|

|

|

|

|||||

|

|

CONMED Corporation CNMD delivered first-quarter 2025 adjusted earnings per share (EPS) of 95 cents, which beat the Zacks Consensus Estimate of 81 cents by 17.3%. The bottom line improved 20.3% from the year-ago level.

GAAP EPS for the quarter was 19 cents compared with 63 cents in the year-ago period. (Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.)

CONMED’s revenues totaled $321.3 million, up 2.9% year over year. The top line beat the Zacks Consensus Estimate by 2.4%. At constant exchange rate (CER), revenues increased 3.8%.

The top line was driven primarily by strong momentum in high-growth product areas (BioBrace, AirSeal, Foot & Ankle), partially offset by lingering supply constraints and some international softness.

CONMED Corporation price-consensus-eps-surprise-chart | CONMED Corporation Quote

Revenues in the Orthopedic Surgery segment totaled $138.3 million, up 2.5% from the year-ago level on a reported basis. At CER, revenues increased 3.9%.

Sales declined 2.1% on a reported basis in the United States. The figure improved 5.6% (up 7.9% at CER) year over year in international markets.

Revenues in the General Surgery segment amounted to $183 million, up 3.2% year over year on a reported basis and 3.8% at CER. U.S. sales increased 6.9% year over year. International sales decreased 5.2% on a reported basis (down 3.3% at CER).

Sales in the United States totaled $183.8 million, up 4.2% year over year. International sales amounted to $137.5 million, up 1.2% year over year on a reported basis and up 3.4% at CER.

CONMED’s adjusted gross profit improved 3.4% year over year to $181.2 million. The gross margin improved 80 basis points to 56.4%.

Selling & administrative expenses increased 20.7% year over year to $148.8 million. Research and development expenses decreased 4.8% year over year to $12.9 million.

The company recorded an adjusted operating income of $36.7 million compared with $32 million in the prior-year quarter. The operating margin was 14.1%, up 110 basis points.

CNMD exited the first quarter with a cash balance of $34.5 million compared with $24.5 million in the previous quarter.

Cash flow provided from operations in the reported quarter was $41.5 million compared with $29.1 million in the fourth quarter of 2024.

CONMED raised its revenue and earnings guidance for 2025.

The company now expects full-year 2025 revenues to be between $1.35 billion and $1.378 billion. This raised outlook reflects lower FX headwinds of approximately 50-70 basis points compared with 100-120 previously. The Zacks Consensus Estimate for the same is pegged at $1.36 billion.

CONMED now expects 2025 adjusted EPS to be in the range of $4.45-$4.60 (previously $4.25-$4.40). The Zacks Consensus Estimate for the same is pinned at $4.35. The company expects a negative impact of 14 cents (due to the raised tariff) for the second half of 2025. This is not included in the guidance.

CNMD also provided revenue guidance for the second quarter of 2025. CNMD expects reported sales to be between $335 million and $340 million.Adjusted EPS for the period is estimated to be between $1.10 and $1.15.

CONMED shares were up 3.4% in after-hours trading as the company exited the first quarter on a better-than-expected note. Earnings and revenues beat their respective Zacks Consensus Estimate. The company’s raised outlook for 2025 looks promising.

Orthopedics saw solid demand, particularly in foot and ankle products and BioBrace, the company’s innovative soft tissue repair solution. BioBrace’s clinical adoption continues to expand, and it is now being used in over 50 procedures. It has recently received FDA clearance for a new rotator cuff delivery device. General Surgery was driven by continued double-digit growth in AirSeal and smoke evacuation products, although international sales in this segment declined due to underperformance in the energy and critical care lines.

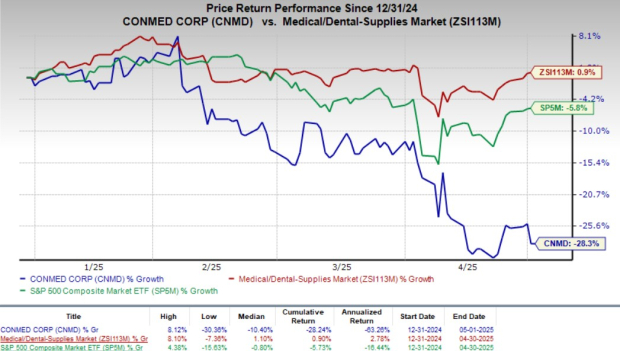

The company’s shares have declined 28.3% so far this year against the industry’s 0.9% growth. The broader S&P 500 Index has decreased 5.8% in the same time frame.

CONMED remains optimistic about the rest of 2025, as hospital systems prioritize minimally invasive procedures, especially in laparoscopy and arthroscopy — areas where CONMED’s portfolio is well-positioned. Management is particularly bullish on the future of AirSeal, Buffalo Filter, BioBrace, and CONMED Foot & Ankle as growth drivers.

Supply-chain issues, which negatively impacted U.S. Orthopedics sales, are showing signs of improvement. The number of SKUs on backorder is declining, and the company anticipates achieving at least $20 million in annual savings through ongoing operational enhancements. Gross margin is expected to trend upward through the year, from the mid-56% range in the second quarter to nearly 57% by the fourth quarter.

Regarding tariffs, CONMED estimates an unfavorable $5.5 million impact in 2025, with 85% stemming from China and 12% from Europe. Mitigation efforts are underway, including adjusting logistics and evaluating pricing strategies. Despite macroeconomic and policy headwinds, CONMED remains focused on driving growth through innovation and operational improvements.

CNMD carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks from the same medical industry are Fresenius Medical Care FMS, Masimo MASI and AdaptHealth AHCO.

Fresenius Medical, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 28.9% for 2025. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FMS’ earnings beat estimates in three of the trailing four quarters and met in one, delivering an average surprise of 15.67%. The company is expected to release first-quarter results next month.

FMS’ shares have gained 12.1% so far this year.

Masimo, carrying a Zacks Rank of 2 at present, has an estimated growth rate of 20% for 2025.

MASI’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 14.41%. Its shares have risen 58.5% compared with the industry’s 3.9% growth year to date. The company is expected to release first-quarter results in May.

MASI’s shares have lost 2.7% so far this year.

AdaptHealth, carrying a Zacks Rank #2 at present, has an estimated earnings growth rate of 16.7% for 2025. The company’s earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average negative surprise of 4.17%. The company is expected to release first-quarter results next month.

AHCO's shares have lost 10.6% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite