|

|

|

|

|||||

|

|

Oportun Financial OPRT is scheduled to release its first-quarter 2025 results on May 8, after market close.

In the last reported quarter, OPRT’s earnings surpassed the Zacks Consensus Estimate. The results benefited from lower operating expenses and higher loans receivable. However, lower interest income and non-interest income were undermining factors.

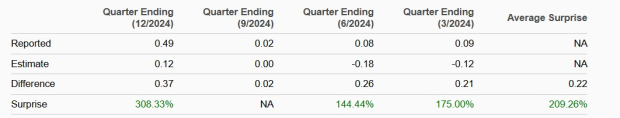

Oportun has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters.

Earnings Surprise

The Zacks Consensus Estimate for earnings of 9 cents per share has remained unchanged over the past seven days. The figure matches the prior-year quarter’s actual. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The consensus estimate for sales is pegged at $229.08 million, indicating a decrease of 8.6%. On the other hand, its peers Enova International Inc. ENVA and Regional Management Corp. RM reflected year-over-year revenue growth during the first quarter of 2025. Enova’s net revenues rose 23.2% from the prior-year quarter to $426.2 million, while Regional Management’s total revenues of $153 million rose 6%.

Is it the right time to add OPRT stock to your portfolio? Let us analyze the factors that are likely to have influenced its performance this time.

Revenues: During the first quarter, the Federal Reserve kept interest rates unchanged at 4.25-4.5% on account of persistent inflation and concerns regarding tariff policies. This, along with the steepened yield curve, is likely to have positively impacted OPRT’s interest income.

The overall lending scenario has improved during the quarter, with a rising demand for consumer loans. Also, Oportun’s efforts to strengthen its credit card sales are expected to have provided some support. The Zacks Consensus Estimate for interest income of $215.9 million indicates a 6.4% decline from the prior-year quarter.

Moreover, Oportun’s servicing fees are likely to have improved in the quarter under review, given decent loan originations. The Zacks Consensus Estimate for servicing fees is pegged at $3.08 million, indicating a 9.7% year-over-year decline.

The consensus estimate for gain on loan sales of $1.69 million implies 12.7% growth. Moreover, subscription revenues and interest on member accounts are likely to have remained resilient given the company’s growth initiatives in new markets, leading to a higher client base. The Zacks Consensus Estimate for total non-interest income is pegged at $13.2 million, indicating a 33.8% year-over-year decline.

Management expects total revenues in the range of $225-$230 million, down from $250.5 million in the prior-year quarter.

Expenses: Oportun has been witnessing a persistent decline in expenses over the past several quarters, given its workforce diversification to lower-cost geographies and a reduction in non-essential vendor spend. However, continued technological investments, rising headcount and inflationary pressures are expected to have offset those efforts to some extent. Thus, overall expenses are expected to have increased in the first quarter.

Our quantitative model does not conclusively predict an earnings beat for Oportun this time around. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

OPRT’s Earnings ESP: Oportun has an Earnings ESP of 0.00% at present.

OPRT’s Zacks Rank: The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

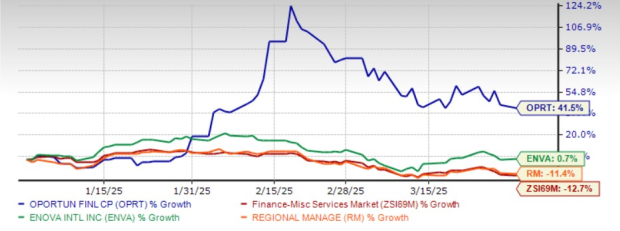

Oportun’s shares have had a remarkable run on the bourses. In the first quarter of 2025, the stock has surged 41.5% against the industry’s decline of 12.7%. Also, it has fared better than Enova and Regional Management stocks during the same period.

First-Quarter 2025 Price Performance

Now, let us look at the value Oportun offers investors at current levels.

Currently, OPRT is trading at 0.54X 12-month price-to-book ratio (P/B), above its five-year median of 0.47X. Meanwhile, the industry’s P/B TTM multiple is 3.30X. Hence, the stock is trading at a huge discount compared with the industry average.

OPRT P/B TTM

Opportun is well-positioned for growth, given its solid loan growth, partnership programs and improving fee income. Further, product diversification efforts and the usage of AI and ML are expected to have driven growth.

OPRT has been driving loan growth through diverse offerings, including personal loans, secured personal loans and “lending as a service” partnership programs, to expand the client base and presence in several markets to generate a higher yield on its loan portfolio. Further, the company has been reducing its customer acquisition costs through higher organic growth.

Also, OPRT has been leveraging technology to boost its underwriting standards and offer personalized customer service. This has enabled enhanced underwriting, leading to lower default risks and ensuring consistent revenue growth while mitigating costs. Further, the lending database allows OPRT to scale up its operations efficiently with minimal infrastructure investment.

Moreover, Oportun has a solid balance sheet position. Further, diversified funding sources have kept the liquidity position strong for the company.

However, higher operating expenses have remained a concern. Last year, OPRT announced a plan to reduce expenses by $30 million on an annualized basis. Despite this, overall expenses are expected to be elevated in the near term as the company intends to enhance technology and raise headcount as it expands into different markets.

Oportun’s efforts to diversify its offerings, higher loan receivable growth and efforts to reduce costs are likely to bode well for its first-quarter results. Further, technology-driven lending is likely to boost OPRT’s operational efficiency in the long run and support sophisticated credit underwriting. A solid balance sheet and diversified funding profile indicate financial stability.

However, uncertainties regarding tariffs, inflationary pressure and rising operating expenses are some near-term headwinds. Yet, attractive valuation and strong long-term growth prospects make OPRT stock worth betting on for now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-24 | |

| Feb-24 | |

| Feb-20 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite