|

|

|

|

|||||

|

|

Oportun Financial Corporation OPRT and Enova International Inc. ENVA are fintech companies that provide credit solutions to underserved consumers. They leverage advanced analytics and digital platforms to offer non-prime borrowers personal loans and financial services, thereby positioning themselves as key players in the alternative lending sector.

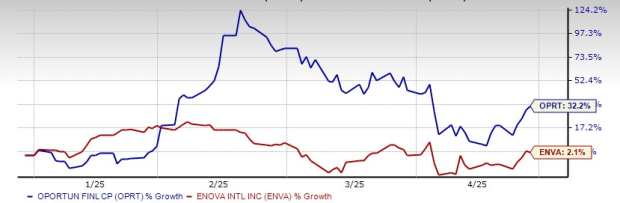

Despite the recent massive turmoil across the markets due to tariff-related apprehension, OPRT and ENVA have remained on investors’ radar. This year, shares of Oportun and Enova have soared 32.2% and 2.1%, respectively.

YTD Price Performance of OPRT & ENVA

Thus, the key question is: Which fintech lender — OPRT or ENVA — stands out as the better investment amid today’s challenging macroeconomic environment? Let’s find out.

Oportun has been leveraging technology to boost its underwriting standards and offer personalized customer service. The company uses artificial intelligence (AI), particularly machine learning (ML), to use alternative datasets to assess the credit profiles of its clients. This enables it to provide a score to roughly all its clients, including those who have little to no credit history.

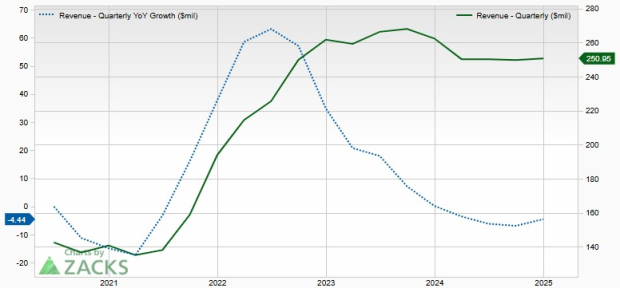

This strengthens underwriting, leading to lower default risks, and ensures consistent revenue growth while mitigating costs. Also, the lending database allows OPRT to scale up its operations efficiently with minimal infrastructure investment. As such, Oportun’s revenue growth has been impressive over the past few years. The company’s total revenues witnessed a five-year (ended 2024) compound annual growth rate (CAGR) of 10.8%.

In the first quarter of 2025, management expects total revenues to be in the range of $225-$230 million, down from $250.5 million in the prior-year quarter. For 2025, the metric is expected to be in the $945-$970 million range compared with $1 billion in 2024.

Revenue Trend

Additionally, OPRT offers the Set & Save product, which helps its clients manage their money by analyzing their obligations and expense routines. Thus, assimilation of sophisticated technology to address its customers’ needs offers the company a competitive edge over its traditional counterparts, who often rely on traditional datasets to provide credit scores. This enables OPRT to grow its market share rapidly and achieve operating efficiency.

Oportun has been driving loan growth through its diverse offerings, including personal loans, secured personal loans and “lending as a service” partnership programs, to expand its client base and presence in several markets. Such offerings enable the company to generate a higher yield on its loan portfolio and boost interest income. The company’s loans receivable at fair value and interest income recorded a five-year (2019-2024) CAGR of 8.1% and 10.8%, respectively.

Also, the company has been witnessing rising non-interest income through higher subscriptions and servicing fees. OPRT’s non-interest income reflected a CAGR of 6.4% over the five years ended 2024.

Thus, Oportun’s solid loans receivables at fair value, improving fee income and product diversification efforts will continue to bolster its top-line growth. Though the company’s loan growth is likely to be subdued this year amid inflationary pressures, tariff-related concerns and higher-for-longer interest rates, it will likely improve as recessionary fears fade away.

As of Dec. 31, 2024, Oportun's cash and cash equivalents (including restricted cash) totaled $214.6 million. It had a debt (including lease liabilities and other liabilities) of $69.1 million as of the same date. Thus, a strong liquidity sheet position and diversified funding profile will continue to support the company’s financials.

Enova has been leveraging technology to increase lending activities and mitigate costs. Given the company’s first-mover advantage, it has accumulated more than 85 terabytes of accessible consumer behavior data from more than 65 million transactions.

The rise of e-commerce and online financial services has driven the demand for alternative lending, particularly among underbanked consumers and small businesses that have limited access to traditional lending. Enova aims to capitalize on this opportunity by leveraging its digital solutions to address this market.

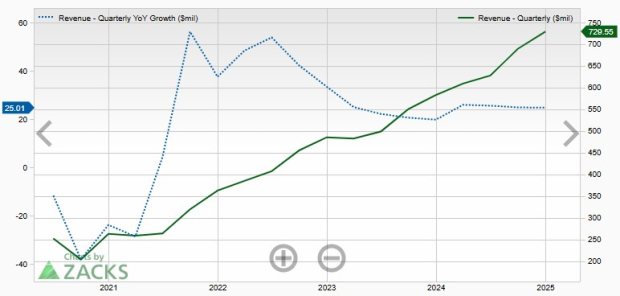

This database enables enhanced underwriting, leading to lower default risks and ensuring consistent revenue growth. ENVA’s revenues witnessed a CAGR of 17.7% over the last five years (2019-2024).

Revenue Trend

Additionally, Enova leverages proprietary analytics, ML and more than 20 years of lending data to enhance credit decision-making, surpassing the traditional Fair Isaac Corporation score-based assessments. The company’s scalable, flexible technology platform supports efficient expansion, enabling rapid growth with minimal infrastructure investment. In 2020, it acquired OnDeck to expand its small business lending and funding.

Enova has been driving loan growth through its lending programs, including the Credit Services Organization program in Texas, which helps expand its reach while mitigating risks by acting as a loan arranger rather than a direct lender. Moreover, its Bank Programs in the United States and Brazil allow the company to facilitate loans without directly originating them, reducing regulatory burdens and providing greater flexibility in scaling its lending operations.

This, combined with other lending products, enables ENVA to expand loan originations and generate higher interest income. The company’s loans and finance receivables recorded a five-year (2019-2024) CAGR of 48.6%. Moreover, Enova has a money transfer business — Pangea, aiding fee income and benefits from exchange rate spreads. Thus, a diversified revenue mix enables it to earn sustainable revenues.

As of Dec. 31, 2024, Enova's cash and cash equivalents (including restricted cash) totaled $322.7 million. It had a long-term debt of $3.6 billion as of the same date. The company had $944 million of revolving credit facilities available.

ENVA relies on share repurchases to reward shareholders. In August 2024, the company announced a repurchase plan worth $300 million, which is set to expire on Dec. 31, 2025. As of Dec. 31, 2024, shares worth $234.6 million were available for repurchase under the existing authorization. The company’s decent liquidity position will likely help to maintain sustainable share buybacks.

The Zacks Consensus Estimate for OPRT’s 2025 revenues implies a year-over-year fall of 3.6%, mainly because of a tough operating backdrop. On the other hand, the company’s 2026 revenues are expected to rise 8.4%.

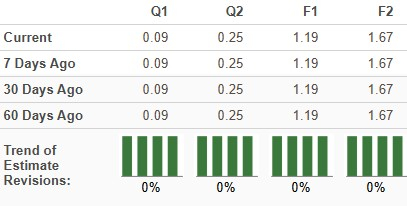

Further, the consensus estimate for Oportun’s earnings indicates a 65.3% and 40.5% jump for 2025 and 2026, respectively. The earnings estimates for both years have remained unchanged over the past month. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

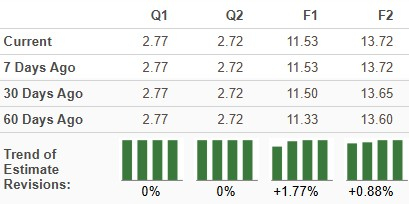

Earnings Trend for OPRT

Oportun anticipates 2025 adjusted net income to be in the $53-$63 million range compared with $29.3 million in 2024. Moreover, 2025 adjusted earnings are expected to be in the range of $1.10-$1.30 per share, up from 72 cents in 2024.

On the contrary, analysts are more bullish on Enova’s prospects. The consensus mark for 2025 and 2026 revenues suggests a year-over-year rise of 16.1% and 15%, respectively. Also, the consensus estimate for earnings suggests a 26% and 19% growth for 2025 and 2026, respectively. The earnings estimates for both years have been revised upward over the past 30 days.

Earnings Trend for ENVA

Valuation-wise, OPRT is currently trading at the 12-month trailing price-to-tangible book (P/TB) of 0.84X, higher than its three-year median. The ENVA stock, on the other hand, is currently trading at the 12-month trailing P/TB of 2.99X, lower than its three-year median.

OPRT & ENVA P/TB Ratio

Thus, Oportun trades at a discount to Enova.

Oportun and Enova operate at the intersection of fintech and alternative consumer lending, specializing in serving non-prime and underbanked customers who typically lack access to traditional credit. Both leverage proprietary data analytics, ML models and digital platforms to underwrite, originate and service loans efficiently.

While their product offerings slightly differ—Oportun leans more toward small-dollar personal loans with a focus on financial inclusion, and Enova offers a broader portfolio including installment loans, lines of credit and SMB loans—their core business models and target demographics are highly aligned.

Enova’s diversified lending portfolio across consumer and small business lending, strong profitability and robust cash flow generation will support it, while exposure to more subprime borrowers could adversely impact its financials in the case of a severe economic downturn.

On the other hand, despite near-term profitability challenges, Oportun’s focus on community-based lending and initiatives in expanding into new markets like credit cards and secured personal loans are expected to drive the financials over time. Also, OPRT stock is currently inexpensive. These factors make it a better investment choice.

Currently, OPRT sports a Zacks Rank #1 (Strong Buy), making the stock a must-pick compared with Enova, which has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-16 | |

| Feb-12 | |

| Feb-10 | |

| Feb-09 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite