|

|

|

|

|||||

|

|

Johnson & Johnson JNJ and AbbVie ABBV are two major U.S. pharmaceutical companies with robust pipelines and global operations. Both companies have a strong presence in immunology, oncology and neuroscience areas. Other than that, J&J also has drugs for cardiovascular and metabolic diseases, pulmonary hypertension and infectious diseases, along with a strong presence in the medical devices segment.

On the other hand, AbbVie entered the aesthetics market by acquiring Botox maker Allergan in 2020.

It seems that 2025 will be a “catalyst year” for JNJ and ABBV, with both expecting their revenues and profits to improve. But which one is a better investment option today? Let’s take a closer look at their fundamentals, growth prospects and challenges to make an informed choice.

J&J’s biggest strength is its diversified business model, which helps it to withstand economic cycles more effectively. It operates through more than 275 subsidiaries.

Its Innovative Medicine unit is showing a growth trend. The segment’s sales rose 4.4% in the first quarter of 2025 on an organic basis despite the loss of exclusivity (LOE) for its multi-billion-dollar product, Stelara, and the negative impact of the Part D redesign. In 2025, J&J expects growth in the Innovative Medicine segment in the face of Stelara biosimilar entrants to be driven by its key products such as Darzalex, Tremfya, Spravato and Erleada, as well as new drugs like Carvykti, Tecvayli and Talvey, and new indications for Tremfya and Rybrevant.

J&J is also making rapid progress with its pipeline and has been on an acquisition spree lately, which has strengthened its pipeline.

Sales in J&J’s MedTech business are facing continued headwinds in the Asia Pacific, specifically in China. Sales in China are being hurt by the impact of the volume-based procurement (VBP) program and the anticorruption campaign. J&J does not expect any improvement in its business in the Asia Pacific region, specifically in China, in 2025. Competitive pressure is also hurting sales growth in some MedTech businesses.

The company lost U.S. patent exclusivity of its blockbuster drug, Stelara, in 2025. Stelara sales declined 33.7% in the first quarter of 2025. The launch of generics is expected to significantly erode the drug’s sales, hurting J&J’s sales and profits in 2025.

J&J faces more than 62,000 lawsuits for its talc-based products, primarily baby powders. The lawsuits allege that its talc products contain asbestos, which caused many women to develop ovarian cancer. J&J insists that its talc-based products are safe and do not cause cancer. The company permanently discontinued the sales of its talc-based Johnson’s Baby Powder.

Last month, a bankruptcy court in Texas rejected J&J’s proposed bankruptcy plan to settle its talc lawsuits after a two-week trial in Houston. J&J will go back to the traditional tort system to fight the lawsuits individually with its bankruptcy strategy to settle the lawsuits failing for the third time.

AbbVie has successfully navigated the LOE of its blockbuster drug, Humira, which once generated more than 50% of its total revenues. It has accomplished this by launching two other successful new immunology medicines, Skyrizi and Rinvoq, which are performing extremely well, bolstered by approvals in new indications and should support top-line growth in the next few years. On the first-quarter conference call in April, AbbVie also raised its EPS guidance for 2025, driven by stronger-than-expected sales of Rinvoq and Skyrizi. AbbVie expects to record combined Skyrizi and Rinvoq sales of more than $31 billion in 2027.

The company’s oncology strategy is also gaining traction, supported by increasing contributions from newer products, Elahere and Epkinly.

AbbVie has several early/mid-stage pipeline candidates with blockbuster potential. The company expects several regulatory submissions, approvals and key data readouts in the next 12 months. AbbVie has also been on an acquisition spree in the past couple of years, which is strengthening its pipeline. It has signed several M&A deals in the immunology space, its core area, while also signing some early-stage deals in oncology and neuroscience areas. It recently forayed into the lucrative obesity space through a licensing deal with Denmark-based Gubra for the latter’s experimental obesity drug.

However, the company faces some near-term headwinds like Humira’s biosimilar erosion, increasing competitive pressure on cancer drug Imbruvica and a slow market growth trend for Juvederm fillers in the United States and China due to challenging market conditions.

The Zacks Consensus Estimate for J&J’s 2025 sales and EPS implies a year-over-year increase of 2.7% and 6.2%, respectively. The EPS estimate for 2025 has risen from $10.58 per share to $10.60 per share over the past 30 days, while that for 2026 has declined from $11.07 per share to $10.98 per share over the same timeframe.

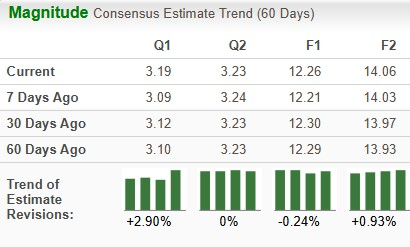

The Zacks Consensus Estimate for AbbVie’s 2025 sales and EPS implies a year-over-year increase of 6.4% and 21.2%, respectively. The EPS estimate for 2025 has declined from $12.30 per share to $12.26 per share over the past 30 days, while that for 2026 has risen from $13.97 per share to $14.06 per share over the same timeframe.

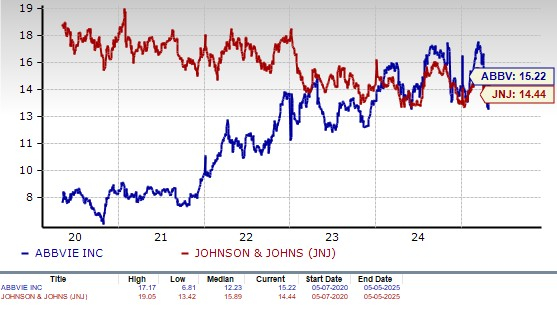

Despite tariff fears and market volatility, stocks of both JNJ and ABBV have risen this year. Year to date, J&J’s stock has risen 8.1%, while AbbVie’s stock has risen 12.4% compared with the industry’s increase of 2.4%

J&J looks a tad more attractive than ABBV from a valuation standpoint. Going by the price/earnings ratio, J&J’s shares currently trade at 14.44 forward earnings, slightly lower than 15.70 for the industry, and its 5-year mean of 15.89. AbbVie’s shares currently trade at 15.22 forward earnings, slightly lower than the industry but much higher than the stock’s 5-year mean of 12.23.

J&J’s dividend yield is 3.2%, while AbbVie’s is around 3.4%.

AbbVie & J&J have a Zacks Rank #3 (Hold) each, which makes choosing one stock a difficult task. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

J&J has shown steady revenue and EPS growth for years. J&J considers 2025 to be a “catalyst year,” positioning the company for growth in the second half of the decade. J&J expects operational sales growth in both the Innovative Medicine and MedTech segments to be higher in the second half of 2025 than in the first. While newly launched products should drive growth in the Innovative Medicines segment in the second half, the MedTech segment may benefit from new products and easier comps. J&J expects growth to accelerate from 2026 onward. However, though J&J’s Innovative Medicines unit is showing a growing trend, the softness in the MedTech unit is a concern. The legal battle surrounding its talc lawsuits has created a bearish sentiment around the stock.

On the other hand, AbbVie has faced its biggest challenge — Humira’s patent cliff — quite well and looks well-positioned for continued strong growth in the years ahead. The company saw a rapid return to sales growth in 2024 after revenues declined in 2023 due to Humira LOE, driven by its ex-Humira platform. AbbVie’s ex-Humira drugs rose more than 20% in the first quarter of 2025. J&J, in sharp contrast, faces LOE of one of its biggest drugs, Stelara, in 2025.

Boosted by its new product launches, AbbVie expects to return to robust mid-single-digit revenue growth in 2025 with a high single-digit CAGR through 2029, as it has no significant LOE event for the rest of this decade.

Despite its steeper valuation, AbbVie is a clear-cut winner due to rising estimates, stock price appreciation, a solid pipeline, and better prospects for sales and profit growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite