|

|

|

|

|||||

|

|

Deckers Outdoor Corporation DECK is trading at a price-to-earnings (P/E) multiple well above the Zacks Retail-Apparel and Shoes industry average. DECK’s forward 12-month P/E ratio sits at 18.15, higher than the industry’s average of 15.39.

DECK Looks Expensive From Valuation Standpoint

This premium positioning is especially notable when compared with peers such as Boot Barn Holdings, Inc. BOOT, which has a forward 12-month P/E of 16.36; Skechers U.S.A., Inc. SKX at 16.60; and Crocs, Inc. CROX at 7.56.

DECK is trading at a premium despite the recent decrease in its stock price. The company has witnessed a significant decline over the past three months, with its shares plummeting 29.7%, underperforming the industry's drop of 17.5%.

The decrease in Deckers’ stock price is largely attributed to slowing growth and increasing competition within the footwear and accessories market. Revenue slowdown, driven by inventory issues impacting major brands like UGG, coupled with anticipated pressure on the gross margin in the fourth quarter of fiscal 2025, has affected investor confidence. The company also trailed the Retail-Wholesale sector’s fall of 8% and the S&P 500's decline of 6% during the same period.

Deckers’ Past Three-Month Performance

The DECK stock has underperformed its peers, including Boot Barn, Skechers and Crocs. Shares of Boot Barn and Skechers have declined 19.7% and 7%, respectively, while Crocs has gained 7.9% during the same period. Skechers is set to go private as 3G Capital acquires the company for $63 per share in a $9.4-billion deal, expected to close in the third quarter of fiscal 2025.

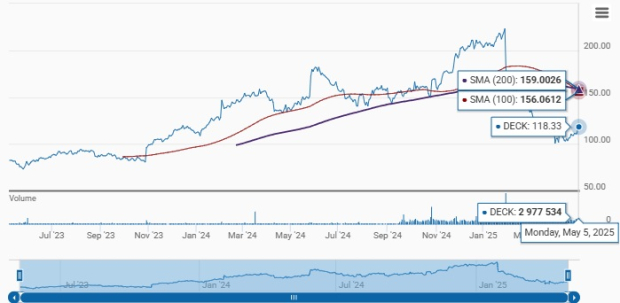

Closing at $118.33 in yesterday’s trading session, Deckers’ stock stands 47.2% below its 52-week high of $223.98 attained on Jan. 30, 2025. DECK is trading below its 100 and 200-day simple moving averages of $156.06 and $159.00, respectively, signaling bearish sentiment in maintaining the recent performance levels.

DECK Trades Below 100 & 200-Day Moving Averages

DECK is currently navigating a challenging macroeconomic landscape characterized by inventory limitations and mounting margin pressures, which are expected to dampen short-term growth. A key headwind is the limited UGG inventory availability due to accelerated order fulfillment earlier in the year, contributing to a projected revenue slowdown.

Management has already indicated a difficult year-over-year comparison for UGG, which posted 16.1% year-over-year growth in the fiscal third quarter. Our estimate suggests a 13.2% decline in UGG sales for the fourth quarter, contributing to an overall deceleration in company-wide revenue growth to just 1% from 21.2% in the previous quarter.

Elevated markdowns and increased promotional efforts (particularly surrounding HOKA, which is currently undergoing a model transition) are expected to place downward pressure on margins in the fourth quarter. Profitability will also be impacted by external cost headwinds, including an estimated 150 basis points from higher freight expenses and approximately 50 basis points from unfavorable foreign exchange movements.

Deckers continues to face mounting cost pressures across its operations. In the fiscal third quarter, selling, general and administrative (SG&A) expenses climbed 24.9% year over year to $535.3 million. This increase was primarily driven by heightened marketing investments, adverse currency effects and workforce expansion. With management maintaining its full-year SG&A forecast at 35% of revenues, sustained pressure on operating margins remains a key concern.

We expect SG&A expenses to deleverage 290 basis points in the final quarter, with the operating margin contracting 610 basis points. As a result, the bottom line is expected to decline 43.8%.

Deckers is strengthening its brand portfolio with innovative product launches and optimized distribution strategies, positioning itself for long-term growth. The rising popularity of UGG and HOKA, along with a balanced product mix and expanding global presence, sets the company up to seize significant growth opportunities. UGG maintains its leadership in premium lifestyle footwear, while HOKA is gaining momentum in the high-performance athletic segment, contributing to projected revenue growth of 15% in fiscal 2025, with HOKA and UGG expected to grow 24% and 10%, respectively.

International markets are also integral to Deckers’ growth trajectory. HOKA is building global momentum through rising brand awareness and a disciplined wholesale expansion strategy, while UGG is extending its reach via product diversification and market entry efforts. Strategic investments in high-potential regions such as China are expected to be meaningful contributors to long-term revenue growth. We expect revenues from international regions to increase 22.2% in fiscal 2025.

Despite its strong brand presence, DECK appears to be facing a convergence of headwinds that cast doubt on its near-term upside potential. The stock’s elevated valuation, combined with signs of slowing growth and margin pressures, makes the current setup less attractive for existing and prospective investors.

While long-term prospects may eventually stabilize, the present environment suggests a more cautious stance may be warranted. Existing investors who have benefited from Deckers' strong multi-year run may consider locking in gains or trimming their positions. For prospective investors, Deckers’ current valuation offers a limited margin of safety.

DECK carries a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 11 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite