE 1 and PURPOSE2 trials, a potential approval of lenacapavir is in the cards that should further solidify GILD’s robust HIV franchise.

Per GILD, lenacapavir, with its twice-yearly dosing, could set a new bar for HIV prevention and allow PrEP to reach a larger number of people who could benefit from a prevention regimen.

Approval of better HIV treatments should strengthen the HIV franchise in the wake of increasing competition from the likes of GSK plc GSK.

GSK continues to grow its HIV business, driven by strong patient demand for long-acting injectable medicines (Cabenuva and Apretude) and Dovato.

The FDA approval of Livdelzi for PBC strengthens GILD’s liver disease portfolio. Seladelpar was added to GILD’s portfolio/pipeline through the acquisition of CymaBay Therapeutics Inc. for $4.3 billion in March 2024. An approval in the EU should boost sales.

Gilead currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the biotech sector are ANIP Pharmaceuticals ANIP and ADMA Biologics ADMA. While ANIP currently sports a Zacks Rank #1 (Strong Buy), ADMA carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2025 earnings per share (EPS) have risen from $5.54 to $6.36. EPS estimates for 2026 have increased from $6.75 to $7.14 during the same period.

ANIP’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 17.32%.

In the past 30 days, estimates for ADMA Biologics’ 2025 EPS have increased from 69 cents to 71 cents. The bottom-line estimate for 2026 has remained constant at 93 cents.

ADMA’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 32.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 41 min | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite