|

|

|

|

|||||

|

|

Jazz Pharmaceuticals JAZZ reported first-quarter 2025 adjusted earnings of $1.68 per share, which significantly missed the Zacks Consensus Estimate of $4.51. This miss was largely due to higher operating expenses incurred during the quarter. Earnings declined 36% year over year.

Total revenues declined 0.5% year over year to $897.8 million. The reported figure also missed the Zacks Consensus Estimate of $981 million, attributed to the soft sales performance of its marketed products. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar)

Shares of Jazz were down 3% in after-market trading yesterday, likely due to the dismal earnings results.

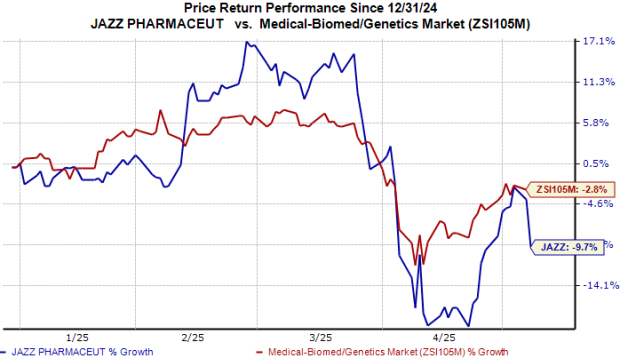

Year to date, the stock has lost 10% compared with the industry’s 3% decline.

Net product sales were flat year over year at $839.4 million. The reported figure missed the Zacks Consensus Estimate and our model estimate of $925 million and $895 million, respectively.

Jazz recorded about $48.9 million in royalty revenues from high-sodium oxybate authorized generic (“AG”), down 2% from the year-ago quarter’s level. Though this metric was in line with our model estimate, it missed the Zacks Consensus Estimate of $50 million.

Other royalties and contract revenues declined 5% to $9.5 million in the quarter.

Sales of Jazz’s neuroscience products rose 4% to $605.2 million.

Net product sales for the combined oxybate business (Xyrem + Xywav) rose about 1% to $382 million. This combined figure missed the Zacks Consensus Estimate of $416 million and our model estimates of $388 million.

Sales of the sleep disorder drug Xyrem plunged 42% year over year to $37.2 million due to patients switching to Xywav and the launch of AGs in 2023.

Xywav, a low-sodium formulation of Xyrem, recorded sales of $344.8 million in the quarter, up 9% year over year. This upside can be attributed to the encouraging uptake of the drug in narcolepsy and idiopathic hypersomnia indications. This drug is currently Jazz’s most extensive product by net sales.

Sales of the epilepsy drug Epidiolex/Epidyolex rose 10% to $217.7 million, likely driven by geographic expansion in ex-U.S. markets. Epidiolex sales missed the Zacks Consensus Estimate and our model estimate of $233 million and $229 million, respectively.

Cannabis-based mouth spray Sativex recorded sales of $5.4 million in the quarter, up 98% year over year.

Oncology product sales declined 11% to $229.4 million.

Chemotherapy drug Rylaze/Enrylaze posted sales of $94.2 million, which fell 8% year over year. The drug’s sales were negatively impacted due to a recent update to pediatric acute lymphoblastic leukemia protocols regarding the timing of asparaginase administration. Jazz expects this impact to normalize during second-quarter 2025. Rylaze sales missed the Zacks Consensus Estimate and our model estimate of $104 million and $103 million, respectively.

Zepzelca, approved for small cell lung cancer, recorded sales worth $63 million, down 16% year over year. This downside was attributed to increased competition in second-line small cell lung cancer (“SCLC”) and treatment protocol updates delaying progression in first-line limited-stage SCLC patients to the second-line setting.

Acute myeloid leukemia drug Vyxeos generated sales of $29.5 million, down 8% from the year-ago period’s level. Defitelio sales fell 15% year over year to $40.7 million.

Sales of Ziihera, which was approved by the FDA in December 2024 for biliary tract cancer indication, added $2 million to the top line compared with $1.1 million in the previous quarter.

Adjusted selling, general and administrative expenses rose 52% year over year to $472.3 million, primarily due to certain Xyrem antitrust litigation settlements of $172 million incurred during the quarter.

Adjusted research and development (R&D) expenses declined 22% to $220.9 million, mainly due to lower clinical program costs incurred during the quarter.

Though Jazz reiterated total sales guidance, it revised expense guidance to account for the $935 million acquisition of clinical-stage biotech Chimerix completed last month.

Total revenues are expected to be in the range of $4.15-$4.40 billion, indicating 5% year-over-year growth at the midpoint compared with the 2024 level. Jazz expects sales for the full year to be driven by the continued growth of Xywav, Epidiolex and its oncology portfolio. By this year’s end, the company expects Epidiolex to achieve blockbuster status.

Adjusted SG&A expenses are now anticipated to be between $1.47 billion and $1.53 billion compared with the prior guidance of $1.25 billion to $1.31 billion. Jazz also raised its forecasts for adjusted R&D expenses, now expected to be in the band of $760-$810 million (previously: $720-$770 million).

The effective tax rate is expected to be between 35% and 45% (previously: 13-15%)

The company expects 2025 adjusted earnings to be in the range of $4.00-$5.60 per share, down from the previous guidance of $22.50-$24.00.

Jazz currently has a Zacks Rank #3 (Hold).

Jazz Pharmaceuticals PLC price | Jazz Pharmaceuticals PLC Quote

Some better-ranked stocks from the industry are Puma Biotechnology PBYI, Elevation Oncology ELEV and Intellia Therapeutics NTLA. While PBYI sports a Zacks Rank #1 (Strong Buy) at present, ELEV and NTLA carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Puma Biotechnology’s 2025 EPS have increased from 52 cents to 54 cents over the past 60 days, while the same for 2026 has increased from 49 cents to 54 cents.

Puma’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 88.62%. Year to date, PBYI stock is down 2%.

In the past 60 days, estimates for Elevation Oncology’s 2025 loss per share have narrowed from 83 cents to 61 cents. Loss per share estimates for 2026 have narrowed from 88 cents to 44 cents during the same time. Year to date, shares of ELEV have declined 40%.

ELEV’s earnings beat estimates in two of the trailing four quarters while missing on the remaining occasions, the average surprise being 5.10%.

In the past 60 days, loss estimates for Intellia Therapeutics’ 2025 EPS have improved from $4.75 to $4.62. During the same timeframe, estimates for 2026 loss per share have narrowed from $4.68 to $4.62.

Intellia’s earnings beat estimates in three of the trailing four quarters and missed the mark once, delivering an average surprise of 5.37%. The stock has lost 38% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 6 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite