|

|

|

|

|||||

|

|

Vale S.A. VALE reported first-quarter 2025 adjusted earnings per share of 35 cents, which missed the Zacks Consensus Estimate of 37 cents. The bottom line marked a 10% decline from earnings of 39 cents per share reported in the year-ago quarter.

Gains from higher iron ore, copper and nickel sales volumes, stronger copper prices as well as lower unit costs in iron ore operations were offset by weaker prices for iron ore and nickel.

Including one-time items, Vale reported earnings per share of 33 cents per share compared with 39 cents in the year-ago quarter.

VALE S.A. price-consensus-eps-surprise-chart | VALE S.A. Quote

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Vale’s net operating revenues were down 4% year over year to around $8.1 billion. The top line missed the Zacks Consensus Estimate of $8.16 billion.

The Iron Solutions segment generated net operating revenues of around $6.38 billion, which marked a 9% decline from last year’s comparable quarter. While total sales volumes for iron ore were up 3.6%, it was offset by lower prices.

The Energy Transition Metals segment’s net operating revenues increased 21.6% year over year to $1.74 billion. Copper revenues gained 41% to $0.9 billion, aided by a 16% jump in average realized prices and higher sales volumes.

Nickel revenues were up 16% year over year to $0.97 billion, attributed to a 17.5% increase in sales volume that offset the 4% decline in average realized prices.

In the first quarter, the cost of goods sold was around $5.5 billion, up 1.6% from the year-ago quarter. The gross profit was down 13.7% year over year to $2.67 billion. The gross margin was 32.9%, a 370-basis point contraction year over year.

Selling, general and administrative expenditures were up 3.6% year over year to $145 million. Research and development expenses were $123 million, 21% lower than the year-ago quarter.

Adjusted operating income was $2.411 billion, a decline of 11.5% from the year-ago quarter. Adjusted EBITDA declined 10% year over year to $3.12 billion.

Proforma adjusted EBITDA (including associates and joint ventures and excluding expenses related to Brumadinho) was down 8% year over year to approximately $3.21 billion. Gains from higher iron ore sales volumes and lower unit costs in iron ore, combined with the improved performance of Vale Base Metals, were somewhat offset by a decline in iron ore and nickel prices. Proforma EBITDA margin was 39.6% in the first quarter compared with 41.4% in the year-ago quarter.

The Iron Solutions segment’s adjusted EBITDA was $2.9 billion, which was 16.5% lower than the first quarter of 2024, dragged down by lower prices.

Energy Transition Metals’ EBITDA surged 116% to $554 million from the year-ago quarter. Copper operations witnessed a 92% year-over-year improvement in adjusted EBITDA to $546 million, attributed to higher realized copper prices and stronger by-product revenues.

Adjusted EBITDA for nickel was $41 million, a 141% improvement from the year-ago quarter on higher volumes. The segment also benefited from lower external feed costs due to the impact of LME prices in refineries' operations, alongside the Onça Puma resumption after the furnace rebuild, which lowered costs. These gains were partially offset by the reduction in the average realized price of nickel.

Vale exited the first quarter of 2025 with cash and cash equivalents of around $3.96 billion compared with around $3.79 billion at the end of fiscal 2024. Cash flow generated from operations was $1.67 billion in the first quarter of 2025 compared with $3.6 billion in the first quarter of 2024.

Gross debt and leases at the end of the first quarter of 2024 were $16.2 billion, higher than $15.5 billion at the end of 2024. The increase was due to the issuance of bonds of $750 million due in 2054, which was partially used to retrieve bonds due in 2034, 2036 and 2039.

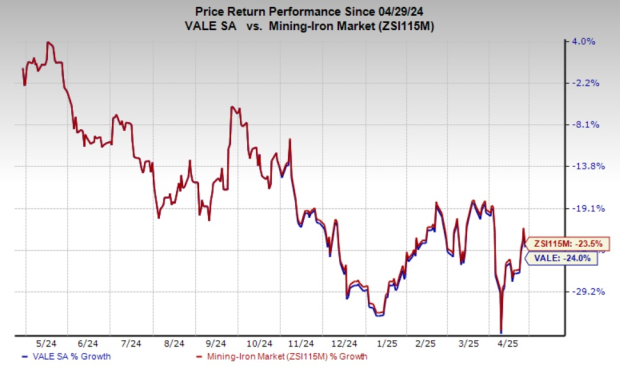

In the past year, shares of Vale have lost 24% compared with the industry’s 23.5% decline.

As seen in Vale’s first-quarter results, its copper segment delivered a solid performance on the back of higher copper prices and volumes. This trend was also reflected in the recent earnings performances of copper-related stocks.

Teck Resources Limited TECK reported first-quarter 2025 adjusted earnings per share (EPS) of 42 cents, beating the Zacks Consensus Estimate of 24 cents. It marked a substantial improvement from the loss of one cent per share in the year-ago quarter. This was attributed to higher copper prices and increased sales volume of copper and zinc in concentrate.

Net sales amounted to $1.595 billion, surpassing the Zacks Consensus Estimate of $1.578 billion. The figure reflects a 33% year-over-year improvement over the prior-year quarter’s adjusted figure of $1.119 billion, aided by higher sales in both the copper and zinc segments.

Southern Copper Corporation SCCO reported first-quarter EPS of $1.19, surpassing the Zacks Consensus Estimate of $1.13. The bottom line came in 25% higher than the year-ago quarter’s earnings of 95 cents per share.

Southern Copper’s net sales in the quarter were $3.122 billion, marking a 20.1% increase from the year-ago quarter. The improvement was attributed to higher sales volumes of copper (up 3.6%), molybdenum (9.9%), zinc (42.4%) and silver (14.1%) and an uptick in metal prices for all its products.

Vale currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A better-ranked stock from the basic materials space is Equinox Gold Corp. EQX, which sports a Zacks Rank of 1 at present.

Equinox Gold has an average trailing four-quarter earnings surprise of 1.07%. The Zacks Consensus Estimate for the company’s fiscal 2025 earnings is pegged at 82 cents per share, implying 310% year-over-year growth. Its shares have gained 29.6% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 16 hours | |

| 16 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite