|

|

|

|

|||||

|

|

Stryker Corporation SYK reported first-quarter 2025 adjusted earnings per share (EPS) of $2.84, which beat the Zacks Consensus Estimate of $2.73 by 4%. The bottom line also improved 13.6% year over year. Our model estimate for the metric was pegged at $2.77 per share.

GAAP EPS was $1.41, down 17.6% from the year-ago quarter’s level. The significant decline was primarily due to the impact of the Inari Medical acquisition and higher interest expenses. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Revenues totaled $5.87 billion, which beat the Zacks Consensus Estimate by 2.9%. The top line also improved 11.9% on a year-over-year basis and 12.8% at constant currency (cc). Our model estimated total sales to be $5.67 billion. The growth reflects positive trends from pricing initiatives.

Revenues in the United States amounted to $4.44 billion, up 13.4% from the prior-year quarter’s level. International sales increased 7.3% year over year to $1.43 billion with strong sales momentum in Australia, New Zealand, Japan and Europe.

Stryker Corporation price-consensus-eps-surprise-chart | Stryker Corporation Quote

Stryker signed an agreement during the first quarter to sell its U.S. spinal implants business to Viscogliosi Brothers, LLC, a family-owned investment firm specializing in the neuro-musculoskeletal space. The new company will be called VB Spine, LLC. Stryker also plans to sell its related international business. The divestment is likely to be completed by the first half of 2025.

Effective from the fourth quarter, its Spine enabling technologies results are reported as part of other orthopedics. Interventional Spine results are reported as part of neurocrine. As a result, spinal implants are now reported separately within orthopedics.

MedSurg and Neurotechnology: This segment reported sales of $3.51 billion, up 9.4% year over year and 14.2% at cc. Our model estimated segment sales to be $3.4 billion.

In the quarter under review, MedSurg and Neurotechnology recorded organic sales growth of 10.7%, which included 11.5% of U.S. organic growth and 5.8% of international organic growth. Instruments recorded U.S. sales growth of 10.4%, led by healthy growth in the Surgical Technologies business.

Endoscopy saw 12.1% U.S. growth on the back of robust core endoscopy and sports medicine portfolios. Medical grew 10.1%, led by emergency care and Sage. LIFEPAK 35 continues to bring significant additional revenues since its launch last year.

Neurovascular grew 5.6% organically in the United States, driven by strong hemorrhagic sales. Internationally, sales were up 12.3%. Neurocranial saw 13.3% growth, led by strong demand for Neurosurgical, ENT and cranial maxillofacial products.

International sales were driven by growth in neurocranial, endoscopy and instruments businesses, especially strong performances in Australia, New Zealand, Europe and most of its emerging markets.

Orthopedics: Sales in the segment amounted to $2.36 billion, up 9.7% year over year and 10.7% at cc. Organically, sales were up 9.3%, which included organic growth of 9.5% in the United States and 8.3% internationally. The knee business grew 8.7%, reflecting its market-leading position in robotic-assisted knee procedures and momentum from the continued strength of its new Mako installations. Our model estimated Orthopedics sales to be $2.27 billion.

U.S. hips business grew 7.6%, driven by Cigna hip stem success and Mako robotic platform momentum. Trauma and Extremities business surged 13.9%, led by strong core trauma and upper extremities growth. Spinal implants declined 2.9%, while Mako deal mix and decline in bone cement led to a 1.9% deterioration in other ortho sales. International Orthopaedics grew 8.8%, with strength in emerging markets like Japan, Europe, South Korea and Canada.

Adjusted gross profit totaled $3.85 billion in the reported quarter, up 15.2% from the year-ago quarter’s level. Adjusted gross margin expanded 190 basis points (bps) to 65.5%. The improvement was primarily driven by positive pricing, manufacturing cost improvements and mix.

Total operating expenses were $2.91 billion, up 23.1% from the year-ago quarter’s level.

Adjusted operating income totaled $1.34 billion, up 17.3% from the year-ago level. Adjusted operating margin was 22.9%, up 100 bps.

Stryker exited the first quarter with cash and cash equivalents of $2.32 billion compared with $3.65 billion at the end of the fourth quarter of 2024.

Cumulative net cash provided by operating activities totaled $250 million compared with $204 million a year ago.

Stryker updated its guidance for 2025. The company now expects total revenues to grow in the range of 8.5-9.5% on an organic basis (previously 8-9%). The Zacks Consensus Estimate for total revenues is pegged at $24.54 billion, implying growth of 8.6%.

SYK lowered its EPS guidance to $13.20-$13.45 from $13.45-$13.70 to reflect the dilutive impact of 20-30 cents from the acquisition of Inari Medical. The Zacks Consensus Estimate for earnings is pegged at $13.46 per share.

Stryker exited first-quarter 2025 on a strong note, wherein earnings and revenues beat the Zacks Consensus Estimate. The company delivered strong operational results, driven by robust demand across its MedSurg, Neurotechnology and Orthopaedics segments. Organic sales grew 10.1%, with especially strong U.S. performance in trauma, extremities, neurocranial and medical divisions. Internationally, growth remained healthy, with notable strength in Australia, New Zealand, Japan and Europe.

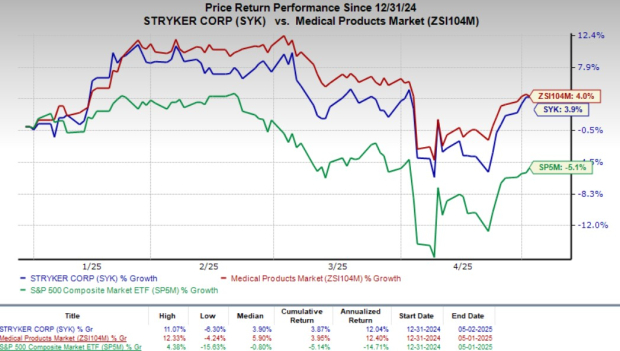

Following the earnings release, shares of SYK were down 0.5% during after-hours trading on May 1. The stock has risen 3.9% year to date compared with 4.3% growth of the industry. The broader S&P 500 Index has moved down 5.7% in the same period.

Mako robotic systems continued to be a significant driver, with record first-quarter installations in both the United States and internationally. The next-generation Mako 4 system, featuring improved OR integration and a smaller footprint, was launched and is expected to boost further adoption. Stryker also highlighted momentum in cementless knees and hips, the Pangea plating system in trauma, and the LIFEPAK 35 defibrillator, which is set for additional international launches later this year.

The company completed the Inari Medical acquisition in February, now integrated under the vascular division, and also finalized the sale of its U.S. spinal implants business. Inari’s early performance aligned with expectations and is expected to contribute meaningfully going forward.

Despite continued supply disruptions in the medical segment and the impact of recently enacted tariffs, Stryker maintained operating momentum. The company estimates a $200 million tariff impact in 2025 but plans to offset this through sales growth, pricing actions, cost control, supply-chain efficiencies and favorable foreign exchange movements. The tariffs will impact in second half of 2025, affecting cost of goods sold, but mitigation efforts are underway across the business.

Management remains confident in sustaining momentum, with new product rollouts, international expansion and the full commercial launch of Mako Spine in the second half of 2025.

Stryker currently carries a Zacks Rank #3 (Hold)

Some better-ranked stocks from the same medical industry are AxoGen AXGN, Masimo MASI and AdaptHealth AHCO.

AxoGen, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 76.9% for 2025. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AXGN’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 113.33%. The company is expected to release first-quarter results later this month.

AXGN’s shares have gained 0.1% so far this year.

Masimo, carrying a Zacks Rank of 2 at present, has an estimated growth rate of 20% for 2025.

MASI’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 14.41%. Its shares have risen 58.5% compared with the industry’s 3.9% growth year to date. The company is expected to release first-quarter results in May.

MASI’s shares have lost 2.6% so far this year.

AdaptHealth, carrying a Zacks Rank #2 at present, has an estimated earnings growth rate of 16.7% for 2025. The company’s earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average negative surprise of 4.17%. The company is expected to release first-quarter results next month.

AHCO's shares have lost 10.6% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 7 hours | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite