|

|

|

|

|||||

|

|

Incyte Corporation INCY reported first-quarter 2025 adjusted earnings of $1.16 per share, which beat the Zacks Consensus Estimate of $1.01. The company had recorded adjusted earnings of 58 cents per share in the year-ago quarter. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Total revenues in the first quarter were $1.05 billion, which grew 20% year over year, driven by the sustained performance of its lead drug, Jakafi (ruxolitinib), and increased sales of Opzelura (ruxolitinib) cream on strong launch and demand. The top line beat the Zacks Consensus Estimate of $1 billion.

All percentages mentioned below are on a reported basis.

Jakafi’s (a first-in-class JAK1/JAK2 inhibitor approved for polycythemia vera, myelofibrosis and refractory acute graft-versus-host disease) revenues came in at $709.4 million, up 24% from the year-ago quarter, owing to a 10% increase in paid demand. Jakafi's sales beat the Zacks Consensus Estimate of $661.1 million.

Opzelura (ruxolitinib) cream, approved for atopic dermatitis and vitiligo, generated $118.7 million in sales, which rose 38% year over year, but missed the Zacks Consensus Estimate of $127 million. The year-over-year rise in sales was driven by continued growth in new patient starts and refills in the United States and increased contribution from the EU, partially offset by a reduction in channel inventory.

The newly approved medicine Zynyz (retifanlimab-dlwr) generated sales of $3 million, which significantly increased from the year-ago quarter and beat the Zacks Consensus Estimate of $1.9 million. The company obtained accelerated approval for Zynyz to treat metastatic or recurrent locally advanced Merkel cell carcinoma. Net product revenues of Iclusig were $29.5 million, down 3% year over year. However, the figure beat the Zacks Consensus Estimate of $28.7 million. Pemazyre generated $18.4 million in sales, reflecting a year-over-year increase of 4%. The figure missed the Zacks Consensus Estimate of $21.6 million.

Minjuvi's revenues totaled $29.6 million, surging 24% year over year, following the acquisition of the exclusive global rights to the drug in February 2024. The figure, however, missed the Zacks Consensus Estimate of $33.4 million. Incyte gained worldwide exclusive global rights for tafasitamab from MorphoSys AG, which is marketed as Monjuvi in the United States and as Minjuvi in the ex-U.S. markets, in February.

Incyte and partner Syndax Pharmaceuticals obtained FDA approval for axatilimab-csfr, an anti-CSF-1R antibody, for the treatment of GVHD after the failure of at least two prior lines of systemic therapy in adult and pediatric patients weighing at least 40 kg. The candidate was approved under the brand name Niktimvo. The drug is Incyte’s second approved treatment for chronic GvHD (third-line) and was launched in the United States during the first quarter of 2025. The drug recorded $13.6 million in sales in the first quarter of 2025, following its launch.

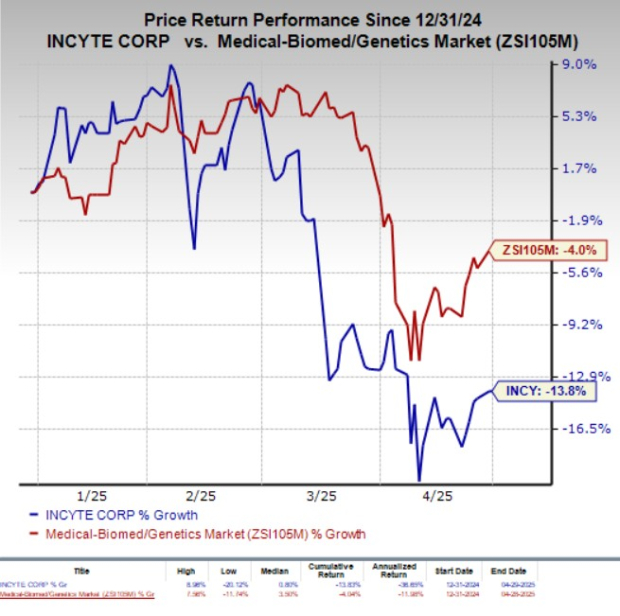

Shares of Incyte have lost 13.8% year to date compared with the industry’s decline of 4%.

Jakafi is marketed by Incyte in the United States and by Novartis NVS as Jakavi in ex-U.S. markets. Jakavi royalty revenues from Novartis for commercialization in ex-U.S. markets rose 3% to $92.1 million. Jakavi royalties missed the Zacks Consensus Estimate of $97.4 million.

Incyte also receives royalties from the sales of Tabrecta (capmatinib) for the treatment of adult patients with metastatic non-small-cell lung cancer. Its partner, NVS, has exclusive worldwide development and commercialization rights for Tabrecta. Royalty revenues from the drug’s sales amounted to $6.4 million, up 23% year over year, beating the Zacks Consensus Estimate of $5.9 million.

Olumiant’s (baricitinib) product royalty revenues from Eli Lilly LLY totaled $30.8 million, up 1% year over year. The figure also missed the Zacks Consensus Estimate of $34.9 million. Incyte has a collaboration agreement with Eli Lilly for Olumiant. The drug is a once-daily oral JAK inhibitor discovered by Incyte and licensed to LLY. It is approved for several types of autoimmune diseases.

Adjusted research and development expenses totaled $400 million, up 3% year over year. This increase was primarily due to continued investment in the company’s late-stage development assets and the timing of certain expenses.

Adjusted selling, general and administrative expenses were $325.7 million, up 8% from the prior year quarter’s number, primarily due to the timing of consumer marketing activities and certain other expenses.

INCY’s cash, cash equivalents and marketable securities totaled $2.4 billion as of March 31, 2025, compared with $2.2 billion as of Dec. 31, 2024.

Incyte Corporation price-consensus-eps-surprise-chart | Incyte Corporation Quote

The company now expects Jakafi revenues for 2025 in the range of $2.95-$3 billion, up from the previously reported range of $2.93-$2.98 billion. Financial guidance provided by the company regarding other items in the last reported quarter remains unchanged. Opzelura net product revenues are expected to be in the band of $630-$670 million in 2025.

Adjusted research and development expenses are expected in the band of $1.78-$1.81 billion, while adjusted selling, general and administrative expenses are expected in the range of $1.16-$1.19 billion.

Incyte currently carries a Zacks Rank #3 (Hold).

A better-ranked stock from the sector is Bayer BAYRY, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Bayer’s earnings per share have remained constant at $1.19 for 2025. During the same time, earnings per share have remained constant at $1.28 for 2026. Year to date, shares of Bayer have gained 34.6%.

BAYRY’s earnings matched estimates in two of the trailing three quarters while missing the same on the remaining occasion, the average negative surprise being 19.61%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 43 min | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite