|

|

|

|

|||||

|

|

As the world accelerates its shift toward renewable energy, with enhanced investments and surging global electricity demand (fueled largely by the rapid expansion of data centers) energy companies like GE Vernova GEV and Siemens Energy SMNEY are emerging as key beneficiaries. While GE Vernova is a pure-play energy company with a strong focus on grid modernization, renewable generation and decarbonization technologies, Siemens Energy offers a broader portfolio, encompassing gas turbines, grid solutions and a growing renewable energy segment through its majority stake in Siemens Gamesa.

As energy investors are now more focused on firms poised to lead the energy transition, both GEV and SMNEY boast the capability to leverage their expertise in addressing the world’s rising power needs and support decarbonization goals. In this article, we explore which of these two powerhouses could be the better investment choice for riding the energy transition wave.

Key Stats & Recent Achievements: GE Vernova currently powers 25% of the world’s electricity through its extensive installed base. It operates the largest gas turbine fleet by megawatt capacity, with around 7,000 units deployed globally, including some of the world’s largest and most efficient turbines. GEV also boasts nearly 57,000 installed wind turbines, totaling over 120 gigawatts (GW) of capacity. It holds the largest onshore wind fleet in the United States.

Among GEV’s recent achievements, worth mentioning are its first-quarter 2025 results, which reflected a solid 11% year-over-year improvement in its revenues, along with solid margin expansion. Its orders grew organically by 8%, setting a solid foundation for continued top-line growth. Additionally, Fitch Ratings revised GEV’s outlook to Positive from Stable in March 2025 for its investment-grade BBB rating, signaling increased confidence in the company’s financial stability and prospects.

Financial Health: GEV’s cash and cash equivalents as of March 31, 2025, totaled $8.11 billion, while both the current and long-term debt values were nil. A comparative analysis of these figures reflects that GE Vernova boasts a strong solvency position, which, in turn, should enable the company to duly meet its commitment to invest $5 billion in research and development (R&D) through 2028. Notably, the company aims to utilize half of this R&D investment in industrializing its existing products and maintaining its installed base. The other half is intended for long-term innovation to deliver next-generation differentiated products.

Challenges to Note: While GE Vernova is well-positioned for long-term growth, its offshore wind business faces notable challenges. Rising material costs, persistent supply-chain issues, and regulatory hurdles continue to affect project timelines and expenses. As a key player in offshore wind turbine manufacturing, GEV has been under pressure from escalating product and project costs, leading to execution delays.

In the first quarter of 2025, offshore wind revenues plunged 53.7% year over year due to slower production. Balancing heavy investments in next-generation technologies while managing these revenue declines could strain GEV’s margins in the near term, making offshore wind a riskier segment of its otherwise strong renewable portfolio.

Key Stats & Recent Achievements: Approximately 17% of global power generation and transmission is based on Siemens Energy’s technology. The company reduced carbon dioxide emissions from its own operations by 55% in 2024 compared to 2019.

Currently, more than 7,000 Siemens Energy gas turbines operate globally. The company has joined forces with Air Liquide to create a joint venture dedicated to the series production of industrial-scale renewable hydrogen electrolyzers to harness volatile energy generated from wind and solar.Among SMNEY’s recent achievements, worth mentioning are its first-quarter fiscal 2025 results, which reflected a solid 18.4% year-over-year improvement in its revenues. Its profit before special items more than doubled year over year. Additionally, S&P Global affirmed the short and long-term BBB-/A-3 rating and stable outlook for Siemens Energy in January 2025, signaling that the rating agency believes Siemens Energy has a solid ability to meet its financial obligations in the near to medium term.

Financial Health: SMNEY’s cash and cash equivalents as of Dec. 31, 2024, totaled $8.56 billion. On the other hand, while its current debt totaled $718 million, long-term debt amounted to $3.36 billion. A comparative analysis of these figures reflects that Siemens Energy boasts a strong solvency position, which, in turn, should enable the company to achieve its manufacturing facility expansion plans to meet the growing electricity demand.

These investments include a factory expansion for converter electronics in Nuremberg, Germany, along with expansions of manufacturing facilities that are currently taking place in Austria, Croatia, Italy and India. The company is also investing in the new Vacuum Interrupters (VI) factory in Berlin, where climate-friendly switchgear products are being manufactured.

Challenges to Note: Siemens Energy carries the weight of past struggles, particularly in its renewable energy segment through Siemens Gamesa. Persistent quality issues in wind turbine components and cost overruns have significantly affected profitability and investor confidence in recent years.

Notably, in the fiscal first quarter, the company witnessed increased negative Special items resulting from expenses related to the wind business restructuring. Additionally, Siemens Energy remains exposed to broader supply-chain disruptions, which can delay project deliveries and inflate costs.

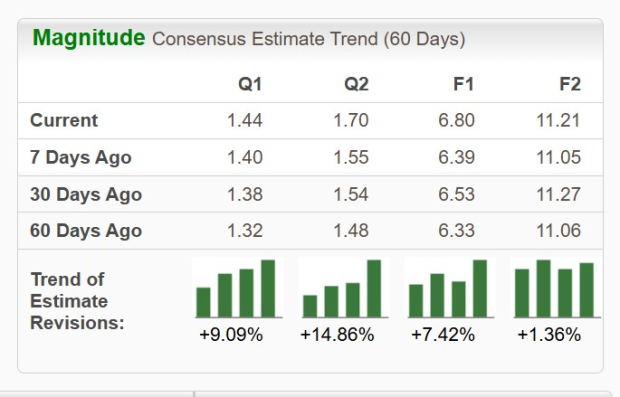

The Zacks Consensus Estimate for GE Vernova’s 2025 sales and earnings per share (EPS) implies an improvement of 5.7% and 21.9%, respectively, from the year-ago quarter’s reported figures. The stock’s EPS estimates have also been trending upward over the past 60 days.

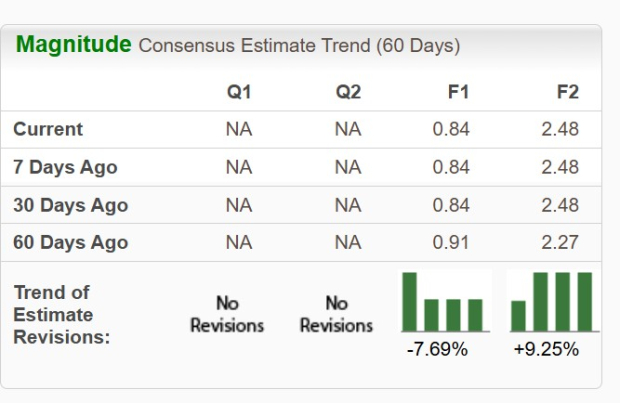

The Zacks Consensus Estimate for Siemens Energy’s fiscal 2025 sales implies a year-over-year improvement of 8.4%, while that for earnings suggests a decline of 42.5%. The stock’s bottom-line estimates for 2025 have moved south over the past 60 days, while those for 2026 have moved north.

GEV (up 5.5%) has underperformed SMNEY (up 37%) over the past three months and has done the same in the past year. Shares of GEV and SMNEY have surged 134.2% and 197.5%, respectively.

SMNEY is trading at a forward earnings multiple of 43.53X, below GE Vernova’s forward earnings multiple of 45.27X.

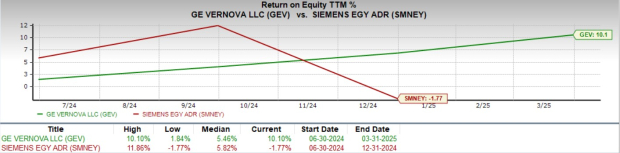

A comparative analysis of both these stocks’ Return on Equity (ROE) suggests SMNEY is less efficient at generating profits from its equity base compared to GEV.

To conclude, while both GE Vernova and Siemens Energy show strong prospects in the growing renewable energy sector, their risks diverge. GEV's focus on grid modernization, renewable generation, and decarbonization positions it well for long-term growth, with impressive installed capacity. However, challenges in its offshore wind segment could affect its margins in the near term. Conversely, Siemens Energy’s broader portfolio, including its focus on gas turbines and renewable hydrogen electrolyzers, gives it a diversified edge. Despite recent struggles with Siemens Gamesa, SMNEY has managed to increase its revenues by more than 18%.

Although SMNEY has recently outperformed GEV in terms of share price performance, the latter’s superior ROE could be a strong indicator of its long-term value and operational efficiency.

In conclusion, both stocks offer strong prospects in the renewable energy transition, but GEV's higher ROE reflects its ability to generate more profit from its investments. If an investor prioritizes efficiency and profitability, GEV could be a better choice despite the offshore wind challenges. However, for those seeking a more diversified play with broader growth prospects, SMNEY may still hold appeal due to its diversified portfolio and expansion plans.

Both stocks currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-15 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite