|

|

|

|

|||||

|

|

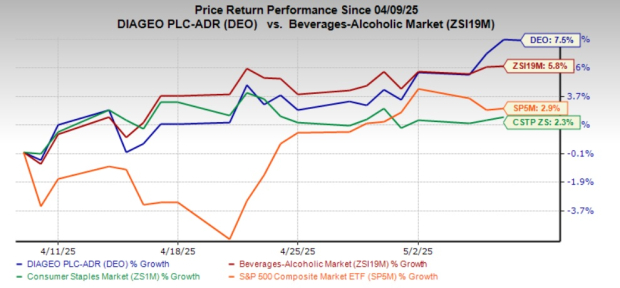

Diageo plc’s DEO recent stock performance reflects strong investor confidence in its fundamentals and strategic initiatives. The company’s shares have seen a 7.5% improvement in the past month, outpacing the industry’s 5.7% increase, the Consumer Staples sector’s 2.3% growth and the S&P 500’s 2.9% increase, suggesting resilience in a challenging market environment.

This upward momentum can be attributed to several key drivers, including the strength of its premium and globally recognized brand portfolio, featuring names such as Johnnie Walker, Guinness, and Tanqueray, which reinforces pricing power and customer loyalty.

Moreover, the company’s continued investments in innovation, digital transformation and e-commerce have improved both operational efficiency and consumer connectivity. Diageo’s disciplined approach to cost management and margin enhancement has also played a vital role in mitigating inflationary pressures, further supporting its recent stock gains.

Diageo has been experiencing significant gains from improved price/mix, which have been aiding growth despite soft volume. In the first half of fiscal 2025, organic net sales rose 1% year over year, marking a return to organic sales growth and a sequential improvement from the second half of fiscal 2024. Hence, management expects to continue driving productivity and pricing to offset the cost inflation.

Diageo is refining its $2 billion productivity program to drive efficiency across the business to bring sustainable growth. A key focus is balancing cost savings with strategic reinvestment, particularly in marketing and brand activation. It remains committed to maximizing value while building the right capabilities for success.

By leveraging advanced data analytics through its Catalyst tool, Diageo aims to enhance the effectiveness of its A&P spend, prioritizing high-impact marketing while reducing non-working costs. The company is also optimizing media efficiencies, allowing it to reinvest savings into growth initiatives while strengthening operating leverage. A stronger focus on commercial excellence ensures better brand visibility at points of sale and expanded on-premise presence.

Despite its recent gains, Diageo’s broader stock performance has faced pressure due to underlying operational challenges and macroeconomic headwinds. In the first half of fiscal 2025, the company reported a 0.6% year-over-year decline in net sales, primarily due to soft volume trends across key markets. Economic uncertainty, persistent inflationary pressures and cautious consumer sentiment led to volume declines in major regions.

Further weighing on investor sentiment are rising overhead costs, including staffing and strategic investments, which have compressed profitability. Currency fluctuations also significantly impacted operating profit, while organic operating profit declined and operating margins contracted, intensifying concerns over the company's earnings potential.

In Asia Pacific, performance weakened as well, with reported net sales down 4% year over year. This was attributed to a mix of organic sales decline, the divestiture of Windsor and a business reclassification to Europe. Organic net sales in the region fell 2.6%, affected by challenging macroeconomic conditions in Greater China, soft demand in Southeast Asia and tough year-over-year comparisons due to prior stock replenishment of Shui Jing Fang. Collectively, these factors have dampened investor confidence and weighed on Diageo’s stock performance despite its long-term strengths.

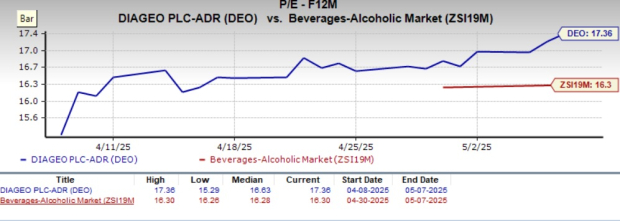

Diageo’s premium valuation is becoming a concern amid slowing growth and rising costs. The stock is currently trading at a forward 12-month P/E ratio of 17.36X, significantly higher than the industry average of 16.30X.

This elevated multiple may be hard to justify given soft volume trends across key regions and macroeconomic uncertainties. This stretched valuation could limit upside potential in the near term, especially if performance fails to accelerate meaningfully.

Diageo’s robust brand portfolio, strategic investments and productivity initiatives position it well for recovery once macro conditions stabilize. However, until there is greater visibility on volume recovery and margin improvement, investors may prefer to wait for a better entry point or confirmation of sustained earnings momentum. For now, long-term investors should hold existing positions and monitor key indicators, particularly margin trends, FX impacts and progress on volume stabilization. Given these dynamics, DEO currently carries a Zacks Rank #3 (Hold).

Primo Brands Corporation PRMB is a branded beverage company with a focus on healthy hydration, delivering sustainably and domestically sourced diversified offerings across products, formats, channels, price points and consumer occasions, distributed primarily in every state and Canada. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Primo Brands’ current financial-year sales and EPS indicates growth of 146.9% and 57.4%, respectively, from the prior-year levels. PRMB has a trailing four-quarter earnings surprise of 7.2%, on average.

Molson Coors Beverage Company TAP, a global manufacturer and seller of beer and other beverage products, has an impressive, diverse portfolio of owned and partner brands. TAP currently flaunts a Zacks Rank of 1.

The Zacks Consensus Estimate for Molson Coors’ current financial-year EPS indicates growth of 6.7% from the prior-year levels. The company has a trailing four-quarter earnings surprise of 18.1%, on average.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. It currently carries a Zacks Rank of 2 (Buy). UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

The consensus estimate for United Natural Foods’ current financial-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 13 hours | |

| 16 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite