|

|

|

|

|||||

|

|

Salesforce CRM and Oracle ORCL are two of the biggest names in the cloud enterprise software market. Both companies offer powerful, enterprise-grade platforms spanning customer relationship management, enterprise resource planning, database management and artificial intelligence (AI)-powered cloud solutions.

Both companies have transformed how businesses manage operations, customer relationships and data infrastructure. With the digital transformation wave accelerating, the question remains: Which stock makes a better investment pick today? Let’s break down their fundamentals, growth prospects and market challenges to determine which offers a more compelling investment case.

Salesforce remains the undisputed leader in the field of customer relationship management software market. Over the past several years, the company has continued to outpace competitors such as Microsoft, Oracle and SAP, holding the largest market share, according to Gartner’s rankings.

Salesforce has built an extensive ecosystem that integrates seamlessly across enterprise applications. Its acquisitions, such as Slack, Own Company and Zoomin, demonstrate a long-term strategy of expanding its footprint beyond the customer relationship management software space into enterprise collaboration, data security and AI-driven automation.

AI is a key part of Salesforce’s growth engine. Since launching Einstein GPT in 2023, the company has embedded generative AI capabilities across its entire platform, allowing customers to automate workflows, enhance decision-making and improve customer interactions. As generative AI adoption accelerates across industries, Salesforce is positioned to capitalize on this trend.

Salesforce’s aggressive investment in AI is paying off. Its new Agentforce platform, combined with Data Cloud, is already delivering multibillion-dollar opportunities. Annual recurring revenues for AI and Data Cloud grew 120% year over year in fiscal 2025, and Salesforce closed more than 3,000 paid Agentforce deals in just 90 days of its launch, signaling rapid enterprise adoption. Salesforce’s “trinity” strategy, unifying apps, data and AI agents into a single, cohesive platform, is creating a distinct competitive advantage.

On the financial front, Salesforce’s revenue growth has slowed down. However, this is not because of any company-specific issues but due to macroeconomic headwinds. Enterprise customers are tightening their IT budgets due to fears of an escalating tariff war and slowing economic growth. In the fourth quarter of fiscal 2025, its revenues grew 7.5% year over year, a sharp contrast to the double-digit growth in the previous years. Nonetheless, Salesforce’s fourth-quarter adjusted earnings per share soared 21.4%, demonstrating its efficient cost management.

Oracle is also becoming more active in the AI space, and its recent third-quarter fiscal 2025 results show that. Revenues from its cloud infrastructure business (IaaS) grew 49% year over year in the third quarter, while demand for graphics processing units used in AI training increased 244% in the trailing 12 months. The company has signed major deals with well-known tech leaders like OpenAI, xAI, Meta, NVIDIA and Advanced Micro Devices, showing growing adoption of Oracle’s AI solutions.

To build on this momentum, Oracle launched a new platform called AI Agent Studio. This tool allows businesses to create and manage AI agents for different parts of their operations. It builds on more than 50 AI agents already built into Oracle’s Fusion Applications. Oracle is offering this tool for free, which could help attract more customers and strengthen its position in the enterprise AI space.

Oracle is also expanding through its multi-cloud strategy. Its Database@Azure service is now available in 14 regions, and the company plans to add 18 more over the next year. According to Chairman Larry Ellison, Oracle’s database business with Microsoft, Google and Amazon grew 92% in the third quarter, which suggests that its multi-cloud approach is working well.

Nonetheless, there are certain reasons to be cautious about its near-term prospects. Oracle’s capital spending is rising fast. The company expects to spend around $16 billion on infrastructure this fiscal year, more than double what it spent last year. This investment is important for growth, but it will put pressure on free cash flow in the short term.

There are also issues with supply. Oracle now has 101 cloud regions, but delays in getting components have slowed down its ability to expand cloud capacity. These delays may hold back revenue growth, even though demand remains strong. The company expects some of these problems to ease in early fiscal 2026, but for now, it’s a limitation investors should watch closely.

Additionally, Oracle’s overall financial performance for the third quarter paints a more mixed picture. Despite strong cloud growth, total revenue growth was a modest 6.4% year over year in the third quarter, while non-GAAP EPS increased by a mere 4.3%. Also, the top and bottom lines missed the respective Zacks Consensus Estimate.

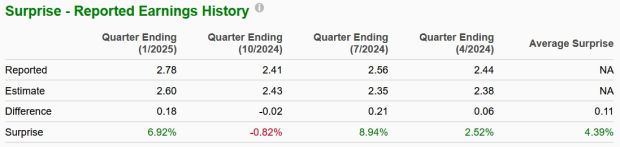

Salesforce has a decent earnings surprise history compared with Oracle. CRM surpassed the Zacks Consensus Estimate for earnings thrice in the trailing four quarters while missing it on one occasion, the average surprise being 4.4%.

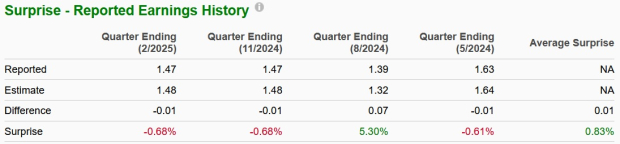

On the other hand, ORCL missed the consensus mark for earnings thrice in the trailing four quarters while beating it on one occasion, the average surprise being 0.8%.

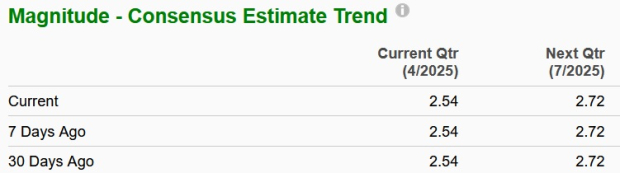

Additionally, the Wall Street analysts seem to be more optimistic about Salesforce’s profitability. Over the past 30 days, the Zacks Consensus Estimate for CRM’s upcoming two quarters’ earnings has remained unchanged.

On the other hand, the consensus mark for ORCL’s upcoming two quarters’ earnings has been revised downward.

The long-term expected earnings growth of 12.7% for Salesforce is also way higher than Oracle’s 9.7%, demonstrating CRM’s superior profitability growth prospect over ORCL.

Both Salesforce and Oracle are formidable forces in the cloud enterprise software market, but Salesforce stands out as the better investment choice today. Salesforce’s accelerated growth in AI, deeply unified platform strategy and superior profitability growth prospects offer a more compelling risk-reward profile. While Oracle’s cloud infrastructure business is growing fast, execution challenges and supply constraints may limit near-term upside.

Currently, Salesforce has a Zacks Rank #3 (Hold), making the stock a stronger pick than Oracle, which has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 30 min | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

ORCL

Investor's Business Daily

|

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite