|

|

|

|

|||||

|

|

Tyson Foods, Inc. TSN reported second-quarter fiscal 2025 results, with the bottom line increasing year over year and surpassing the Zacks Consensus Estimate. The top line remained unchanged from the year-ago quarter’s reported figure and missed the Zacks Consensus Estimate. With consumer demand for protein remaining robust, TSN’s diversified multi-channel, multi-protein portfolio places it well to meet this need while solidifying its status as a leading global food company.

Tyson Foods posted adjusted earnings of 92 cents per share, which crushed the Zacks Consensus Estimate of 85 cents. The bottom line increased 48% from the year-ago quarter’s reported figure of 62 cents. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Total sales of $13,074 million remained flat year over year. The top line missed the Zacks Consensus Estimate of $13,097.8 million. Average price changes had a 2.6% positive impact on the top line, while total volumes remained flat year over year.

The gross profit in the quarter was $600 million, down from the $866 million reported in the year-ago period.

Tyson Foods’ adjusted operating income soared 27% to $515 million from the $406 million reported in the year-ago period. The adjusted operating margin expanded to 3.8% from 3.1% recorded in the year-ago quarter.

Tyson Foods, Inc. price-consensus-eps-surprise-chart | Tyson Foods, Inc. Quote

Beef: Sales in the segment increased to $5,196 million from $4,954 million reported in the year-ago quarter. Volumes fell 1.4%, and the average price jumped 8.2% in the segment.

Pork: Sales in the segment decreased to $1,244 million from $1,486 million reported in the year-ago quarter. Volumes fell 3.8%, but the average price increased 4.3%.

Chicken: Sales in the segment improved to $4,141 million from $4,065 million reported in the year-ago quarter. Sales volumes grew 3%, while the average price was down 1.1%.

Prepared Foods: Sales in the segment came in at $2,396 million, down from $2,404 million reported in the year-ago quarter. Volumes dipped 2.6%, and the average price rose 2.3%.

International/Other: Sales in the segment were $566 million compared with $580 million reported in the year-ago quarter. Volumes fell 1.5%, whereas the average sales price declined 0.9%.

The company exited the quarter with cash and cash equivalents of $992 million, long-term debt of $8,172 million and total shareholders’ equity (including non-controlling interests) of $18,531 million. For the six months ended March 29, 2025, cash provided by operating activities amounted to $846 million.

Liquidity was $3.2 billion as of March 29. Management expects liquidity to stay above the company’s minimum target of $1 billion in fiscal 2025. Tyson Foods projects capital expenditure to be $1-$1.2 billion for fiscal 2025. Free cash flow in fiscal 2025 is expected to be in the range of $1-$1.6 billion.

For fiscal 2025, the United States Department of Agriculture ("USDA") suggests domestic protein production (beef, pork, chicken and turkey) to increase around 1% from the fiscal 2024 level.

For the Beef segment, the USDA projects domestic protein production for beef to remain flat year over year in fiscal 2025. For Pork, the USDA projects domestic production to grow slightly. For Chicken, the USDA expects domestic protein production to grow about 2% year over year. Management anticipates improved adjusted results from the company’s foreign operations during fiscal 2025.

Total company revenue growth is anticipated to come in the range of flat to an increase of 1% in fiscal 2025 versus fiscal 2024 levels. Adjusted operating income is envisioned in the $1.9-$2.3 billion band.

Segment-wise, management expects a fiscal 2025 adjusted operating loss in the band of $0.4-$0.2 billion for the Beef segment. For the Pork, Chicken and Prepared Foods segments, Tyson Foods envisions fiscal 2025 adjusted operating income of $0.1-$0.2 billion, $1-$1.3 billion and $0.9-$1.1 billion, respectively.

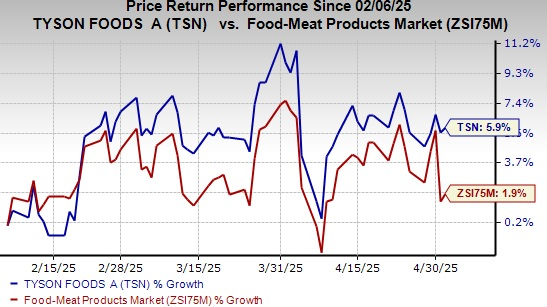

The Zacks Rank #3 (Hold) company’s shares have gained 5.9% in the past three months compared with the industry’s growth of 1.9%.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank of 2. MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

BRF Brasil Foods SA BRFS, formerly Perdigao S.A., is a Brazil-based food company. It carries a Zacks Rank #2 at present. BRFS delivered a trailing four-quarter average earnings surprise of 9.6%.

The consensus estimate for BRF’s current financial-year sales indicates growth of 0.3% from the prior-year reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite