|

|

|

|

|||||

|

|

Sensata Technologies Holding plc ST reported first-quarter 2025 adjusted earnings per share (EPS) of 78 cents compared with 89 cents a year ago. However, the bottom line topped the Zacks Consensus Estimate by 8.3%.

Revenues for the quarter reached $911.3 million, down 9.5% from a year ago. The top-line contraction was attributable to divestment of $200 million in annualized revenues related to various low-margin, low-growth products and the sale of the Insights business in September 2024. However, the figure outperformed management’s expectations ($870-$890 million) and also beat the consensus estimate by 3.6%. Strength in Sensing Solutions cushioned the top-line performance.

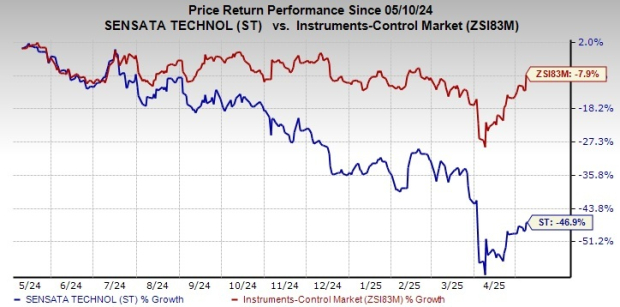

Following the announcement, shares of ST gained 4.6% in the pre-market trading today. In the past year, shares have lost 46.9% against the Instruments-Control industry’s decline of 7.9%. (Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

Performance Sensing revenues (71.4% of total revenues) decreased 8.8% year over year to $650.4 million. The top line was affected by divested products and lower light vehicle production volume in key markets. Lower demand in heavy vehicle, construction and agricultural segments also acted as a headwind.

Segmental adjusted operating income was $142.9 million compared with $169 million in the prior-year quarter.

Sensing Solutions’ revenues (28.6%) were $260.8 million, up 1.2% year over year. The performance was driven by stability across industrials and aerospace, and higher demand for A2L gas leak detection sensing products.

Sensata Technologies Holding N.V. price-consensus-eps-surprise-chart | Sensata Technologies Holding N.V. Quote

Segmental adjusted operating income was $76.1 million compared with $72.3 million in the prior-year quarter.

Adjusted operating income was $166.5 million compared with $188.8 million in the year-ago quarter. Adjusted operating margin contracted 40 basis points to 18.3%.

Adjusted EBITDA totaled $200.2 million in the quarter, down from $223.2 million in the previous year’s quarter.

Total operating expenses were $789.1 million, down 8.5% year over year.

In the quarter under discussion, Sensata generated $119.2 million of net cash from operating activities compared with $106.5 million in the prior-year quarter. Free cash flow was $86.6 million compared with $64.4 million a year ago.

As of March 31, 2025, the company had $588.1 million in cash and cash equivalents and $3,177.3 million of net long-term debt compared with $593.7 million and $3,176.1 million, respectively, as of Dec. 31, 2024.

In the reported quarter, Sensata returned $17.9 million to its shareholders via quarterly dividends and repurchased shares worth $100.5 million.

For the second quarter, the company projects revenues in the band of $910-$940 million, indicating an increase of 0-3% sequentially. This includes approximately $20 million related to expected tariff recovery from customers.

Adjusted operating income is expected to be $169-$177 million, implying a sequential increase of 1% to 6%.

On a sequential basis, adjusted EPS is estimated to be 80-86 cents, implying an improvement of 3-10%. Adjusted net income is anticipated in the $117-$125 million range, indicating an increase of 0% to 7%.

Sensata currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Badger Meter, Inc. BMI reported earnings of $1.30 for the first quarter of 2025, which beat the Zacks Consensus Estimate by 20.4%. Also, the bottom line compared favorably with the year-ago quarter’s EPS of 99 cents. Quarterly net sales of BMI were $222.2 million, up 13% from $196.3 million in the year-ago quarter, driven by higher utility water sales and the initial contribution from the SmartCover acquisition. The Zacks Consensus Estimate was pegged at $222 million.

In the past six months, shares of BMI have inched up 1.1%.

Watts Water Technologies, Inc. WTS reported first-quarter 2025 adjusted EPS of $2.37 compared with $2.33 in the prior-year quarter. The bottom line topped the Zacks Consensus Estimate by 11.8%. Watts Water’s quarterly net sales declined 2% year over year to $558 million. The top line surpassed the Zacks Consensus Estimate by 3.2%. Organic sales were down 2% year over year. Incremental acquisition sales in the Americas added $5 million, contributing 1% to the reported growth.

In the past six months, shares of Watts Water have risen 10.9%.

Itron Inc. ITRI reported non-GAAP EPS of $1.52 for first-quarter 2025, which beat the Zacks Consensus Estimate by 16.9%. The company reported earnings of $1.24 per share in the prior-year quarter. Amid the ongoing tariff tensions and global trade volatility, Itron’s regional supply strategy supports the bottom line, with most U.S. products made locally and key parts imported tariff-free from Mexico. Revenues inched up 1% year over year to $607 million, backed by the catch-up of delayed sales in the first quarter of 2024. The Zacks Consensus Estimate was pegged at $614.3 million. The figure also missed management’s guidance ($610-$620 million) owing to weakness across the Device Solutions and Networked Solutions segments amid strength in the Outcomes unit.

In the past six months, shares of ITRI have lost 13.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 12 hours | |

| 12 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite