|

|

|

|

|||||

|

|

As robotic-assisted surgery becomes a cornerstone of modern healthcare, two medtech giants — Intuitive Surgical ISRG and Stryker SYK — are leading the charge. Intuitive, the pioneer behind the da Vinci Surgical System, has long dominated soft tissue procedures. Meanwhile, Stryker has carved out a niche in orthopedics with its Mako robotic platform.

Both companies are investing heavily in innovation and global expansion, making them attractive plays for investors eyeing the future of surgical technology. But with differing specialties, growth strategies and financial profiles, which stock presents the stronger buy today? In this faceoff, we compare these two leaders to help investors determine which robotic surgery innovator is better positioned for long-term success.

Intuitive Surgical pioneered robotic surgery with the da Vinci platform — the Xi for multiport procedures and the SP for single-port access, featuring 3D HD vision and EndoWrist instruments. Stryker entered robotics by acquiring Mako Surgical in 2013, deploying the Mako system for knee and hip arthroplasty and rolling out Mako 4 with hip revision, spine and shoulder modules.

Intuitive holds nearly 80% of global surgical robotics volume, while Stryker leads orthopedic robotics with more than 1.5 million Mako procedures and real-time analytics integration with implants. ISRG’s broad clinical reach contrasts with SYK’s orthopedic focus, marking distinct niches in surgical robotics.

Intuitive’s first-quarter 2025 revenues rose 19% to $2.25 billion. da Vinci procedure grew 17% with 367 new system placements. Instruments and accessories revenues reached $1.37 billion (+18%), boosting recurring income. While Stryker’s MedSurg/Neurotechnology sales rose 10.6% to $3.89 billion in the fourth quarter of 2024, Orthopaedics climbed 10.8% to $2.55 billion, fueled by robust Mako knee/hip robotics demand.

The global robotic surgery market is projected to witness a 16.5% CAGR through 2029, per a report by Markets and Markets. This can be attributed to minimally invasive trends and aging populations. Intuitive’s 15% installed-base growth and recurring consumables model position it to lead share gains, while Stryker’s Mako orthopaedic platform and double-digit knee segment growth equips it to capture the booming joint-replacement robotics niche.

The Zacks Consensus Estimate for ISRG’s fiscal 2025 sales and EPS implies a year-over-year improvement of 15.6% and 7.1%, respectively. EPS estimates for 2025 and 2026 have trended southward over the past 60 days.

ISRG Estimate Movement

The Zacks Consensus Estimate for Stryker’s 2025 sales and EPS implies a year-over-year improvement of 8.6% and 10.4%, respectively. However, EPS estimates for 2025 and 2026 have declined 2 cents each over the past 60 days.

SYK Estimate Movement

Intuitive Surgical is investing heavily in next-generation platforms, most notably the Ion endoluminal system for robotic bronchoscopy and peripheral lung biopsy. ISRG has a run rate of over 100,000 procedures, almost entirely in the United States. The company recently launched the device in Australia. The company also won FDA 510(k) clearance for da Vinci 5, its multiport surgical robot featuring several design innovations and higher computing power, with further da Vinci variants under development.

Stryker is advancing its Mako SmartRobotics suite with AI-driven 3D CT planning and AccuStop haptic feedback for ultra-precise implant placement. In late 2024, Stryker introduced Mako Spine and Shoulder in limited markets and showcased fourth-generation Q Guidance modules across hip, knee, spine and shoulder at AAOS 2025, signaling expansion beyond orthopaedics. These investments should help Intuitive strengthen its minimally invasive thoracic and general surgery leadership, while Stryker leverages AI for orthopaedics and adjacent specialties.

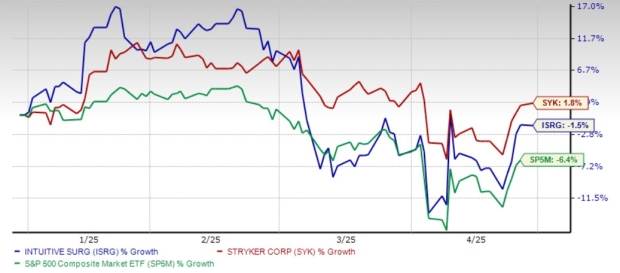

The year-to-date price performances of both Intuitive Surgical and Stryker have not been impressive, likely due to tariff concerns and rising competition from Chinese robotic device makers. Shares of ISRG have lost 1.5% year to date, while those of SYK have gained 1.8%.

P/E F12M for ISRG vs SYK

Intuitive Surgical’s da Vinci dominance — nearly 80% market share, sustainable 19% revenue growth, recurring consumables and Ion lung biopsy system — underpins broad surgical robotics leadership. Stryker’s Mako orthopaedic platform, AI-driven planning, haptic feedback and integrated MedSurg offerings fuel double-digit segment growth and cross-selling across care pathways. With a 10-15% market CAGR through 2030, ISRG suits growth-oriented investors seeking diversified global exposure, while SYK appeals to those targeting the fast-growing joint-replacement robotics niche.

Both Intuitive Surgical and Stryker have a Zacks Rank #3 (Hold) at present, which makes it difficult to choose one of them. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Style Score can help investors choose between these companies, although they have the same Zacks Rank. ISRG’s style score of ‘F’ reflects its expensive valuation and low growth potential going forward. However, SYK’s style score of ‘C’ indicates a strong growth prospect despite its moderately high valuation. With current fundamentals, Stryker has better odds of generating higher returns for investors than Intuitive Surgical.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite