|

|

|

|

|||||

|

|

Constellation Energy Corporation’s CEG shares have declined 1.2% since its first-quarter 2025 earnings release on May 6. Earnings of $2.14 per share were in line with the Zacks Consensus Estimate. The bottom line increased 17.6% from the year-ago quarter’s level of $1.82. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

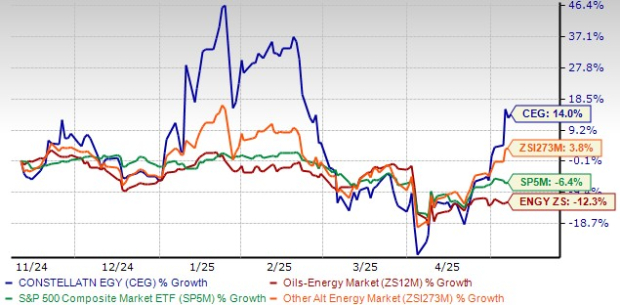

The CEG stock closed at $270.59 on May 8. However, in the past six months, the company’s shares have gained 14% compared with the industry’s 3.8% rally. CEG has also outperformed the S&P 500’s decline of 6.4% and the Zacks Oil-Energy sector’s decline of 12.3%.

Is it a good time to add this alternate energy stock to your portfolio? Let's examine the key factors that contributed to the share price gain, review the first-quarter results and assess the stock's investment prospects.

Revenues totaled $6.79 billion, which surpassed the Zacks Consensus Estimate of $5.92 billion by 14.6%. The top line also increased 10.2% from the year-ago figure of $6.16 billion.

In the first quarter, CEG reached a definitive agreement to acquire Calpine in a cash-and-stock deal valued at approximately $16.4 billion. The transaction includes 50 million shares of Constellation Energy stock, $4.5 billion in cash, and the assumption of around $12.7 billion in Calpine's net debt.

CEG’s nuclear fleet, including its owned output from the Salem and South Texas Project Generating Stations, produced 45,582 gigawatt-hours (GWhs) compared with 45,391 GWhs in the first quarter of 2024.

Excluding the Salem and South Texas Project Generating Stations, CEG’s nuclear plants at ownership achieved a 94.1% capacity factor for the first quarter of 2025 compared with 93.3% for the first quarter of 2024. There were no non-refueling outage days in the first quarter of 2025, and 10 in the first quarter of 2024, for sites that CEG operates.

The Crane Clean Energy Center has been selected by PJM for expedited grid connection as part of its Reliability Resource Initiative. Restarting Crane’s Unit 1 reactor will bring new, reliable, emissions-free energy to the grid at a time of tightening reserves and rising prices. PJM also selected additional uprate projects within CEG’s fleet, bringing the total addition to the grid to more than 1,150 megawatts of clean electricity.

Constellation Energy’s systematic investments, focus on renewable energy and share repurchases boosted its earnings. CEG beat on earnings in three of the trailing four quarters and met in one, delivering an average surprise of 7.41%.

Another company, Duke Energy DUK produces a large volume of clean energy from its nuclear units. It also reported first-quarter earnings on May 6. Quarterly earnings of $1.76 per share beat the Zacks Consensus Estimate of $1.59 by 10.7%. Duke Energy beat on earnings in three of the trailing four quarters and missed in one, delivering an average surprise of 6.1%.

Constellation Energy’s primary power production comes from its nuclear fleet, and it is well-positioned in terms of nuclear fuel. CEG’s strategic investment plans and focus on expanding its renewable portfolio drive its earnings performance. It expects capital expenditures of nearly $3 billion and $3.5 billion for 2025 and 2026, respectively. Nearly 35% of projected capital expenditures are allocated to the acquisition of nuclear fuel, which includes additional nuclear fuel to replenish inventory levels.

Constellation Energy is taking advantage of the rising demand from data centers by using its current fleet of nuclear power generators and strategic initiatives like the Production Tax Credit. The company has been striking deals with major tech companies like Microsoft to supply power to their data centers, demonstrating a strategic focus on this growing market.

Constellation Energy also benefits from operating nuclear-powered generating plants. Nuclear power facilities may operate for up to two years without requiring refueling and can consistently generate carbon-free energy round the clock in all weather conditions. These plants are ideal for meeting the growing need for clean power from AI-driven data centers, which require electricity 24/7.

Before announcing a $26.6-billion acquisition of natural gas and geothermal giant Calpine at the beginning of 2025, Constellation was already the biggest nuclear power company in the United States. Through this acquisition, the country's largest clean energy company is formed, and its presence is extended into tech-heavy, power-hungry Texas and California.

By balancing investments between maintaining its leading nuclear capabilities and expanding into renewables, the company positions itself to thrive in an evolving energy market focused on sustainability.

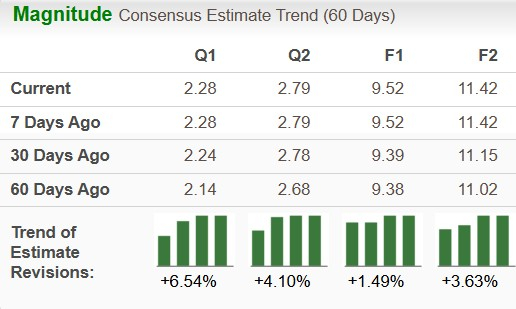

The Zacks Consensus Estimate for Constellation Energy’s 2025 and 2026 earnings per share has increased 1.5% and 3.6%, respectively, in the past 60 days.

Another company, Vistra Corp VST is also exploring potential expansions of nuclear power generation. VST operates four nuclear power plants. Vistra's Comanche Peak plant, a 2.4 GW facility with two pressurized water reactors, has a license extension until 2053. Vistra also owns the second-largest competitive nuclear fleet in the United States after acquiring three nuclear stations from Energy Harbor. The Zacks Consensus Estimate for Vistra’s earnings per share has decreased 3.6% for 2025 and increased 7% for 2026 in the past 60 days.

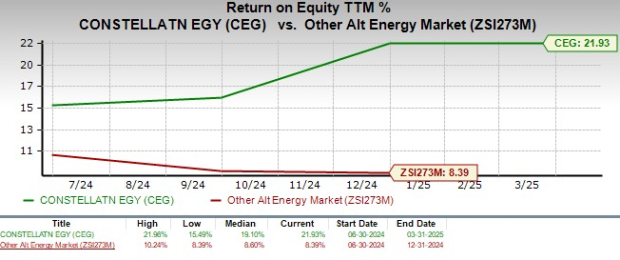

Constellation Energy’s trailing 12-month return on equity of 21.93% is better than the industry average of 8.39%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Constellation Energy is currently trading at a premium compared with its industry on a forward 12-month P/E basis.

Duke Energy and Vistra are also trading at a premium compared to their industry on a forward 12-month P/E basis.

Since 2023, CEG’s board of directors has authorized the repurchase of up to $3 billion of the company's outstanding common stock. As of March 31, 2025, the company had approximately $841 million remaining authority to repurchase shares of its outstanding common stock.

The company aims to increase its dividend by 10% annually, subject to its board's approval. Its quarterly dividend is 38.78 cents per share at present, resulting in an annualized dividend of $1.55 per share. Check CEG’s dividend history here.

Due to the growth of AI-driven data centers, Constellation Energy stands to benefit from the rising demand for clean energy in its service areas. CEG will be able to meet the growing demand, thanks to its robust production capacity. The company delivered an earnings surprise for the trailing four quarters.

Investors may consider adding this Zacks Rank #2 (Buy) stock to their portfolio and enjoy the benefits of dividends, share buybacks and rising earnings estimates.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Nuclear Stock Briefly Flashes Buy Signal On Earnings Beat After Cathie Wood Sells

CEG +6.41%

Investor's Business Daily

|

| Feb-24 |

Nuclear Stock Flashes Buy Signal On Earnings Beat As Cathie Wood Sells

CEG +6.41%

Investor's Business Daily

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite