|

|

|

|

|||||

|

|

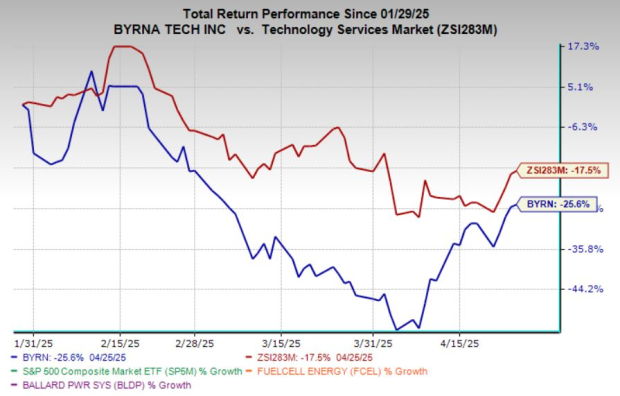

Byrna Technologies Inc. BYRN has seen a sharp fall in its stock price, declining 39% in three months compared to the broader industry’s 2.7% decline. This aligns with the performance of other small-cap service providers like FuelCell Energy FCEL, down 52%, and Ballard Power Systems BLDP, which saw a 24% decline during the same period.

Many investors may be considering an entry as the stock is experiencing a significant pullback. Let's assess whether Byrna's current price offers a compelling buying opportunity.

Byrna has achieved high brand visibility through a successful celebrity endorsement program and extensive media coverage. In fiscal 2024, the company realized more than 5X return on ad spend through celebrity endorsements, driving a record $28.0 million in sales for the fourth quarter of fiscal 2024.

Increased media exposure has helped normalize less-lethal solutions, significantly boosting demand from both consumers and law enforcement. This drove a notable 79% year-over-year sales growth for the fourth quarter, while net income improved from a loss of $0.8 million in the year-ago quarter to a profit of $9.7 million, an impressive $10.5 million increase.

Looking ahead, Byrna is well-positioned for growth with several strategic initiatives. The company is ramping up production and is preparing to launch its new Compact Launcher in mid-2025. The company has boosted launcher production by 33% in the first fiscal quarter of 2025, reaching 24,000 units per month to meet rising market demand and drive operational expansion.

Additionally, Byrna is expanding its retail presence with more company-owned stores and strengthening its footprint in Latin America through partnerships with law enforcement.

BYRN recently extended its reach into Mexico by collaborating with Mexico’s Secretaría de Trabajo y Previsión Social to establish a federally certified training program allowing civilians to legally carry Byrna devices. Furthermore, the company is enhancing its supply chain by shifting ammunition production domestically, which is expected to improve product margins. These initiatives, alongside continued marketing investment, are anticipated to drive growth through 2025 and beyond, positioning Byrna for sustained success.

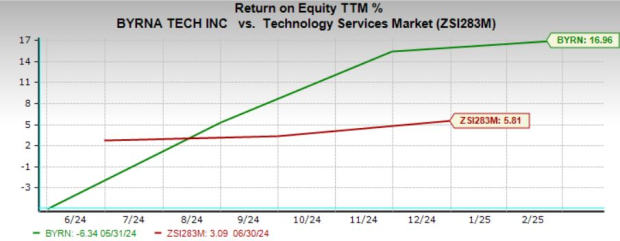

Byrna’s return on equity (ROE) of 15.39% at the end of the fourth quarter of fiscal 2024, outperforming the industry average of 5.44%, signals stronger profitability and efficient use of shareholders' equity. These suggest that the company is generating more profit relative to each dollar of equity than its industry peers, implying effective management and an edge in capital utilization. A higher ROE generally aligns with higher shareholder returns and is indicative of the potential for continued growth, thus enhancing investor confidence.

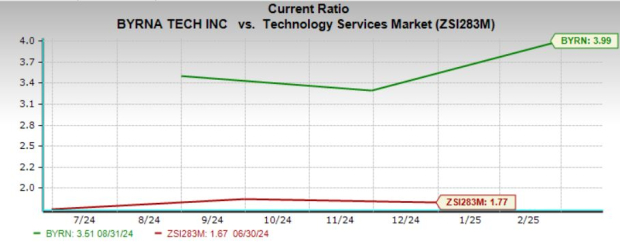

Byrna’s liquidity position is also strong, with a current ratio of 3.3 at the end of the fourth quarter of fiscal 2024 compared to the industry’s 0.1.65. Such a robust liquidity position offers financial flexibility, allowing the company to invest in growth opportunities or manage unforeseen expenses without the immediate need for additional financing. This stability reinforces investors’ confidence in Byrna’s financial health and resilience, supporting sustainable growth and potentially higher returns.

Byrna is prioritizing growth investments, which is leading to short-term pressure on profitability. However, the company remains debt-free, highly profitable, and continues to demonstrate strong revenue growth and promising market potential.

The Zacks Consensus Estimate for BYRN’s fiscal 2025 earnings is pegged at 31 cents, flat with the year-ago level. Earnings in 2026 are projected to increase by 58% year over year.

The company's sales are expected to grow 29.4% in fiscal 2025 and 17.2% in fiscal 2026.

This positive outlook is reinforced by upward estimate revisions. In the past 30 days, two estimates for fiscal 2025 earnings have been revised upward, with no downward revisions. The Zacks Consensus Estimate for 2025 earnings has increased 10.7% during this period. Two estimates for fiscal 2026 earnings have been revised north, with no southward revisions. The Zacks Consensus Estimate for fiscal 2026 earnings has increased 29% during this period.

BYRN represents a compelling growth investment with its strong brand momentum and expanding market presence. The company’s strategic use of celebrity endorsements and extensive media coverage has bolstered its visibility, leading to heightened demand for its innovative, less-lethal solutions. Byrna’s focus on expanding its product lineup and strengthening partnerships both domestically and internationally showcases a forward-looking approach that aligns with market trends, positioning it well for sustained growth.

Additionally, Byrna’s strong liquidity and prudent management of resources reflect a solid foundation, allowing it to pursue growth initiatives confidently. With plans to further expand its retail footprint, enhance its supply chain, and launch new products, the company is well-prepared to capitalize on rising demand. For investors seeking a stock with high growth potential and strategic vision, Byrna Technologies stands out as a Buy, with strong indicators of continued success.

BYRN currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-07 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite