|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Wall Street has witnessed severe volatility in 2025 after recording an astonishing bull run in the last two years. Year to date, all three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — are in negative territory. The small-cap benchmarks — the Russell 2000 and the S&P 600 — are also in the negative zone year to date. Similarly, the mid-cap-specific S&P 400 Index is also in the red.

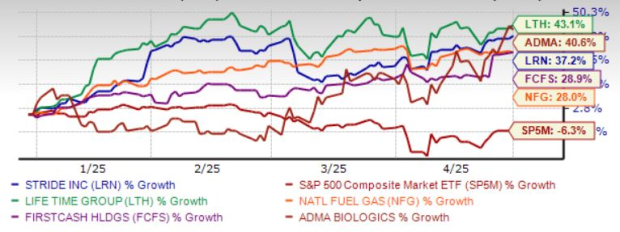

Despite this headwind, a handful of mid-cap stocks are flying high providing more than 25% returns year to date. We have selected five such stocks with a favorable Zacks Rank. These are: ADMA Biologics Inc. ADMA, FirstCash Holdings Inc. FCFS, Stride Inc. LRN, Life Time Group Holdings Inc. LTH and National Fuel Gas Co. NFG.

These stocks have strong revenue and earnings growth potential for 2025. Moreover, these stocks have seen positive earnings estimate revisions over the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

ADMA Biologics is a specialty immune globulin company. ADMA develops, manufactures and intends to market plasma-based biologics for the treatment and prevention of certain infectious diseases.

ADMA’s target patient populations include immune-compromised individuals who suffer from an underlying immune deficiency disease or who may be immune-suppressed for medical reasons. ADMA sells its products through independent distributors, drug wholesalers, specialty pharmacies, and other alternate site providers.

ADMA Biologics has an expected revenue and earnings growth rate of 16.3% and 44.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.9% over the last 60 days.

Zacks Rank #2 FirstCash Holdings operates retail pawn stores in the United States, Mexico, and rest of Latin America. FCFS operates through three segments: U.S. Pawn, Latin America Pawn, and Retail POS Payment Solutions.

FCFS’ pawn stores lend money on the collateral of pledged personal property, including jewelry, electronics, tools, appliances, sporting goods, and musical instruments; and retails merchandise acquired through collateral forfeitures and over-the-counter purchases of merchandise from customers.

FirstCash Holdings also provides retail POS payment solutions, which focuses on LTO products and facilitating other retail financing payment options across the network of traditional and e-commerce merchant partners. FCFS serves cash and credit-constrained consumers.

FirstCash Holdings has an expected revenue and earnings growth rate of 0.2% and 17.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the last seven days.

Zacks Rank #1 Stride is a technology-based education service company, which is engaged in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. LRN’s technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

LRN offers integrated package of systems, services, products, and professional expertise to support a virtual or blended public school, software and services to schools and school districts, individual online courses and supplemental educational products, and products and services for the general education market focused on subjects, including math, English, science, and history for kindergarten through twelfth grade students.

LRN also provides career learning products and services that are focused on developing skills to enter in industries, including information technology, health care, and business, and operates tuition-based private schools.

Stride has an expected revenue and earnings growth rate of 14.9% and 48.4%, respectively, for the current year (ending June 2025). The Zacks Consensus Estimate for current-year earnings has improved 4.3% over the last 30 days.

Zacks Rank #1 Life Time Group Holdings provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada. LTH primarily engages in designing, building, and operating of sports and athletic, professional fitness, family recreation, and spa centers in a resort-like environment in suburban and urban locations of metropolitan areas.

Life Time Group Holdings also offers fitness floors with equipment, locker rooms, group fitness studios and spaces, indoor and outdoor pools and bistros, indoor and outdoor tennis and pickleball courts, basketball courts, LifeSpa, LifeCafe, and childcare and Kids Academy learning spaces.

In addition, LTH’s Life Time Digital provides live streaming fitness classes, remote goal-based personal training, nutrition and weight loss support, curated award-winning health, and fitness and wellness content. Further, LTH offers media, athletic events, and related services.

Life Time Group Holdings has an expected revenue and earnings growth rate of 12.9% and 37.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.5% over the last 60 days.

Zacks Rank #1 National Fuel Gas’ systematic investments should strengthen its operations and reduce greenhouse gas emissions. Strong liquidity should allow it to meet debt obligations.

NFG’s steady process of replacing and modernizing the existing pipelines should further boost earnings. NFG also acquired Shell’s assets, which should further boost its top-line performance.

NFG invested $936 million in fiscal 2024 and expects to invest $923 million in fiscal 2025. Net E&P production was 392 Bcfe in fiscal 2024. Net E&P production in fiscal 2025 is likely to be in the range of 410-425 Bcfe. E&P capital expenditure amounted to $530 million in fiscal 2024 and is anticipated to be in the $495-$515 million range in fiscal 2025.

National Fuel Gas has an expected revenue and earnings growth rate of 31.5% and 39.1%, respectively, for the current year (ending September 2025). The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite