|

|

|

|

|||||

|

|

Innodata INOD is scheduled to report first-quarter 2025 results on May 8.

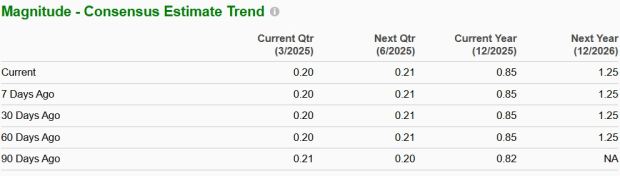

For the first quarter, the Zacks Consensus Estimate for revenues is pegged at $58.66 million, suggesting a 121.36% rise from the year-ago quarter’s reported figure.

The Zacks Consensus Estimate for earnings is pinned at 20 cents per share, indicating an increase of 566.67% from the prior-year quarter’s reported figure.

Innodata has a positive earnings surprise history. In the last reported quarter, the company delivered an earnings surprise of 40.91%. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 220.46%.

Innodata Inc. price-eps-surprise | Innodata Inc. Quote

Our proven model does not conclusively predict an earnings beat for Innodata this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

INOD has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Innodata approaches its first-quarter 2025 earnings report following an exceptional performance in the fourth quarter of 2024, where the company posted record-breaking 127% year-over-year growth and substantial profit improvements. While the strong momentum is expected to continue, several factors suggest investors should hold their positions or await a better entry point before adding to their stakes.

The recent beta launch of Innodata's Generative AI Test & Evaluation Platform, powered by NVIDIA technology, represents a strategic expansion of the company's AI services portfolio. This platform, showcased at NVIDIA GTC 2025 in March, aims to address enterprise needs for AI risk mitigation and performance optimization. While this initiative aligns with Innodata's growth strategy in the AI services market, the platform's full commercial release isn't expected until the second quarter of 2025, limiting its revenue impact on first-quarter results.

Innodata's strong relationship with its largest customer, which contributed significantly to the fourth quarter of 2024 results, is likely to have continued to drive growth in first-quarter 2025. The company previously announced additional programs valued at approximately $24 million in annualized run rate revenues with this customer. However, this concentration risk remains a concern, despite efforts to diversify the client base by expanding relationships with seven other Big Tech customers.

The company's forecast of 40% or more revenue growth for full-year 2025 suggests continued strong performance, but the projected reinvestment of cash from operations back into the business might have temporarily impacted profit margins in the first quarter. These investments, while positioning Innodata for sustained multi-year growth, could create near-term volatility in financial metrics.

Industry tailwinds from AI-driven capital expenditure among major tech companies are likely to have benefited Innodata in the first quarter of 2025, as the company continues to position itself as a key player in the growing AI services market. The company's strong balance sheet, with $46.9 million in cash at the end of 2024, provides flexibility to execute its expansion strategy while weathering any short-term fluctuations.

Investors should monitor how effectively Innodata is diversifying its customer base and commercializing new offerings like the AI Test & Evaluation Platform. While the long-term growth prospects remain promising, potential volatility associated with ongoing investments and customer concentration suggests a cautious approach ahead of the first-quarter 2025 earnings report.

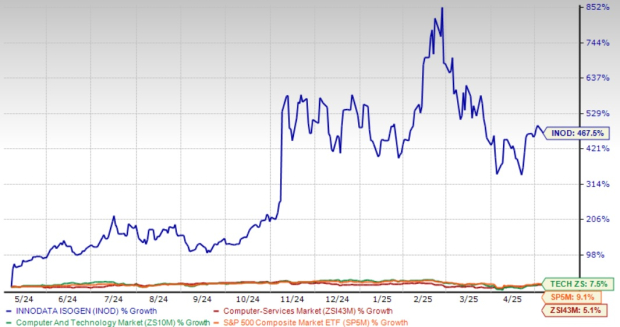

INOD shares have skyrocketed 467.5% in the trailing 12-month period, outperforming the Zacks Computer and Technology sector’s appreciation of 5.1% and the industry’s return of 7.5%.

While INOD stock trades at a premium with a six-month forward 12-month P/S ratio of 4.62x compared with the Zacks Computer – Services industry average of 1.75x, this premium valuation appears justified given the company's strong growth prospects and strategic positioning in the generative AI (GenAI) space.

Morgan Stanley has projected combined capital expenditures of $300 billion in 2025 and $337 billion in 2026 for Amazon AMZN, Alphabet GOOGL, Meta Platforms META and Microsoft on GenAI and large language model-enabled advancements. By focusing on Big Tech’s increasing investments in GenAI, Innodata has positioned itself as a key partner for data engineering, particularly in creating supervised fine-tuning data for training advanced AI models.

Innodata's investment case presents a mixed outlook ahead of first-quarter 2025 results. While the company delivered 127% growth in fourth-quarter 2024 and projects more than 40% revenue growth for 2025, investors should exercise caution at current valuation levels. The beta launch of its NVIDIA-powered AI Test & Evaluation Platform represents future potential, but full commercialization won't occur until the second quarter. Customer concentration risk persists despite diversification efforts with other Big Tech clients. Planned reinvestment in operations may temporarily pressure margins, despite the strong $46.9 million cash position.

Innodata presents a cautious investment case with recent record growth juxtaposed against premium valuation and increasing competition in AI services. The unrealized first-quarter impact of its NVIDIA-powered platform, ongoing customer concentration risks, and planned reinvestments suggest potential near-term volatility. Investors should consider holding existing positions or awaiting a more attractive entry point following the first-quarter results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour |

Woman Suing Meta, YouTube Testifies Its Too Hard to Be Without Social Media

META

The Wall Street Journal

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Young woman says she was on social media 'all day long' as a child in landmark addiction trial

META

Associated Press Finance

|

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite