|

|

|

|

|||||

|

|

International Paper Company IP is scheduled to report its first-quarter 2025 results on April 30, before the opening bell.

On Jan. 31, 2025, International Paper completed the previously announced acquisition of DS Smith, forming a global leader in sustainable packaging solutions, with a focus on the North America and EMEA markets. The upcoming quarter results will be the first time the combined company reports its results. International Paper’s top and bottom-line results are, thus, expected to reflect significant improvements from the year-ago quarter’s reported figure.

The Zacks Consensus Estimate for IP’s first-quarter revenues is pegged at $6.61 billion, indicating 43.1% growth from the year-ago reported figure.

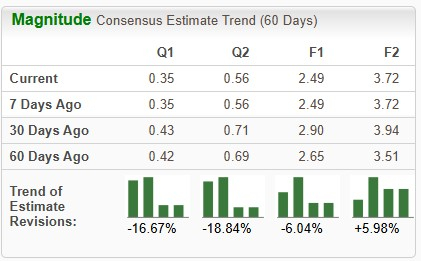

The Zacks Consensus Estimate for International Paper’s earnings has moved down 16.7% in the past 60 days to 35 cents per share. The estimate indicates a 106% year-over-year upsurge from the 17 cents reported in the quarter.

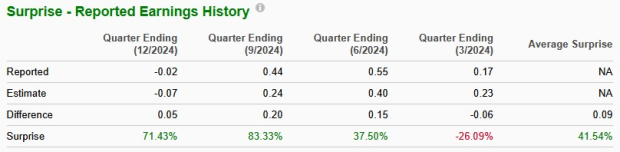

International Paper’s earnings beat the Zacks Consensus Estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 41.5%. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Our proven model does not conclusively predict an earnings beat for IP this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

But that is not the case here, as you can see below. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: International Paper has an Earnings ESP of 0.00% at present.

Zacks Rank: The company currently has a Zacks Rank of 3

Reflecting the impacts of the DS Smith acquisition, we expect EMEA Packaging’s volumes to reach 2,452 thousand short tons in the first quarter of 2025. This marks a significant increase from the 340 thousand tons reported by International Paper in the first quarter of 2024. EMEA Packaging’s revenues for the first quarter of 2025 are projected to be $2.44 billion.

The North American Packaging Solutions segment is likely to have witnessed a year-over-year increase in volume in corrugating Packaging volumes (1.4%), containerboard (3.3%), recycling (0.5%), Gypsum/Release Kraft (1%) and Saturated Kraft (6%). Our estimate for containerboard volumes is 763 thousand short tons for the first quarter and 2,264 thousand short tons for corrugated Packaging.

We expect average realized pricing for the North American Packaging Solutions segment to be 7% higher year over year. Revenues for the segment are expected at $3.79 billion for the first quarter.

Overall, volumes for the Industrial Packaging segment (which includes North American Packaging Solutions and EMEA Packaging) are projected at 6165 thousand short tons, which indicates a 54.5% year-over-year rise. We expect average realized pricing for the Industrial Packaging segment to be 5.5% higher year over year. Our model projects Industrial Packaging revenues to be $6.2 billion, which indicates 62.9% year-over-year growth, backed by higher prices and volumes and the contribution from the DS Smith acquisition.

Our model projects the Industrial Packaging segment’s quarterly operating profit to surge 73% to $373 million. North American Packaging Solutions’ operating profit for the quarter is expected to be $285 million and $87.7 million for EMEA Packaging .

We expect the Global Cellulose Fibers segment’s volumes to be 622 thousand metric tons, indicating a 14.7% year-over-year dip. Pricing is expected to rise 1.3% year over year. The segment’s first-quarter revenues, per our model, are estimated to be $608 million, implying a decline of 13.6% from the year-ago quarter’s reported level. Higher prices will be offset by lower volumes.

The segment is expected to report an operating income of $19.5 million, indicating an improvement from the year-ago reported operating loss of $47 million.

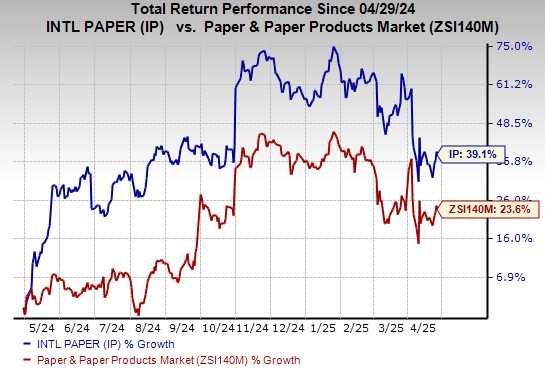

IP shares have gained 39.1% in the past year compared with the industry's 23.6% growth.

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this time around.

CF Industries Holdings, Inc. CF, scheduled to release earnings on May 7, has an Earnings ESP of +3.67% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CF’s earnings for the first quarter of 2025 is pegged at $1.45, indicating year-over-year growth of 38.8%. CF Industries has a trailing four-quarter average earnings surprise of 18.1%.

Kinross Gold Corporation KGC, scheduled to release first-quarter earnings on May 6, currently has an Earnings ESP of +11.07% and a Zacks Rank #3.

The Zacks Consensus Estimate for Kinross Gold's earnings for the first quarter of 2025 is pegged at 21 cents, indicating a surge of 111% from the year-ago quarter’s actual. Kinross Gold presently has a trailing four-quarter average earnings surprise of 23.6%.

Methanex Corporation MEOH, scheduled to release first-quarter earnings on April 30, has an Earnings ESP of +4.74% and a Zacks Rank #3.

The Zacks Consensus Estimate for Methanex's earnings for the first quarter of 2025 is pegged at $1.25, indicating a surge of 92.3% from the year-ago quarter’s reported figure. MEOH has a trailing four-quarter average earnings surprise of 85.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

KGC +6.22%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite