|

|

|

|

|||||

|

|

With AI workloads and cloud infrastructure scaling rapidly in 2025, Astera Labs ALAB and Marvell Technology MRVL have emerged as key enablers of high-performance data connectivity. Both companies are delivering advanced semiconductor solutions designed to overcome critical data, memory and network bottlenecks in hyperscale environments.

Astera Labs, a newer entrant, delivers a purpose-built platform for AI infrastructure that integrates high-speed mixed-signal hardware with its COSMOS software suite. Its portfolio, ranging from Smart Retimers to Fabric Switches, is already powering AI platforms at leading hyperscalers.

Marvell Technology, an established leader in the space, has expanded aggressively into AI-centric networking through strategic acquisitions and product innovation. Its stronghold in PAM and ZR optical solutions positions it well for the next wave of data center demand.

With AI and cloud infrastructure poised for sustained growth, forward-looking investors should consider both these stocks for their long-term upside potential.

Despite strong long-term potential, semiconductor stocks are under pressure as Trump’s new tariffs raise fears of a prolonged trade war. Analysts warn that tariffs could drive up costs and dampen global electronics demand. This could continue to hit both Marvell and Astera Labs in the near term.

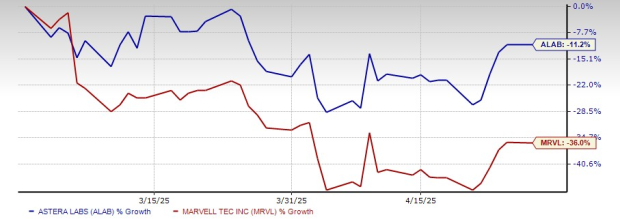

Marvell Technology, with roughly 43% of its sales tied to China, has been hit particularly hard, plunging 36% in the past two months. The new tariffs, combined with China's aggressive retaliatory measures, threaten to disrupt Marvell’s supply chains and sales channels.

Astera Labs, though less exposed to China, fell 11.2%, with investors worrying that rising costs and delayed Big Tech spending could slow demand for its AI connectivity products.

$12 Billion TAM by 2028 With Greenfield Growth in AI Fabrics: Astera Labs expects its portfolio of hardware and software solutions across retimers, controller and fabric switches to capture a large share of a $12 billion total addressable market by 2028, much of which is untapped (“Greenfield”) in the AI fabric interconnect space.

Custom AI Racks Built With Third-Party GPUs: Despite the near-term gloom, Astera Labs expects to grow in 2025 with the ramp-up of custom AI racks using third-party graphics processing units (GPUs). The company is providing Scorpio P Series switches and Aries PCIe Gen 6 Retimers to boost GPU performance while supporting customers’ networking setups. Pre-production shipments are already underway, with full deployments expected in the second half of the year.

Growing Share in General Compute Infrastructure: Beyond AI, Astera Labs is gaining traction in general compute platforms, including new CPUs, SSDs and network cards. Products like Aries Retimers, Taurus Ethernet FTM and Leo CXL are expanding its reach in this space. While smaller than the AI segment, general compute adds stability and diversity, helping drive consistent growth across a wider range of data center applications.

AI and Custom Silicon Momentum: Marvell’s data center business gained 78% year over year and 24% sequentially in the fourth quarter of fiscal 2025, driven by strong demand for its custom AI silicon and high-speed connectivity products like Electro-Optics and Teralynx switches. The company continues to lead in AI infrastructure, introducing innovations such as the first 3nm 1.6T PAM DSP and securing key design wins with hyperscalers like Meta. Marvell now has two major AI custom silicon programs in high-volume production and a third, announced in April 2024, is set to be launched in 2026. These programs are expected to fuel long-term revenue growth and strengthen Marvell’s position in the AI market.

Financial Stability: Marvell delivered $5.77 billion in revenues in fiscal 2025, with second-half revenues growing 37% compared with the first half. In the fiscal, the company posted $1.68 billion in operating cash flow and significantly increased capital returns to its stockholders, returning $933 million through dividends and buybacks. Non-GAAP gross margin for the year was 61%, and operating margin improved by over 1,000 basis points throughout the year (from 23.3% in the fiscal first quarter to 33.7% in the fiscal fourth quarter).

Promising Outlook: For the first quarter of fiscal 2026, Marvell's operating expenses are expected to modestly increase, though partially offset by NRE credits. The company remains focused on increasing operating leverage and aims to reach its long-term non-GAAP operating margin target of 38%-40%, while maintaining strong cash flow and shareholder returns.

Marvell is trading at a forward 12-month price-to-sales of 5.86X, below its 1-year median of 10.22X. Meanwhile, Astera Labs is presently trading at a forward 12-month price-to-sales of 14.70X, which is also below its 1-year median of 22.81X.

This suggests that Marvell remains attractively valued when compared with Astera Labs, as well as its own historical average.

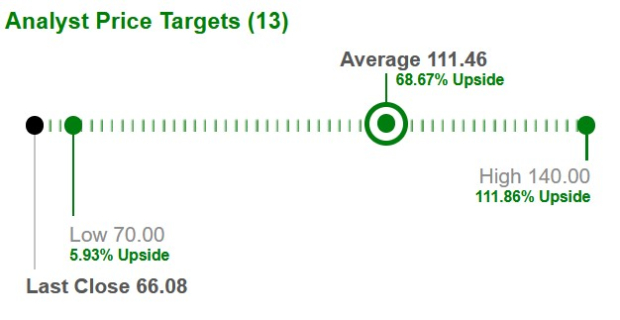

Based on short-term price targets by 13 analysts, the average price target for Astera Lab of $111.46 implies a 68.7% upside from the last close.

Based on short-term price targets by 29 analysts, the average price target for Marvell Technology of $111.79 implies an 89.7% upside from the last close.

While both Astera Labs and Marvell Technology are well-positioned for long-term growth in AI-driven infrastructure, Marvell, a Zacks Rank #2 (Buy) stock, stands out as the better buy right now, banking on its scale, diversification and strong strategic executions. The company recorded $1.37 billion in fiscal fourth-quarter data center revenues. It already has multiple high-volume custom AI silicon programs in production. Its strong operating margins and robust cash generation give it long-term resilience.

In contrast, Astera Labs, a Zacks Rank #3 (Hold) stock, though promising, is still in earlier ramp-up stages. It is dependent on a few product lines and exposed to hyperscaler CapEx volatility. For investors seeking a stable, cash-generating AI infrastructure player with scale and visibility, Marvell offers a stronger risk-reward profile today.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite