|

|

|

|

|||||

|

|

Online casino and sports betting company Rush Street Interactive (NYSE:RSI) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 20.7% year on year to $262.4 million. On the other hand, the company’s full-year revenue guidance of $1.05 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was 47.7% above analysts’ consensus estimates.

Is now the time to buy Rush Street Interactive? Find out by accessing our full research report, it’s free.

Richard Schwartz, Chief Executive Officer of RSI, said, “We have started 2025 with strong momentum, building on our success from recent years. Our first quarter revenue increased by 21% year-over-year to $262 million, and our Adjusted EBITDA reached a record $33 million, nearly double that of Q1 2024. These strong results are driven by our commitment to innovation and enhancing the quality of our player experience, alongside efficient acquisition and retention of high-value players. The consistency and durability of our business, particularly in online casino, is reflected in our execution and performance and is the foundation of the optimism we have for sustaining our momentum going forward.”

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE:RSI) is an operator of digital gaming platforms.

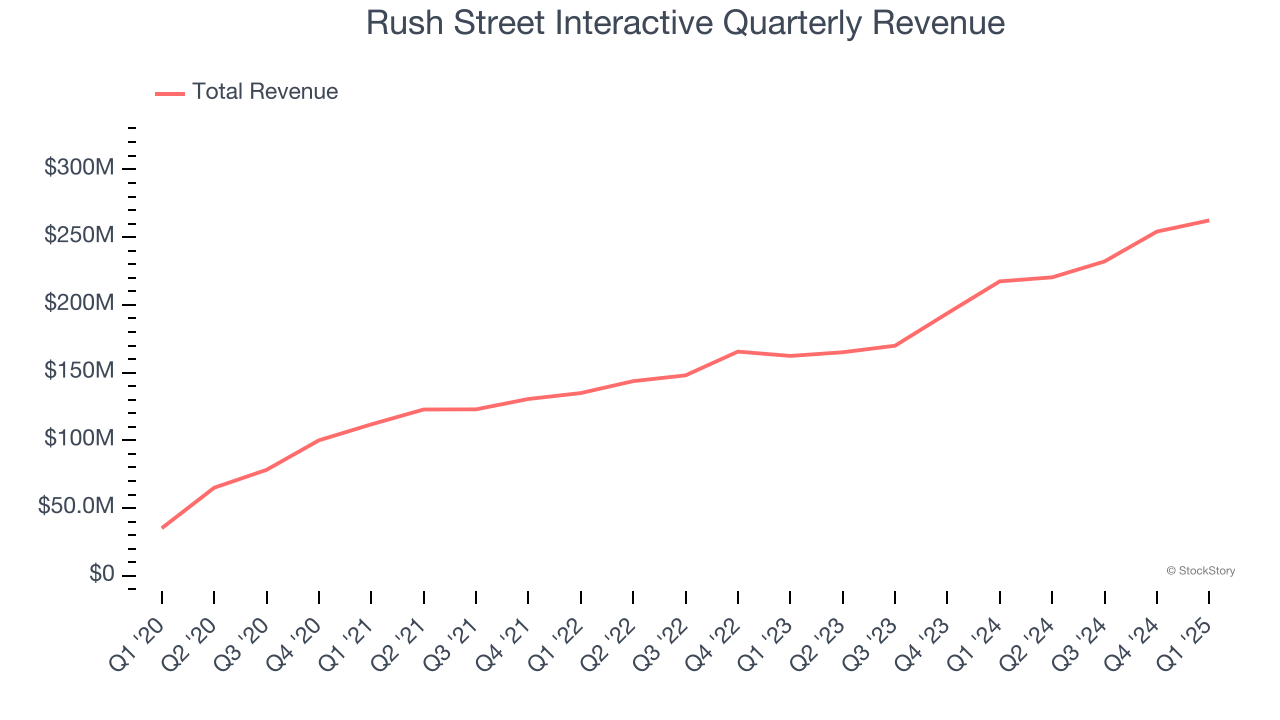

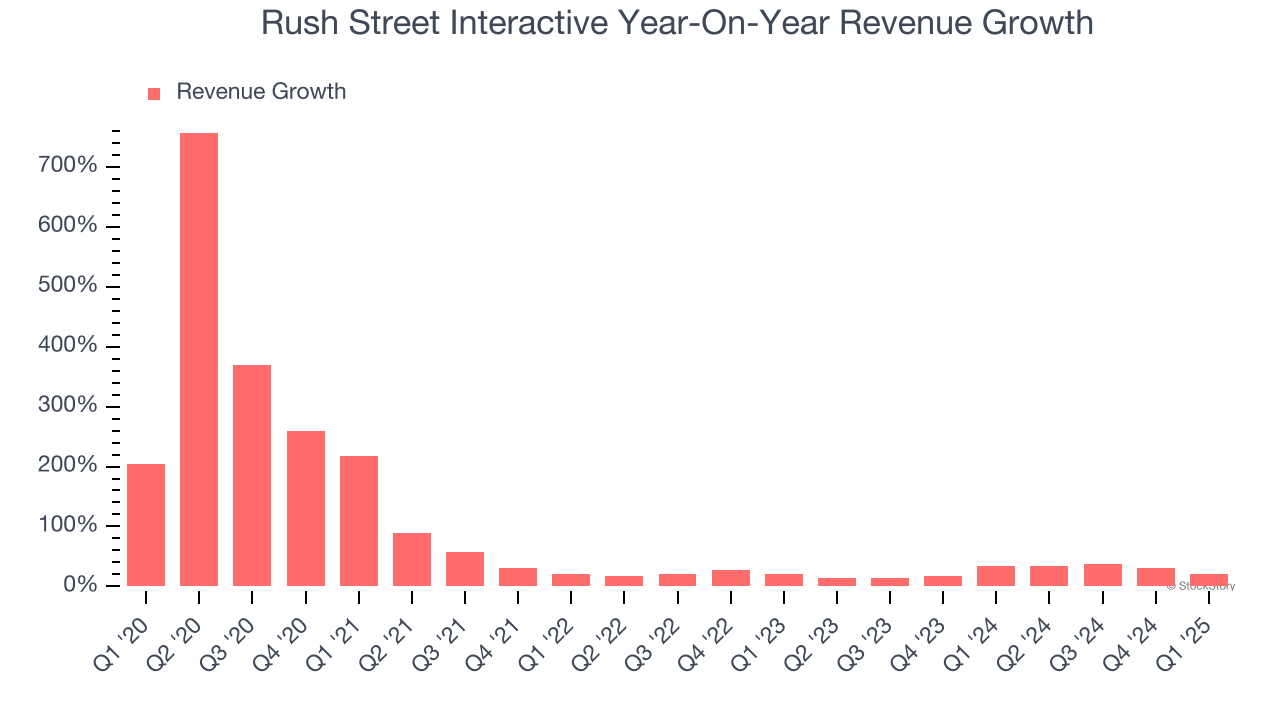

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Rush Street Interactive’s sales grew at an incredible 61.9% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Rush Street Interactive’s annualized revenue growth of 25.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

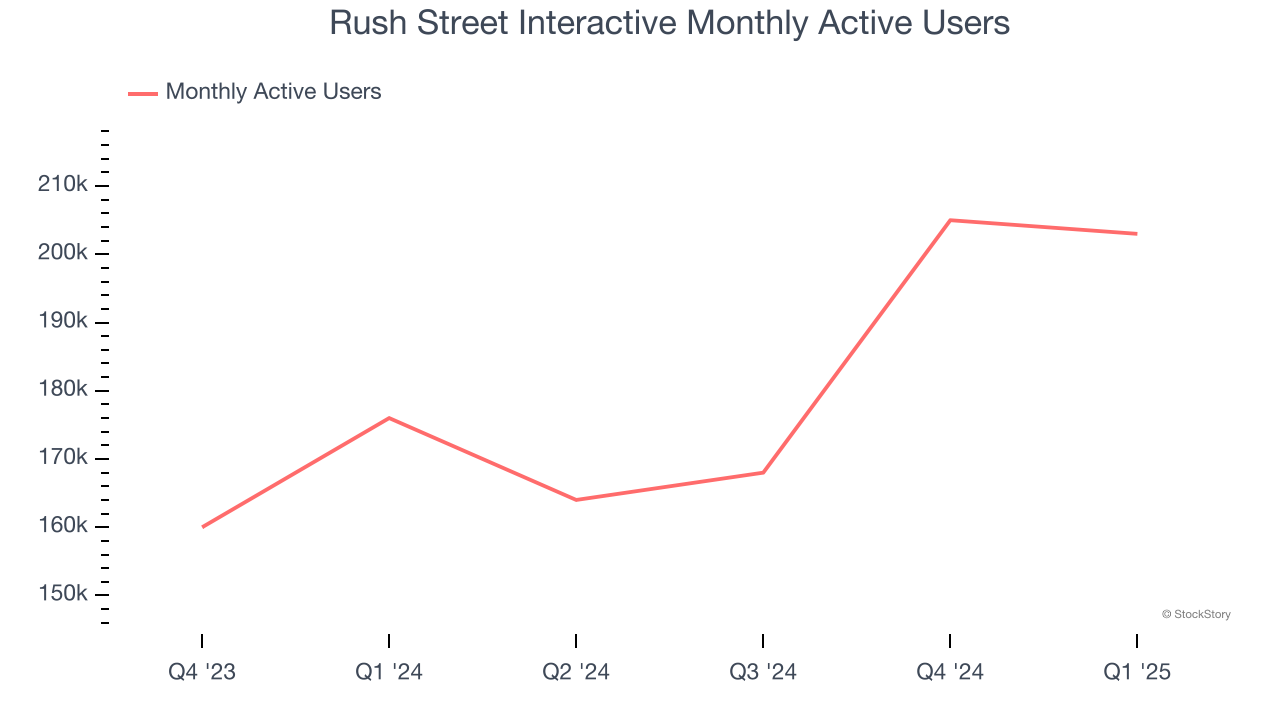

Rush Street Interactive also discloses its number of monthly active users, which reached 203,000 in the latest quarter. Over the last two years, Rush Street Interactive’s monthly active users averaged 21.7% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Rush Street Interactive reported robust year-on-year revenue growth of 20.7%, and its $262.4 million of revenue topped Wall Street estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 12.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market sees some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

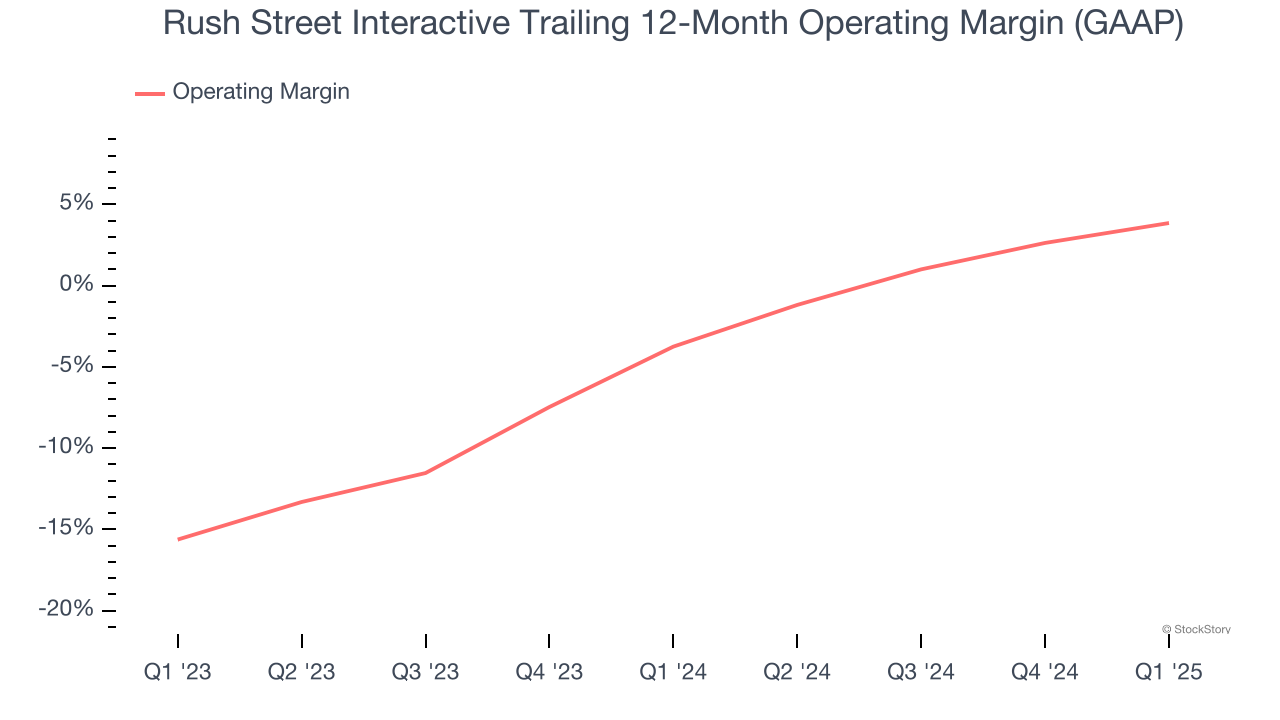

Rush Street Interactive’s operating margin has been trending up over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

This quarter, Rush Street Interactive generated an operating profit margin of 5.6%, up 4.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

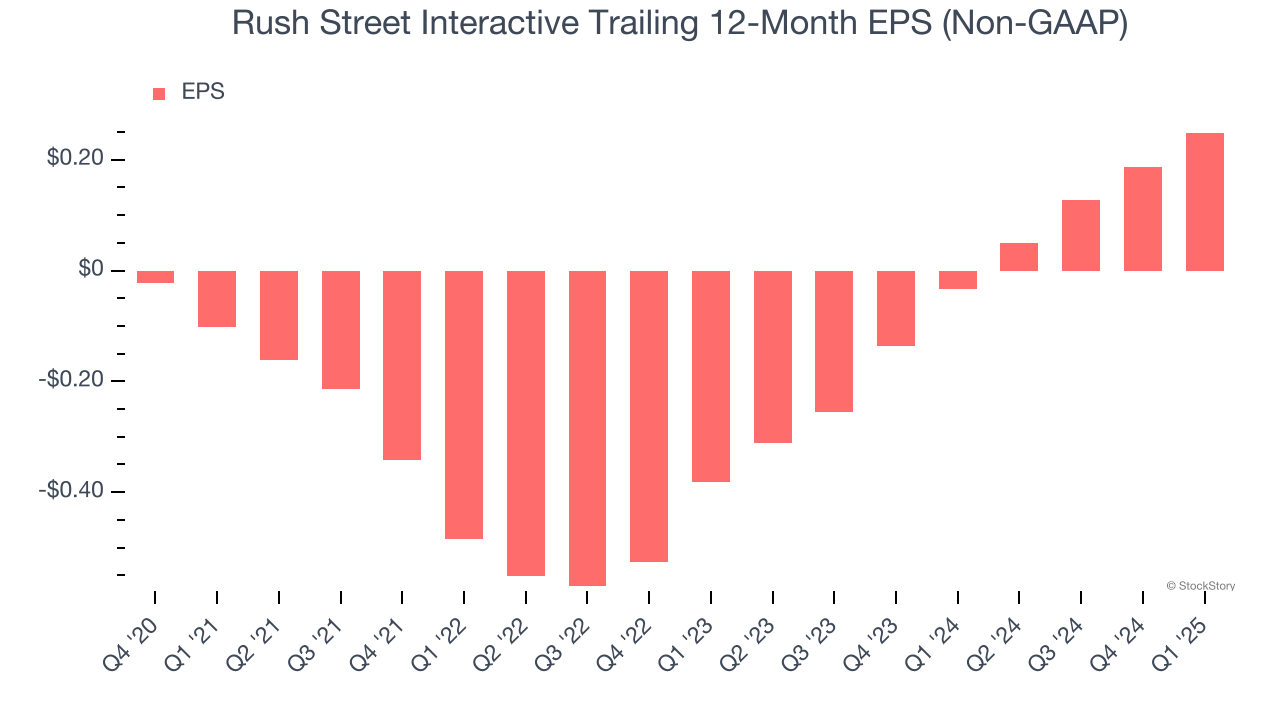

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Rush Street Interactive’s full-year EPS flipped from negative to positive over the last four years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Rush Street Interactive reported EPS at $0.09, up from $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Rush Street Interactive to perform poorly. Analysts forecast its full-year EPS of $0.25 will hit $0.33.

We were impressed by how significantly Rush Street Interactive blew past analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. Overall, this quarter had some key positives. The stock traded up 8.9% to $13.20 immediately following the results.

Sure, Rush Street Interactive had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| 1 hour | |

| 3 hours | |

| 11 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-06 | |

| Feb-06 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite