|

|

|

|

|||||

|

|

EMCOR Group, Inc. EME is scheduled to report first-quarter 2025 results on April 30, before the opening bell.

In the last reported quarter, EMCOR reported earnings per share (EPS) of $6.32, exceeding expectations by 14.1%. However, revenue for the quarter came in at $3.77 billion, reflecting 9.6% year-over-year growth, but still missed the Zacks Consensus Estimate by 2.6%. Operating margin of 10.3% rose 190 basis points (bps), showing the company’s ability to expand profitability even amid challenging market conditions. The company's backlog (Remaining Performance Obligations, or RPOs) grew to $10.1 billion from $1.25 billion in the prior year.

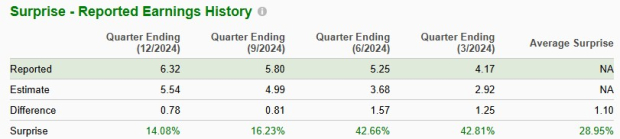

This specialty contracting services provider surpassed earnings estimates in each of the trailing four quarters, with an average of 29%. You can see the historical figures in the chart below. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The Zacks Consensus Estimate for the first-quarter EPS has remained unchanged at $4.57 over the past 30 days. The estimated figure indicates 9.6% growth from the year-ago reported figure. The consensus mark for revenues is $3.80 billion, suggesting a 10.6% year-over-year increase. For 2025, EME is expected to witness 12.8% growth from the 2024 level.

For 2025, EME is expected to register 8.6% EPS growth from a year ago.

Our proven model does not conclusively predict an earnings beat for EMCOR for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: EME has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Despite persistent inflationary and uncertain economic conditions, EMCOR’s revenues and earnings are expected to have increased in the first quarter of 2024. The company has been benefiting from increased project flows from high-tech manufacturing and network and communications market sectors due to solid demand for semiconductor and data center construction projects.

The company remains confident in its ability to sustain momentum, driven by a solid backlog of $10.1 billion (as of the fourth quarter of 2024-end) and continued demand in key growth sectors such as data centers, semiconductor manufacturing, healthcare and industrial services. These tailwinds are likely to have aided its top line in the to-be-reported quarter.

Again, we believe the recent Miller Electric acquisition is expected to be favorable for EMCOR, given its meaningful exposure to the faster-growing Florida market and data centers (approximately 25% of Miller Electric sales). Miller Electric generates about 90% of its revenues from Florida and the greater Southeastern United States, regions where EMCOR has had limited electrical construction operations.

However, the U.S. Building Services segment will face a revenue headwind of approximately $60–$70 million in the first quarter. This is a direct consequence of the previously announced non-renewal of certain large site-based maintenance contracts. While Mechanical Services within Building Services remains strong, the drag from the lost contracts will impact the first quarter's top-line performance. That said, EMCOR's other segments, particularly U.S. Electrical Construction and U.S. Mechanical Construction, are positioned to more than offset this temporary weakness.

While the company did not provide a specific first-quarter margin guidance, the impact from the Miller amortization and the revenue shortfall in Building Services could modestly pressure quarterly margins compared to the very strong fourth-quarter 2024 performance.

However, increased material and labor woes are likely to have negatively impacted the company’s performance in the first quarter.

EME stock has exhibited an upward movement in the past month and outperformed the Zacks Building Products - Heavy Construction industry, the broader Construction sector and the S&P 500 index, as you can see below.

EMCOR stock is now trading at a 24.8% discount to its 52-week high of $545.29 and a premium of 28.4% to its 52-week low of $319.49.

During the past month, EMCOR has also outperformed competitors like Dycom Industries (DY,), AECOM ACM and MasTec, Inc. MTZ. Dycom, AECOM and MasTec stocks have gained 8.5%, 5% and 7.2%, respectively, during the period.

EME’s 1-Month Price Performance

EMCOR stock is currently trading above the 50-day simple moving average (SMA) but below the 200-day SMA, suggesting the stock has had positive short-term momentum.

Presently, EME stock is trading at a slight discount to the industry average, as shown in the chart below. The stock is trading at a forward 12-month P/E ratio of 17.08 — lower than the Zacks Building Products - Heavy Construction industry average of 17.38 but well above its five-year median of 16.72. EMCOR is trading at a discount to Dycom (17.36X), AECOM (18.1X) and MasTec (21.07X).

EMCOR’s P/E Ratio (Forward 12-Month) vs. Industry

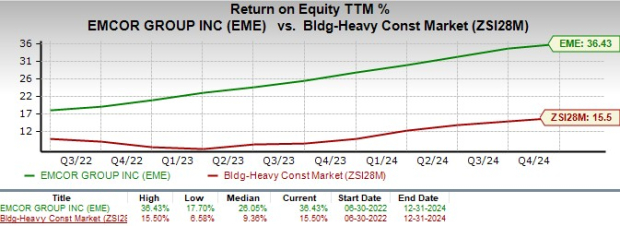

Meanwhile, its trailing 12-month return on equity of more than 36% far exceeds the industry average, reflecting its efficiency in generating shareholder returns.

The company’s strong backlog, consistent earnings beats, and exposure to high-growth sectors like data centers and semiconductor construction support continued revenue and profit expansion. While a temporary headwind is expected in Building Services, EMCOR’s core construction segments and the Miller Electric acquisition should more than offset the impact.

Valuation remains favorable, as it trades below peers like AECOM and MasTec, and its strong ROE highlights operational efficiency. With EME stock trading above its 50-day moving average but still well below its 52-week high, investors have a timely chance to buy into a fundamentally strong company before a potential earnings-driven upside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours |

Broadcom Stock, Fiber Optic Star Ciena Step Up To Earnings Plate After Nvidia Carnage

DY

Investor's Business Daily

|

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite