|

|

|

|

|||||

|

|

Moderna MRNA incurred a loss of $2.52 per share in the first quarter of 2025, narrower than the Zacks Consensus Estimate of a loss of $2.92. In the year-ago period, the company had reported a loss of $3.07.

Total revenues in the quarter were $108 million, which missed the Zacks Consensus Estimate of $127 million. Revenues declined around 35% year over year, owing to lower net product sales. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Moderna currently has two marketed vaccines in its portfolio — the COVID-19 vaccine Spikevax and the recently launched RSV vaccine mResvia. Product sales were down 49% year over year to $86 million due to lower Spikevax sales.

The company recorded $84 million from Spikevax sales in the quarter compared with $167 million in the year-ago quarter. Per Moderna, this downtick in sales represents lower vaccination rates compared to the year-ago period and the continued normalization of COVID into a seasonal commercial market.

mResvia sales during the quarter stood at $2 million, which significantly missed our model estimate of $70 million. This significant miss was likely due to the vaccine being approved and recommended later in the contracting season. By that time, many customers had already completed their orders.

Notably, RSV vaccine sales have been weak across the industry. For instance, sales of Pfizer’s PFE RSV vaccine Abrysvo and GSK plc’s GSK RSV vaccine Arexvy also declined in the first quarter. While sales of Pfizer’s Abrysvo fell 9% year over year to $131 million, GSK plunged 57% to £78 million (~$98 million). This downtick can be attributed to the restrictive recommendation issued by the U.S. CDC last year for individuals in the 60-74 age bracket.

Moderna generated $22 million from grants, collaborations, licensing and royalty revenues in the quarter. The company usually earns collaboration revenues from agreements with several big pharma/biotech companies, including Merck MRK and Vertex Pharmaceuticals. It did not record any revenues in the year-ago period.

Selling, general and administrative (SG&A) expenses were $212 million, down 23% year over year. This downside was primarily driven by broad-based cost-cutting activities.

Research & development (R&D) expenses were down 19% to $856 million, driven by the reduction in clinical spending across respiratory programs due to the timing of clinical studies and program wind-downs.

Moderna reiterated its total revenue guidance for 2025, which was initially issued in January. It expects total revenues in the range of $1.5-$2.5 billion, mainly from product sales of its COVID-19 and RSV vaccines. The company expects to generate around $0.2 billion in revenues in the first half of the year, owing to the seasonality of its respiratory business.

MRNA expects full-year R&D expenses to be around $4.1 billion, while SG&A expenses are projected to be around $1.1 billion.

Capital expenditure is expected to be around $0.4 billion in 2025.

The company expects to end 2025 with cash, cash equivalents and investments of nearly $6 billion.

Alongside the financial results, Moderna announced that it is expanding its cost efficiency and prioritization programs to further improve its cash burn. The company now expects to incur $5.4-$5.7 billion in operating expenses next year, a reduction from the previous guidance of $5.9 billion.

MRNA expects to incur $4.7-$5.0 billion in operating costs for 2027, which suggests a cut of $1.4-$1.7 billion compared to 2025 estimates.

The company submitted three regulatory filings to the FDA in the fourth quarter of 2024. These included a fresh filing seeking approval for mRNA-1283 (the next-generation COVID-19 vaccine) and a regulatory filing seeking label expansion for mResvia in high-risk adults aged 18-59. While a final decision on mRNA-1283 is expected by this month’s end, the agency’s decision on mResvia is expected by June 12.

The company also submitted a third filing that seeks approval for the company’s COVID-19 and influenza combination vaccine, mRNA-1083. However, it received the FDA’s feedback asking for ‘Phase 3 flu efficacy data.’ This latest development not only extends the review timeline but could also delay the company’s launch plans.

This was likely the reason for the fall in Moderna’s shares by 5% in pre-market trading today, as the company now expects the vaccine’s approval next year, instead of the company’s initial plans of securing approval before 2025-end.

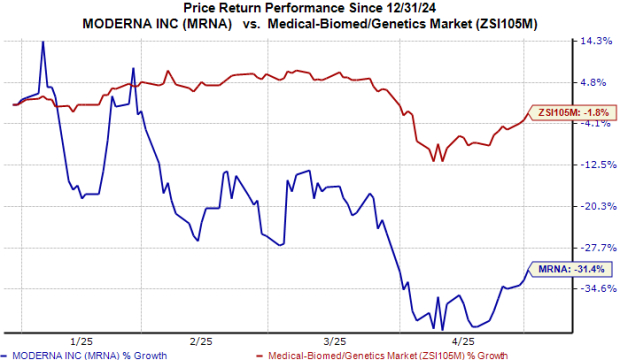

Year to date, the stock has plunged 31% compared with the industry’s decline of 2%.

Moderna has more than 40 mRNA-based investigational candidates in different stages of clinical studies, targeting various indications, including cancer. The company is evaluating multiple candidates in late-stage studies — mRNA-1647 (cytomegalovirus [CMV] vaccine), mRNA-1010 (influenza vaccine), and the cancer therapy intismeran autogene (formerly, mRNA-4157/V940). Efficacy data from the CMV study is expected later in 2025.

Moderna is co-developing intismeran autogene with Merck. The companies are evaluating this therapy in three pivotal phase III studies — one in the melanoma indication and the other two for non-small cell lung cancer (NSCLC). Moderna and Merck have also started three mid-stage studies evaluating intismeran autogene across cutaneous squamous cell carcinoma, renal cell carcinoma and muscle-invasive bladder cancer indications.

The company also announced that it is expanding its oncology pipeline with the addition of mRNA-4359, an investigational checkpoint adaptive immune modulation therapy. mRNA-4359 is currently being evaluated in early-to-mid-stage clinical studies for first-line melanoma and first-line metastatic NSCLC.

Moderna also remains on track to start a registrational study on its methylmalonic acidemia therapeutic candidate mRNA-3705 later this year. This drug was selected by the FDA for its Support for Clinical Trials Advancing Rare Disease Therapeutics pilot program, which accelerates the development of novel therapies addressing unmet medical needs in rare diseases.

Moderna, Inc. price | Moderna, Inc. Quote

Moderna currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite