|

|

|

|

|||||

|

|

Last week, Bristol Myers BMY reported better-than-expected first-quarter 2025 results. Adjusted earnings per share (EPS) of $1.80 comfortably beat the Zacks Consensus Estimate of $1.51. In the year-ago quarter, BMY posted an adjusted loss per share of $4.40.

Total revenues of $11.2 billion surpassed the Zacks Consensus Estimate of $10.7 billion. However, revenues were down 6% from the year-ago period’s level due to the impact of generics and Medicare Part D redesign in the Legacy portfolio.

Bristol Myers also raised its annual revenue guidance. However, the stock has been down 4% since the earnings announcement, probably reflecting broader market concerns and investors’ skepticism on BMY’s growth prospects.

Let us analyze BMY’s fundamentals in such a scenario.

Growth portfolio primarily comprises Opdivo, Orencia, Yervoy, Reblozyl, Opdualag, Abecma, Zeposia, Breyanzi, Camzyos, Sotyku, Krazati and others.

Strong growth in Opdivo, Breyanzi, Reblozyl and Camzyos fueled revenue growth in the first quarter.

Revenue growth was solid for the leading immuno-oncology drug Opdivo, driven primarily by volume growth.

The FDA had earlier granted approval to Opdivo Qvantig (nivolumab and hyaluronidase-nvhy) injection for subcutaneous use. Per BMY, this new subcutaneous formulation of Opdivo should help extend the reach and impact of its immuno-oncology franchise to patients into the next decade. The launch in the United States is progressing well, with early adoption across multiple tumor types. BMY expects physicians to convert approximately 30-40% of patients to this new product.

Thalassemia drug Reblozyl, for which BMY has a collaboration agreement with Merck MRK, has put up a stellar performance since its approval, driven by strong growth in the first and second-line treatment of myelodysplastic syndromes (MDS)- associated anemia. Higher sales in the United States were related to increased use in the first-line setting. Outside the United States, Reblozyl's strong double-digit sales growth was driven by demand across newly-launched markets in Europe and Japan. The drug is expected to contribute significantly in the coming decade.

Camzyos witnessed strong global demand in the first quarter. Solid momentum due to its compelling efficacy and safety profile in obstructive HCM should further drive growth.

BMY earlier won FDA approval for xanomeline and trospium chloride (formerly KarXT), an oral medication for the treatment of schizophrenia, in adults. The drug was approved under the brand name Cobenfy.

The approval of Cobenfy for schizophrenia broadens BMY’s portfolio and validates the acquisition of Karuna Therapeutics.

Cobenfy represents the first new pharmacological approach to treating schizophrenia in decades. The initial uptake is encouraging, with sales of $27 million in the first quarter. This drug is expected to contribute meaningfully to BMY’s top line in the coming years as it looks to expand the drug’s label into other indications.

However, BMY recently announced disappointing top-line results from the phase III ARISE study on schizophrenia drug Cobenfy. The study is evaluating the efficacy and safety of the drug as an adjunctive treatment to atypical antipsychotics in adults with inadequately controlled symptoms of schizophrenia. Treatment with Cobenfy as an adjunctive demonstrated a 2.0-point reduction in the Positive and Negative Syndrome Scale total score compared to placebo with an atypical antipsychotic at week six. However, this data did not reach the threshold for statistical significance for the primary endpoint.

The late-stage ODYSSEY-HCM study evaluating cardiovascular drug Camzyos for the treatment of adult patients with symptomatic New York Heart Association (“NYHA”) class II-III non-obstructive hypertrophic cardiomyopathy also did not meet its dual primary endpoints.

Legacy Portfolio revenues declined 20% in the first quarter due to continued generic impact on Revlimid, Pomalyst, Sprycel and Abraxane, as well as the U.S. Medicare Part D redesign effect.

Among these, blood thinner medicine Eliquis, for which BMY has a worldwide co-development and co-commercialization agreement with pharma giant Pfizer PFE, is the biggest contributor to the top line.

Eliquis sales were down 4% due to the impact of Medicare Part D redesign in the United States. The company expects sales to steadily increase in the second half of 2025 due to the elimination of the coverage gap.

Bristol-Myers raised its annual revenue guidance to $45.8-$46.8 billion from $45.5 billion on the back of strong performance of the Growth Portfolio, better-than-expected Legacy Portfolio sales in the first quarter of 2025 and a favorable impact of approximately $500 million related to foreign exchange rates.

The company now expects legacy portfolio to decline approximately 16-18% for the year (previous guidance: 18-20%), primarily due to Revlimid's strong performance in the first quarter.

The company now expects adjusted earnings per share to be in the range of $6.70-$7 (previous guidance: $6.55-$6.85).

Management added that the stated guidance revisions include the estimated impact of current tariffs on U.S. products shipped to China but do not account for potential pharmaceutical sector tariffs.

While BMY’s strategy of acquiring companies with promising drugs/candidates is encouraging, it has resulted in colossal debt to finance these acquisitions.

As of March 31, 2025, the company had cash and equivalents of $12.1 billion and a long-term debt of $46.1 billion.

Shares of BMY have lost 13.4% year to date compared with the industry’s decline of 4.4%.

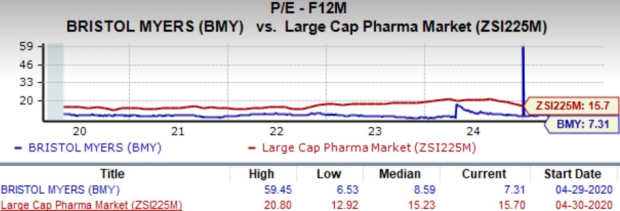

Going by the price/earnings ratio, BMY’s shares currently trade at 7.31x forward earnings, lower than its mean of 8.59x and the large-cap pharma industry’s 15.70x.

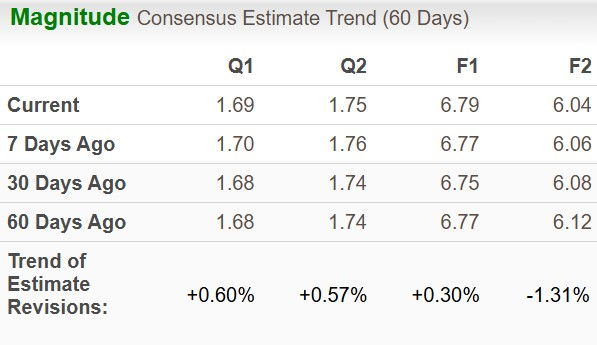

The Zacks Consensus Estimate for 2025 EPS has moved up to $6.79 from $6.77 in the past seven days, while that for 2026 has moved down to $6.04 from $6.06.

Large biotech companies are generally considered safe havens for investors interested in this sector. Drugs like Reblozyl, Breyanzi, Camzyos and Opdualag have enabled BMY to stabilize its revenue base amid generic competition for its legacy drugs. Approval of additional new drugs and label expansion of top drugs should further diversify its pipeline.

However, generic competition is a major headwind for the company and the new drugs will take some time to offset this steep decline. The recent pipeline setbacks weigh on the stock. We recommend prospective investors to wait and watch for the time being.

For investors already owning the stock, staying invested would be a prudent move. The company’s attractive dividend yield (5.18%) is a strong reason for existing investors to stay invested.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite