|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Caterpillar Inc. CAT reported adjusted earnings per share of $4.25 for the first quarter of 2025, which missed the Zacks Consensus Estimate of $4.30 by a margin of 1%. The bottom-line figure was down 24% year over year due to volume declines across its segments. The drop in sales volume was due to the impact of changes in dealer inventories.

Including one-time items, Caterpillar’s earnings per share were $4.20, a 27% decline compared with the reported figure of $5.75 in the year-ago quarter.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Caterpillar Inc. price-consensus-eps-surprise-chart | Caterpillar Inc. Quote

Caterpillar reported first-quarter revenues of around $14.2 billion, which missed the Zacks Consensus Estimate of $14.5 billion by a margin of 2%. The top line declined 10% year over year due to a decline in volumes in its segments and unfavorable price realization and currency impact.

The lower sales volume was attributed to the changes in dealer inventories. Dealer inventory increased $100 million during the first quarter of 2025 compared with an increase of $1.4 billion during the year-ago quarter.

Caterpillar witnessed revenue declines across all regions, with revenues down 10% in North America, 3% in Latin America, 12% in Asia Pacific and 12% in EAME.

On a positive note, Caterpillar reported a record sequential backlog growth of $5 billion in the quarter. Its backlog is currently a solid $35 billion.

The cost of sales decreased 7% year over year to around $9 billion. Gross profit was down 14% to $5.28 billion from the prior-year quarter due to lower sales. The gross margin was 37.1% compared with 38.8% in the year-ago quarter.

Selling, general and administrative expenses inched up 1% year over year to around $1.59 billion. Research and development expenses were down 8% to $480 million.

CAT reported an operating profit of $2.58 billion, a 27% decline from the year-ago quarter. The operating margin was 18.1%, a 420-basis point contraction from the year-ago quarter.

Adjusted operating profit was around $2.61 billion, down 26% from the year-ago quarter. The adjusted operating margin was 18.3% compared with 22.2% in the first quarter of 2024.

Machinery and Energy & Transportation (ME&T) sales dipped 11% year over year to around $13.4 billion.

Construction Industries' total sales were down 19% year over year to $5.18 billion on lower sales volume and unfavorable price realization. The impact of changes in dealer inventories weighed on volumes in the quarter. Regionally, sales dropped 24% in North America, 15% in Latin America, 13% in EAME, and 12% in Asia/Pacific. The segment’s total sales were lower than our estimate of $5.39 billion.

Total sales in the Resource Industries segment were down 10% year over year to $2.88 billion. Lower volumes, due to lower sales of equipment to end users, unfavorable price realization and unfavorable currency impacts, led to the decline. Sales in Latin America were up 18% but were offset by a 14% decline in sales in North America. Asia/Pacific and EAME also witnessed declines of 14% and 13%, respectively. The segment’s first-quarter total sales were a bit higher than our projection of $2.84 billion.

Sales of the Energy & Transportation segment were around $6.57 billion, a 2% dip from last year’s quarter. Lower sales volumes and unfavorable currency impacts offset favorable price realization. Our estimate for the segment’s sales for the quarter was $6.73 billion.

The segment reported sales growth in Power Generation (23%), which was offset by declines in the Oil and Gas sector (20%), the Transportation sector (10%) and the Industrial sector (2%). Regionally, a 6% sales increase in North America was offset by decreases of 9% in Latin America, 13% in EAME and 14% in Asia/Pacific.

The ME&T segment reported an operating profit of around $2.52 billion, down 26% year over year. Our model’s projection was $2.55 billion.

The Energy & Transportation segment reported a 1% year-over-year increase in operating profit to $1.31 billion, higher than our estimate of $1.296 billion.

The Construction Industries segment’s operating profit plunged 42% year over year to $1.02 billion. Our projection was $1.39 billion.

The Resource Industries segment’s operating profit slumped 18% year over year to $0.6 billion. Our estimate for the segment’s operating profit was $0.63 billion.

Financial Products’ total revenues rose 2% from the year-ago quarter to $1 billion. The segment reported a profit of $215 million compared with $293 million in the first quarter of 2024. Our model had projected revenues of $1.13 billion and an operating profit of $230 million for the first quarter of 2025.

Caterpillar generated an operating cash flow of $1.3 billion in the first quarter of 2024 compared with $2.05 billion in the prior-year quarter due to lower profits.

The company returned around $4.3 billion in cash to shareholders as dividends and share repurchases through the quarter. CAT ended the quarter with cash and equivalents of around $3.6 billion, lower than the cash holding of around $6.9 billion at 2024-end.

The company anticipates revenues in the second quarter of 2025 to be flat year over year. Adjusted operating margin is anticipated to be lower compared with the second quarter of 2024, reflecting lower price realization and excluding tariff impact.

CAT anticipates an additional cost headwind of $250-$350 million from tariffs for the quarter, after accounting for initial mitigation and other cost control measures.

The company outlined its outlook for 2025 for both the scenarios, pre and post tariffs.

Excluding tariffs, CAT now expects 2025 revenues to be roughly flat compared with 2024, an improvement from its prior projection of a slight year-over-year decline.

Adjusted operating profit margin is expected to be in the top half of its target range, corresponding to the anticipated level of revenues. Caterpillar also expects ME&T free cash flow in 2025 to be in the top half of its targeted range of $5-$10 billion.

Considering the impact of tariffs, Caterpillar expects 2025 full-year revenues to be down slightly from 2024, maintaining its previous expectation. Adjusted operating profit margin is expected to be within its target range, corresponding to the anticipated level of revenues. Caterpillar expects ME&T free cash flow in 2025 to be within its targeted range of $5-$10 billion.

Terex Corporation TEX is scheduled to release its first-quarter 2025 results on May 2. The Zacks Consensus Estimate for TEX’s earnings is pegged at 49 cents per share, indicating a year-over-year plunge of 69%.

The consensus estimate for Terex’s top line is pegged at $1.22 billion, indicating a decrease of 5.5% from the prior year’s actual. TEX has a trailing four-quarter average earnings surprise of 9.9%.

Hyster-Yale, Inc. HY will release first quarter 2025 results on May 6. HY has a trailing four-quarter average surprise of 12.4%. The Zacks Consensus Estimate for HY’s earnings is pegged at 47 cents per share, implying a year-over-year plunge of 84%.

The consensus estimate for the company’s top line is pegged at $948 million, indicating a 10% drop from the prior-year figure.

The Manitowoc Company MTW is set to release its first-quarter 2025 results on May 6. The Zacks Consensus Estimate for MTW’s earnings is pegged at a loss of 10 cents per share against the year-ago quarter’s profit of 14 cents per share.

The consensus estimate for Manitowoc’s top line is pegged at $480 million, indicating a 3% dip from the prior year’s actual. MTW has a trailing four-quarter average earnings surprise of negative 73%.

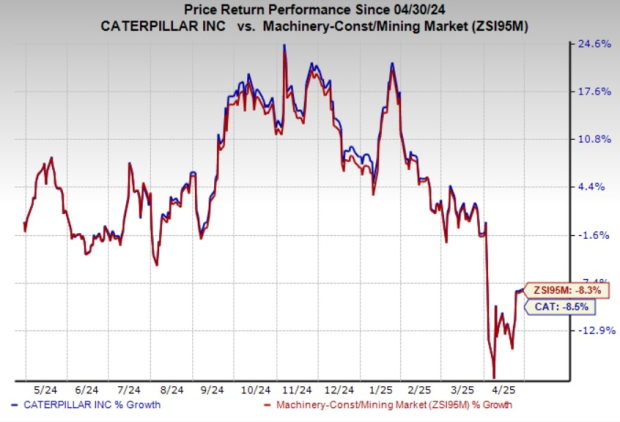

Over the past year, Caterpillar's stock has dipped 8.5% compared with the industry’s 8.3% fall.

Caterpillar carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite