|

|

|

|

|||||

|

|

Shares of Constellation Energy Corporation CEG have rallied 12.1% in the past month compared with the Zacks Alternate Energy – Other industry’s growth of 4.9%. CEG continues to add clean energy to the grid through its efficient operation of nuclear plants and extending the lives of existing plants through new licenses.

CEG continues to add clean energy to the grid through its efficient operation of nuclear plants and extending the lives of existing plants through new licenses.

CEG shares have also outperformed the Zacks S&P 500 Composite and and the Zacks Oil-Energy sector in the last month.

Is it a good time to add this alternate energy stock to your portfolio? To assess, let’s delve deep into the factors influencing the increase in share price before its first-quarter results and evaluate the stock’s investment potential.

Constellation Energy primarily generates power through its strong nuclear fleet and has taken strategic steps to secure a reliable supply of nuclear fuel. To safeguard against potential disruptions in the nuclear fuel market, the company has developed a diverse and resilient procurement approach. This includes entering into multiple long-term uranium supply agreements that extend well into the 2030s, ensuring consistent fuel availability for its operations.

In addition to securing its fuel needs, Constellation Energy is heavily investing in its future growth. The company has outlined capital expenditures of nearly $3 billion for 2025 and around $3.5 billion for 2026. A significant portion of these planned investments — approximately 35% — is dedicated to acquiring nuclear fuel, with a particular focus on increasing inventory levels to further strengthen supply security and operational stability.

Beyond nuclear operations, Constellation Energy is actively expanding its renewable energy portfolio. This strategic focus not only diversifies its energy mix but also supports long-term earnings growth. By balancing investments between maintaining its leading nuclear capabilities and expanding into renewables, the company positions itself to thrive in an evolving energy market focused on sustainability.

Constellation Energy’s operational performance remains a key strength, driven by the high efficiency of its nuclear fleet. Over the past decade, the company has consistently achieved a fleetwide capacity factor above 94%, roughly 4% higher than the industry average. This impressive performance underscores the reliability of its nuclear assets and their critical role in delivering stable, emission-free electricity.

Constellation Energy’s earnings are consistent, visible and easy to calculate. It is expected to increase over time through returns on organic growth, PTC inflation, and share repurchases. The company has reported positive earnings surprises in the last four reported quarters.

Another firm, Duke Energy Corporation DUK, also produces a large volume of clean energy from its nuclear units. Duke Energy reported positive earnings surprises in three of the last four reported quarters and missed estimates in one quarter, resulting in an average surprise of 4.3%.

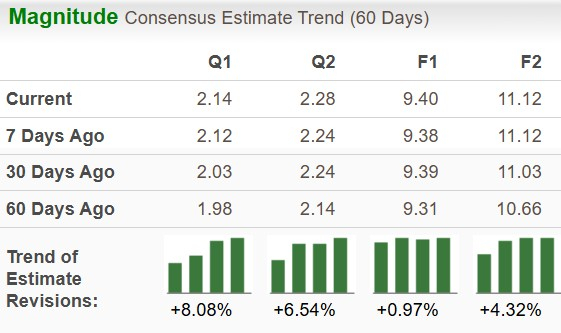

The Zacks Consensus Estimate for CEG’s 2025 and 2026 earnings per share has moved up 0.97% and 4.32%, respectively, in the past 60 days. Long-term (three to five years) earnings growth of the company is pegged at 12.4%.

Another firm, Vistra Corp. VST, has a sizeable power production from nuclear power plants. Vistra, through its four nuclear power facilities, generates nearly 6,400 MW of clean energy. The Zacks Consensus Estimate for Vistra’s 2025 and 2026 earnings per share has declined 5.02% and 1.9%, respectively, in the past 60 days. Long-term earnings growth of the company is pegged at 10.63%.

Constellation Energy continues to make share repurchases and has repurchased shares to raise shareholders’ value. In 2023, CEG’s board of directors authorized the repurchase of up to $3 billion of the company's outstanding common stock, after share repurchases in 2024 and 2023. As of Dec. 31, 2024, there was $991 million of remaining authority to repurchase shares of the company's outstanding common stock.

CEG pays a quarterly dividend to its shareholders. The company aims to increase its dividend by 10% annually, subject to its board's approval. Check CEG’s dividend history here.

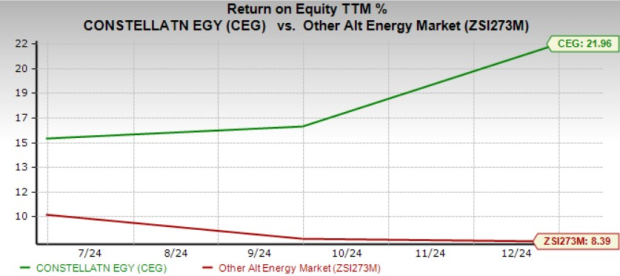

Constellation Energy’s trailing 12-month return on equity of 21.96% is better than the industry average of 8.39%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Constellation Energy is currently trading at a premium compared with its industry on a forward 12-month P/E basis.

Duke Energy and Vistra Corp. are both trading at a premium compared with their industry’s P/E F 12M.

Constellation Energy is well-positioned to capitalize on the growing demand for clean energy across its service areas, a trend largely fueled by the rapid expansion of AI-powered data centers. With its robust generation capacity, the company is equipped to meet this rising energy demand effectively.

For existing shareholders, maintaining their position in this Zacks Rank #3 (Hold) stock is a prudent strategy. They stand to benefit from ongoing dividends, share repurchase programs, and increasing earnings projections, all of which contribute to the company’s strong financial outlook.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 7 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 14 hours | |

| 18 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite