|

|

|

|

|||||

|

|

McKesson Corporation MCK is scheduled to report fourth-quarter fiscal 2025 results on May 8, after market close.

The company delivered a negative earnings surprise of 0.12% in the last reported quarter. Its earnings beat estimates in two of the trailing four quarters and missed twice, delivering an average surprise of 2.51%. (Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.)

McKesson’s revenue growth has been driven largely by the rapid adoption of GLP-1 weight loss drugs and sustained demand for branded pharmaceuticals, both of which have fueled sales over the past several quarters. Additionally, the rising demand for specialty pharmaceuticals has contributed significantly to revenue expansion.

A rebound in primary care visits has also supported top-line growth in the last two reported quarters. Furthermore, the company’s investment in expanding distribution centers and integrating artificial intelligence (AI) into its services and products has recently bolstered revenues. However, earnings remain affected by higher cost of sales, primarily due to increased sales of lower-margin products.

McKesson Corporation price-eps-surprise | McKesson Corporation Quote

The Zacks Consensus Estimate for earnings is pegged at $9.81 per share, implying a significant improvement of 58.7% year over year. The consensus mark for revenues is pegged at $93.7 billion, indicating a surge of 22.7% year over year.

U.S. Pharmaceutical

McKesson derives a substantial share of its revenues from its U.S. Pharmaceutical segment, which distributes medications and healthcare products nationwide. Prescription volume — a key performance metric for the segment — likely continued its steady growth from the prior quarter. This growth was probably fueled by strong demand for specialty pharmaceuticals, especially oncology treatments, which are likely to have played a major role in boosting fourth-quarter prescription activity.

In the fiscal third quarter, MCK added access and affordability support for pharma brands that span across 30 indications and more than 12 therapeutic areas. This should have aided the top line in the soon-to-be-reported quarter.

The rising popularity of GLP-1 medications in the United States also likely contributed to McKesson’s revenue growth by increasing shipment volumes of these high-demand drugs. Furthermore, the company's continued investment in expanding its distribution network and operations in Canada likely provided additional support during the quarter.

On the downside, the sale of its European operations likely had a negative impact on sales. In September, McKesson divested its Canadian subsidiaries Rexall and Well.ca as part of its broader strategy to streamline its portfolio and concentrate on high-growth areas like oncology and biopharma services. These divestments are expected to have further impacted sales in the fiscal fourth quarter.

Meanwhile, lower distribution volumes of COVID-19 vaccines and a decline in certain brand volumes due to formulary changes by a retail national account customer might have weighed on the segmental performance. The lower margin for GLP-1 medications must have continued to hurt the gross margin during the quarter.

Our estimate for this segment’s revenues is pegged at $84.7 billion, indicating an improvement of 12.3% from the prior-year level.

Prescription Technology Solutions

This segment connects patients, pharmacies, providers, pharmacy benefit managers, health plans and biopharma companies, and solves medication access, affordability and adherence challenges for patients.

revenues are likely to have been driven by a strong demand for technology services. Additionally, the growing demand for access solutions, supported by newly launched products, is expected to have persisted in the fourth quarter. However, lower contributions from third-party logistics businesses might have negatively impacted the segmental income.

Our top-line estimate for the Prescription Technology Solutions segment is pegged at $1.33 billion, implying a 12.3% improvement year over year.

Medical Surgical Solutions

The Medical-Surgical Solutions segment delivers medical-surgical supply distribution, logistics, and related services to healthcare providers. Over the past few quarters, the segment has seen a sequential rebound in primary care visits, a trend that likely continued into the fourth quarter. This continued recovery is expected to have supported increased volume in specialty pharmaceuticals.

Although recovery in care visits looks promising, the patient volume might have acted as a headwind amid less demand for illness season products. The segmental result may also reflect unfavorable customer mix and product demand shifts in the primary care channel.

Our top-line estimate for the Medical Surgical Solutions segment is pegged at $2.8 billion, implying a 1.5% decline year over year.

A weaker illness season this fiscal year (compared with the previous year) is likely to have acted as a headwind for operating profit growth during the fourth quarter. Meanwhile, interest expenses followed multiple rate hikes over the past couple of years, which must have hurt the bottom line.

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: McKesson has an Earnings ESP of -1.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

McKesson is a leading U.S. drug distributor, recognized for its vast distribution network and comprehensive healthcare support services. Its commitment to innovation has been a key factor in its strong performance over the years. The company continues to enhance efficiency through strategic investments in automation and technology, which are expected to drive future growth.

Last year, McKesson expanded its distribution network by opening two new technologically advanced centers in the United States. This expansion is expected to streamline drug distribution, particularly for specialty pharmaceuticals. In August, the company signed a definitive agreement to acquire a controlling 70% stake in Community Oncology Revitalization Enterprise Ventures, a move that management views as crucial toward strengthening community-based oncology care. Last year, MCK also acquired certain assets of US Retina and launched a new GPO program called Onmark Vision. Earlier this month, it acquired a controlling interest in PRISM Vision that will expand its access to 180 providers, 91 office locations and seven ambulatory surgery centers.

McKesson has assembled a distinctive portfolio of assets to capitalize on the expanding Oncology and Biopharma markets. Its multi-year initiative to modernize distribution centers across Canada also represents a significant opportunity to drive future revenue growth.

With a broad network that includes over 50,000 pharmacies and nearly 900,000 healthcare providers, McKesson plays a vital role in pharmaceutical distribution and reaches an extensive patient base. This scale enhances its appeal to pharmaceutical manufacturers, potentially fueling further revenue expansion.

The company is also embracing advanced technologies, particularly artificial intelligence, to enhance service delivery. AI-powered tools are being deployed to support healthcare providers in areas such as revenue cycle management and clinical solution assessment. These technologies are expected to streamline complex insurance and reimbursement processes. Additionally, McKesson plans to use AI for automating clinical note generation and optimizing various supply-chain operations.

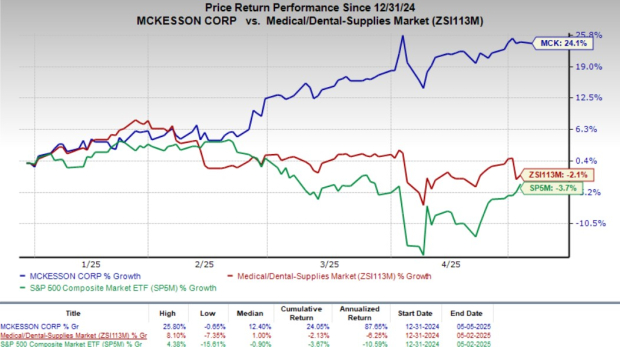

MCK’s shares have gained 24.1% so far this year against the industry’s decline of 2.1%. The outperformance can be attributed to anticipated strong top-line growth in the first quarter. The S&P 500 Index has lost 3.7% in the said period.

The company’s plans should help it continue on its uptrend going forward. Per the Zacks Style Score, a Zacks proprietary method to evaluate stocks, the company looks moderately undervalued (Value Score: B).

As the Zacks Rank, coupled with the style score, does not conclusively predict that MCK will beat on earnings this reporting cycle, we caution against any new investment bet in the stock at present. However, those who have already invested in MCK may continue to hold it in their portfolio.

Here are some medical stocks worth considering, as these have the right combination of elements to post an earnings beat this reporting cycle.

Premier PINC has an Earnings ESP of +13.82% and a Zacks Rank #2 at present.

PINC’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 20.43%. The Zacks Consensus Estimate for fiscal third-quarter EPS implies a decline of 43.6% from the year-ago reported figure.You can see the complete list of today’s Zacks #1 Rank stocks here.

HealthEquity HQY has an Earnings ESP of +2.03% and a Zacks Rank #3 at present.

HQY’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 12.78%. The Zacks Consensus Estimate for fiscal first-quarter EPS implies an improvement of 1.3% from the year-ago reported figure.

Progyny PGNY has an Earnings ESP of +2.68% and a Zacks Rank #3 at present. The company is scheduled to release first-quarter results on May 8.

PGNY’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 54.91%. The Zacks Consensus Estimate for first-quarter EPS implies an improvement of 15.4% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| 8 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite