|

|

|

|

|||||

|

|

Upbound Group, Inc. UPBD has posted strong first-quarter 2025 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Also, UPBD’s revenues and earnings increased year over year. Following the impressive results, this Plano, TX-based company has raised its 2025 guidance.

The company delivered strong results in the first quarter due to the resilience of its business model, effective strategy and the efforts of its talented team. Key drivers included Gross Merchandise Volume (GMV) growth at Acima, and momentum at Brigit (which the company acquired at the end of January 2025).

Upbound Group, Inc. price-consensus-eps-surprise-chart | Upbound Group, Inc. Quote

UPBD posted adjusted earnings of $1.00 per share, surpassing the Zacks Consensus Estimate of 94 cents. Also, the bottom line increased from 79 cents in the year-ago quarter. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Total revenues of $1,176.4 million surpassed the consensus estimate of $1,119 million. The metric increased 7.3% year over year due to growth in rentals and fees revenues, increased merchandise sales, and the contribution from the Brigit acquisition.

Adjusted EBITDA was $126.1 million, up 15.6% year over year. This increase was driven by higher adjusted EBITDA in the Acima segment and the addition of Brigit's EBITDA, partially offset by a decline in the Rent-A-Center segment.

The company’s adjusted EBITDA margin increased 70 basis points year over year to 10.7%, reflecting margin expansion in the Acima segment and strong performance from Brigit, partially offset by a margin decline in Rent-A-Center.

Revenues in the Rent-A-Center segment decreased 4.9% year over year to $489 million due to a reduced number of company-owned stores and fewer deliveries resulting from disciplined underwriting. Same-store sales declined 2% year over year. The Zacks Consensus Estimate for the Rent-A-Center segment’s revenues was pegged at $457.4 million for the quarter.

Adjusted EBITDA declined $11.7 million year over year to $72.1 million due to lower gross profit, partially offset by reduced operating costs. Lease charge-offs for company-owned Rent-A-Center stores were 4.6%, down 10 basis points year over year. The Rent-A-Center segment now includes financial results from all franchised locations, which were previously reported separately.

Revenues at the Acima segment (formerly known as the Preferred Lease segment) rose 13.5% year over year to $637.3 million. The Zacks Consensus Estimate for the Acima segment’s revenues was pegged at $613.2 million. Applications increased more than 10% year over year in the first quarter. GMV rose 8.8% from the prior year, driven by an increase in retailer locations, higher application volume and continued growth in direct-to-consumer offerings.

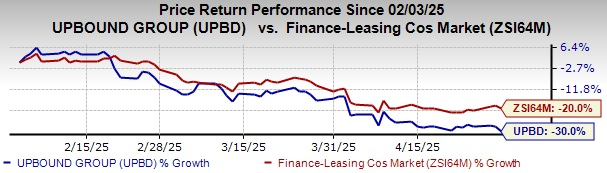

UPBD Stock Past Three-Month Performance

GMV from the Acima marketplace experienced significant growth, surging more than 75% in the first quarter. The adjusted EBITDA margin rose 170 basis points to 13.3%. These improvements were driven by operating efficiencies achieved through lower operating costs, revenue growth and reduced lease charge-off rates.

Brigit generated total revenues of $31.9 million for February and March 2025, reflecting a 35.4% increase from the same period in 2024. Average revenue per user rose 5.9% year over year to $12.88, driven by higher expedited transfer fees, a shift toward the Premium tier and improved subscription collection rates. Paying subscribers grew 26.1% from the prior year. Cash advance volume increased 23.3% to $218.4 million. Adjusted EBITDA totaled $11.4 million, with a margin of 35.9%.

The Zacks Rank #3 (Hold) company’s Mexico segment’s revenues totaled $18.2 million, reflecting a year-over-year increase of 6.3% on a constant-currency basis. Adjusted EBITDA was $1.7 million. As of March 31, 2025, the Mexico segment owned and operated 132 locations.

The company ended the reported quarter with cash and cash equivalents of $107.3 million, net senior debt of $1.09 billion, and stockholders' equity of $679.2 million.

Revenues in 2025 are expected to be $4.60-$4.75 billion. Adjusted EBITDA is projected between $510 million and $540 million compared with the previously mentioned $500-$540 million. Adjusted earnings per share are forecast between $4.00 and $4.40. The company previously anticipated adjusted earnings between $3.90 and $4.40. The free cash flow is expected to be $150-$200 million.

For the second quarter of 2025, revenues are anticipated between $1.05 billion and $1.15 billion, with an adjusted EBITDA of $125-$135 million.

The stock has lost 30% in the past three months compared with the industry’s decline of 20%.

Some better-ranked stocks in the same space are The Gap, Inc. GAP, Nordstrom Inc. JWN and Stitch Fix SFIX.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s fiscal 2025 earnings and sales indicates growth of 7.7% and 1.5%, respectively, from the year-ago actuals. GAP has a trailing four-quarter average earnings surprise of 77.5%.

Nordstrom is a leading fashion specialty retailer in the United States. The company offers an extensive selection of branded and private-label merchandise. It currently flaunts a Zacks Rank of 1.

The Zacks Consensus Estimate for Nordstrom’s fiscal 2025 earnings and sales indicates growth of 1.8% and 2.2%, respectively, from the year-ago actuals. JWN has a negative trailing four-quarter average earnings surprise of 26.1%.

Stitch Fix delivers customized shipments of apparel, shoes and accessories for women, men and kids. It currently has a Zacks Rank of 2 (Buy).

The Zacks Consensus Estimate for SFIX’s fiscal 2025 earnings implies growth of 64.7% from the year-ago actual. Stitch Fix delivered a trailing four-quarter average earnings surprise of 48.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite